Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1. IV Burritos needs to buy corn to manufacture their burritos. Specifically, they need to buy 2.5 tons of corn for the coming spring,

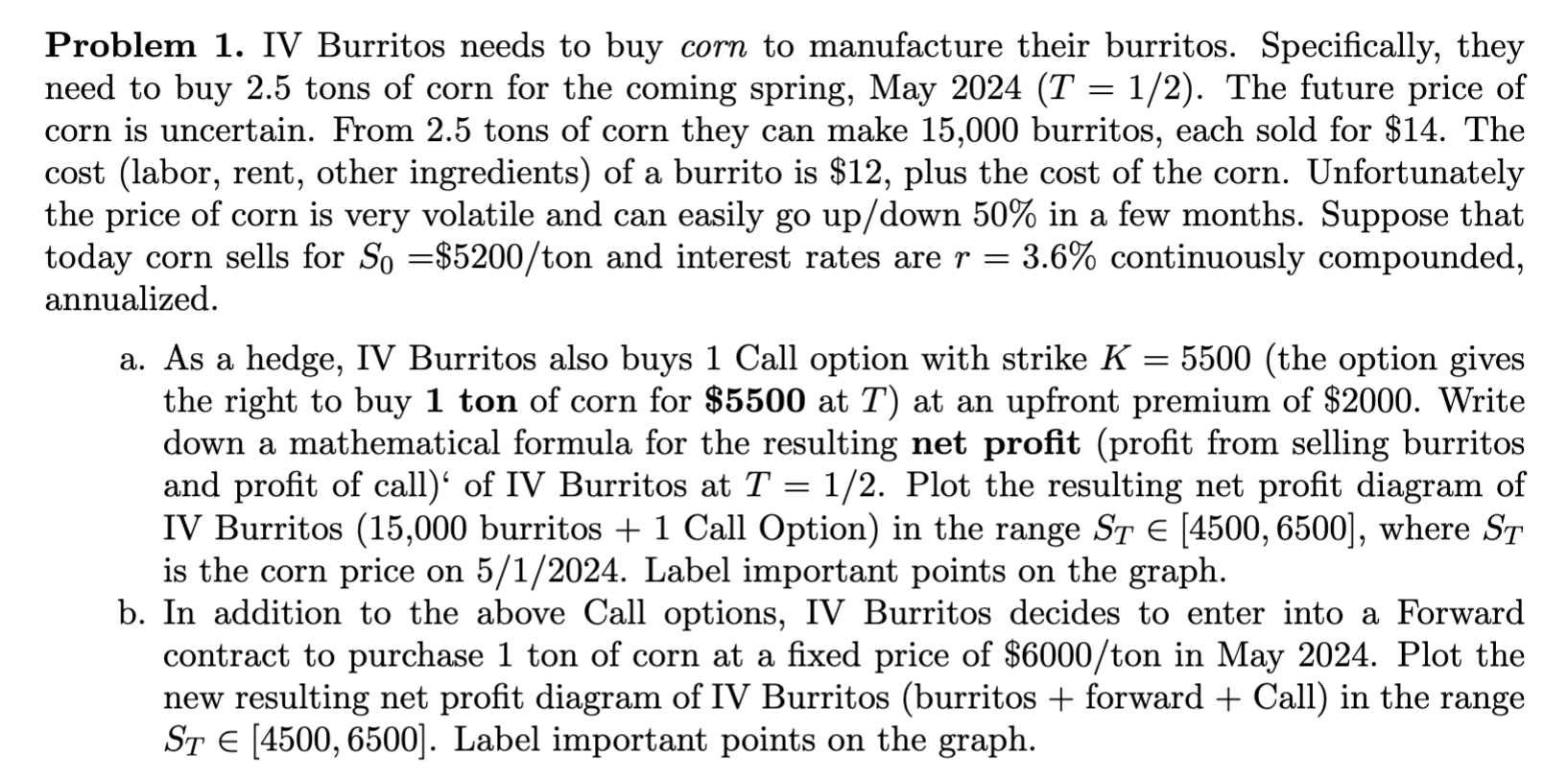

Problem 1. IV Burritos needs to buy corn to manufacture their burritos. Specifically, they need to buy 2.5 tons of corn for the coming spring, May 2024(T=1/2). The future price of corn is uncertain. From 2.5 tons of corn they can make 15,000 burritos, each sold for $14. The cost (labor, rent, other ingredients) of a burrito is $12, plus the cost of the corn. Unfortunately the price of corn is very volatile and can easily go up/down 50% in a few months. Suppose that today corn sells for S0=$5200/ ton and interest rates are r=3.6% continuously compounded, annualized. a. As a hedge, IV Burritos also buys 1 Call option with strike K=5500 (the option gives the right to buy 1 ton of corn for $5500 at T ) at an upfront premium of $2000. Write down a mathematical formula for the resulting net profit (profit from selling burritos and profit of call) of IV Burritos at T=1/2. Plot the resulting net profit diagram of IV Burritos (15,000 burritos +1 Call Option) in the range ST[4500,6500], where ST is the corn price on 5/1/2024. Label important points on the graph. b. In addition to the above Call options, IV Burritos decides to enter into a Forward contract to purchase 1 ton of corn at a fixed price of $6000/ ton in May 2024. Plot the new resulting net profit diagram of IV Burritos (burritos + forward + Call) in the range ST[4500,6500]. Label important points on the graph

Problem 1. IV Burritos needs to buy corn to manufacture their burritos. Specifically, they need to buy 2.5 tons of corn for the coming spring, May 2024(T=1/2). The future price of corn is uncertain. From 2.5 tons of corn they can make 15,000 burritos, each sold for $14. The cost (labor, rent, other ingredients) of a burrito is $12, plus the cost of the corn. Unfortunately the price of corn is very volatile and can easily go up/down 50% in a few months. Suppose that today corn sells for S0=$5200/ ton and interest rates are r=3.6% continuously compounded, annualized. a. As a hedge, IV Burritos also buys 1 Call option with strike K=5500 (the option gives the right to buy 1 ton of corn for $5500 at T ) at an upfront premium of $2000. Write down a mathematical formula for the resulting net profit (profit from selling burritos and profit of call) of IV Burritos at T=1/2. Plot the resulting net profit diagram of IV Burritos (15,000 burritos +1 Call Option) in the range ST[4500,6500], where ST is the corn price on 5/1/2024. Label important points on the graph. b. In addition to the above Call options, IV Burritos decides to enter into a Forward contract to purchase 1 ton of corn at a fixed price of $6000/ ton in May 2024. Plot the new resulting net profit diagram of IV Burritos (burritos + forward + Call) in the range ST[4500,6500]. Label important points on the graph Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started