Answered step by step

Verified Expert Solution

Question

1 Approved Answer

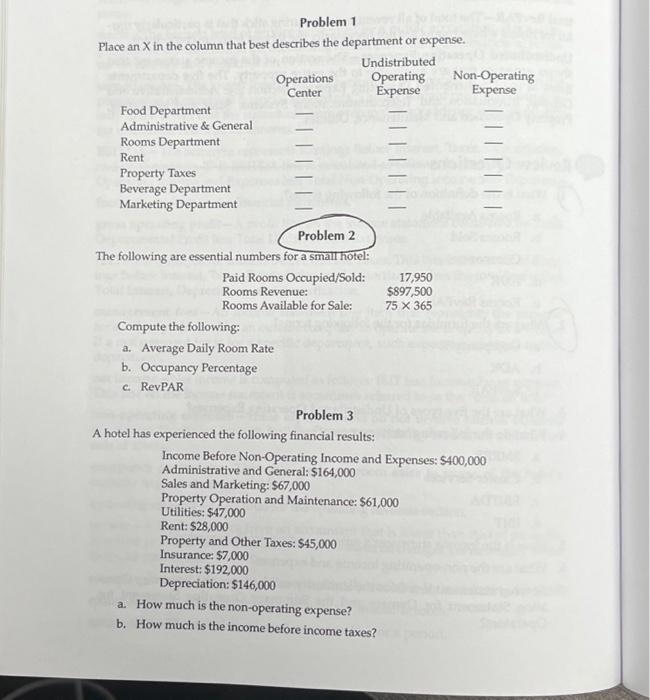

Problem 1. Place an X in the column that best describes the department or expense. Food Department Administrative & General Rooms Department Rent Property

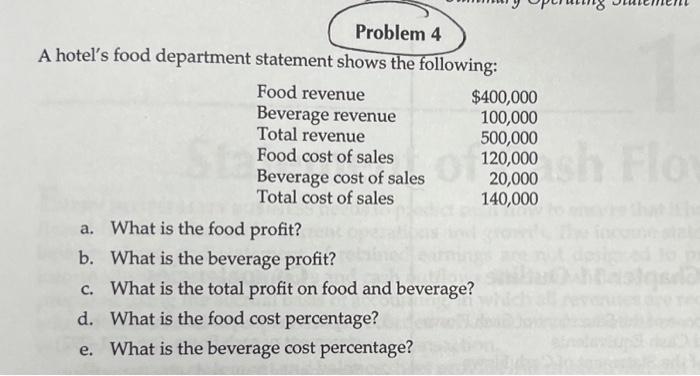

Problem 1. Place an X in the column that best describes the department or expense. Food Department Administrative & General Rooms Department Rent Property Taxes Beverage Department Marketing Department Operations Center Undistributed Operating Expense Problem 2 The following are essential numbers for a small hotel: Compute the following: a. Average Daily Room Rate b. Occupancy Percentage c. RevPAR Paid Rooms Occupied/Sold: Rooms Revenue: Rooms Available for Sale: Problem 3 A hotel has experienced the following financial results: 17,950 $897,500 75 x 365 Non-Operating Expense Income Before Non-Operating Income and Expenses: $400,000 Administrative and General: $164,000 Sales and Marketing: $67,000 Property Operation and Maintenance: $61,000 Utilities: $47,000 Rent: $28,000 Property and Other Taxes: $45,000 Insurance: $7,000 Interest: $192,000 Depreciation: $146,000 a. How much is the non-operating expense? b. How much is the income before income taxes? Problem 4 A hotel's food department statement shows the following: Food revenue Beverage revenue Total revenue Food cost of sales Beverage cost of sales Total cost of sales $400,000 100,000 500,000 of ash Flo 120,000 20,000 140,000 a. What is the food profit? b. What is the beverage profit? c. What is the total profit on food and beverage? d. What is the food cost percentage? e. What is the beverage cost percentage? that the algsda

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets tackle each problem step by step Problem 1 Department or Expense Category Undistributed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started