Answered step by step

Verified Expert Solution

Question

1 Approved Answer

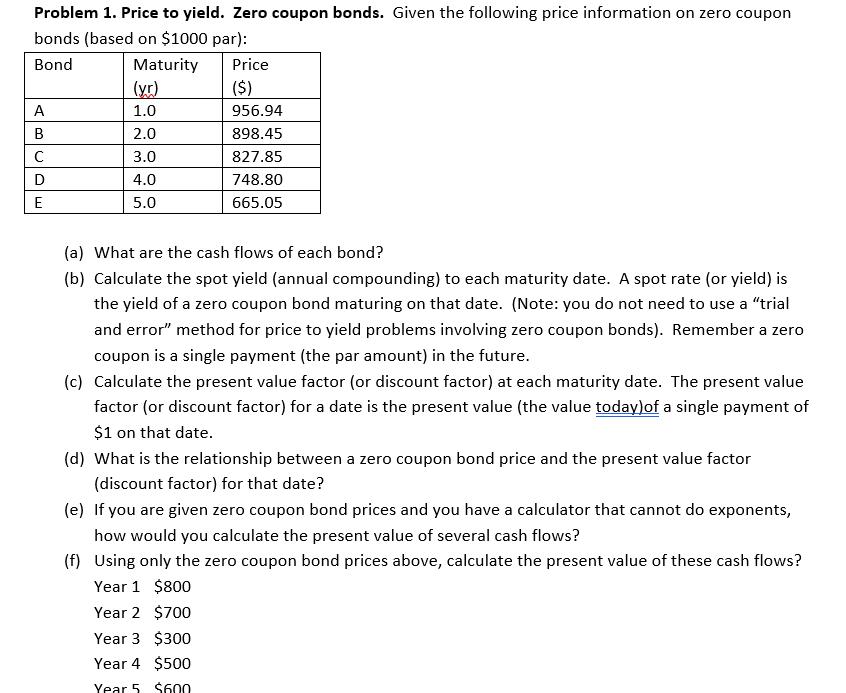

Problem 1. Price to yield. Zero coupon bonds. Given the following price information on zero coupon bonds (based on $1000 par): Bond Maturity (yr)

Problem 1. Price to yield. Zero coupon bonds. Given the following price information on zero coupon bonds (based on $1000 par): Bond Maturity (yr) 1.0 2.0 3.0 4.0 5.0 A B C D E Price ($) 956.94 898.45 827.85 748.80 665.05 (a) What are the cash flows of each bond? (b) Calculate the spot yield (annual compounding) to each maturity date. A spot rate (or yield) is the yield of a zero coupon bond maturing on that date. (Note: you do not need to use a "trial and error" method for price to yield problems involving zero coupon bonds). Remember a zero coupon is a single payment (the par amount) in the future. (c) Calculate the present value factor (or discount factor) at each maturity date. The present value factor (or discount factor) for a date is the present value (the value today) of a single payment of $1 on that date. $800 $700 $300 $500 $600 (d) What is the relationship between a zero coupon bond price and the present value factor (discount factor) for that date? (e) If you are given zero coupon bond prices and you have a calculator that cannot do exponents, how would you calculate the present value of several cash flows? (f) Using only the zero coupon bond prices above, calculate the present value of these cash flows? Year 1 Year 2 Year 3 Year 4 Year 5

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The cash flows of each bond can be determined based on their maturity and par value 1000 Since these are zero coupon bonds the cash flows occur only ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started