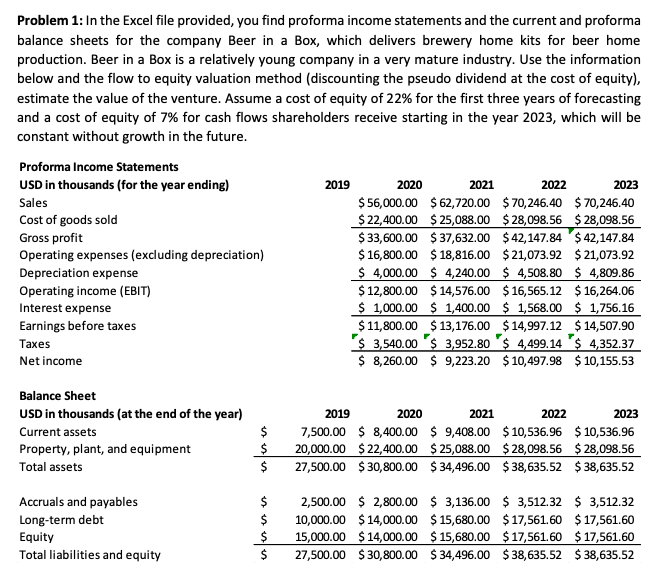

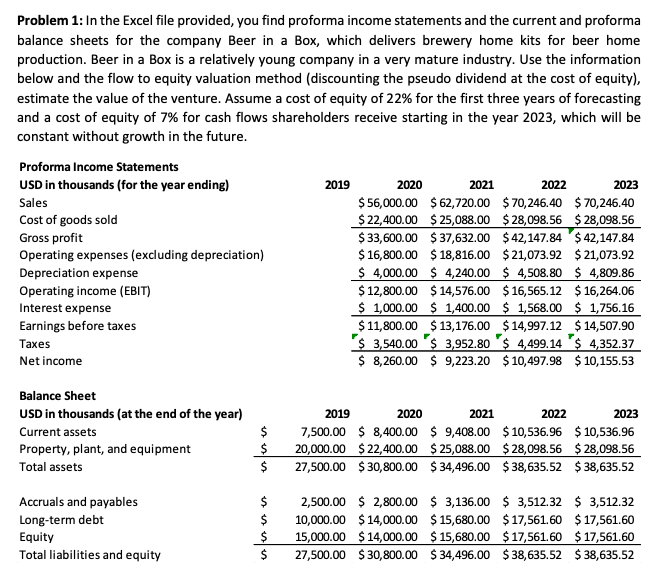

Problem 1: In the Excel file provided, you find proforma income statements and the current and proforma balance sheets for the company Beer in a Box, which delivers brewery home kits for beer home production. Beer in a Box is a relatively young company in a very mature industry. Use the information below and the flow to equity valuation method (discounting the pseudo dividend at the cost of equity), estimate the value of the venture. Assume a cost of equity of 22% for the first three years of forecasting and a cost of equity of 7% for cash flows shareholders receive starting in the year 2023, which will be constant without growth in the future. 2019 Proforma Income Statements USD in thousands (for the year ending) Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Operating income (EBIT) Interest expense Earnings before taxes Taxes Net income 2020 $ 56,000.00 $ 22,400.00 $ 33,600.00 $ 16,800.00 $ 4,000.00 $ 12,800.00 $ 1,000.00 $ 11,800.00 $ 3,540.00 $ 8,260.00 2021 $ 62,720.00 $ 25,088.00 $ 37,632.00 $ 18,816.00 $ 4,240.00 $ 14,576.00 $ 1,400.00 $ 13,176.00 $ 3,952.80 $ 9,223.20 2022 2023 $ 70,246.40 $ 70,246.40 $ 28,098.56 $28,098.56 $ 42, 147.84 $ 42, 147.84 $ 21,073.92 $ 21,073.92 $ 4,508.80 $ 4,809.86 $ 16,565.12 $ 16,264.06 $ 1,568.00 $ 1,756.16 $14,997.12 $ 14,507.90 $ 4,499.14 '$ 4,352.37 $ 10,497.98 $ 10,155.53 Balance Sheet USD in thousands (at the end of the year) Current assets Property, plant, and equipment Total assets $ $ $ 2019 2020 2021 2022 7,500.00 $ 8,400.00 $ 9,408.00 $ 10,536.96 20,000.00 $ 22,400.00 $ 25,088.00 $ 28,098.56 27,500.00 $ 30,800.00 $ 34,496.00 $ 38,635.52 2023 $ 10,536.96 $ 28,098.56 $ 38,635.52 $ Accruals and payables Long-term debt Equity Total liabilities and equity 2,500.00 $ 2,800.00 $ 3,136.00 $ 3,512.32 $ 3,512.32 10,000.00 $ 14,000.00 $ 15,680.00 $ 17,561.60 $ 17,561.60 15,000.00 $ 14,000.00 $ 15,680.00 $ 17,561.60 $ 17,561.60 27,500.00 $ 30,800.00 $ 34,496.00 $ 38,635.52 $ 38,635.52 $ $ Problem 1: In the Excel file provided, you find proforma income statements and the current and proforma balance sheets for the company Beer in a Box, which delivers brewery home kits for beer home production. Beer in a Box is a relatively young company in a very mature industry. Use the information below and the flow to equity valuation method (discounting the pseudo dividend at the cost of equity), estimate the value of the venture. Assume a cost of equity of 22% for the first three years of forecasting and a cost of equity of 7% for cash flows shareholders receive starting in the year 2023, which will be constant without growth in the future. 2019 Proforma Income Statements USD in thousands (for the year ending) Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Operating income (EBIT) Interest expense Earnings before taxes Taxes Net income 2020 $ 56,000.00 $ 22,400.00 $ 33,600.00 $ 16,800.00 $ 4,000.00 $ 12,800.00 $ 1,000.00 $ 11,800.00 $ 3,540.00 $ 8,260.00 2021 $ 62,720.00 $ 25,088.00 $ 37,632.00 $ 18,816.00 $ 4,240.00 $ 14,576.00 $ 1,400.00 $ 13,176.00 $ 3,952.80 $ 9,223.20 2022 2023 $ 70,246.40 $ 70,246.40 $ 28,098.56 $28,098.56 $ 42, 147.84 $ 42, 147.84 $ 21,073.92 $ 21,073.92 $ 4,508.80 $ 4,809.86 $ 16,565.12 $ 16,264.06 $ 1,568.00 $ 1,756.16 $14,997.12 $ 14,507.90 $ 4,499.14 '$ 4,352.37 $ 10,497.98 $ 10,155.53 Balance Sheet USD in thousands (at the end of the year) Current assets Property, plant, and equipment Total assets $ $ $ 2019 2020 2021 2022 7,500.00 $ 8,400.00 $ 9,408.00 $ 10,536.96 20,000.00 $ 22,400.00 $ 25,088.00 $ 28,098.56 27,500.00 $ 30,800.00 $ 34,496.00 $ 38,635.52 2023 $ 10,536.96 $ 28,098.56 $ 38,635.52 $ Accruals and payables Long-term debt Equity Total liabilities and equity 2,500.00 $ 2,800.00 $ 3,136.00 $ 3,512.32 $ 3,512.32 10,000.00 $ 14,000.00 $ 15,680.00 $ 17,561.60 $ 17,561.60 15,000.00 $ 14,000.00 $ 15,680.00 $ 17,561.60 $ 17,561.60 27,500.00 $ 30,800.00 $ 34,496.00 $ 38,635.52 $ 38,635.52 $ $