Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 Problem 2 Situation 1: Minmin Company made the following individual cash purchases: Land and building Machinery and office equipment Delivery equipment An appraisal

Problem 1

Problem 2

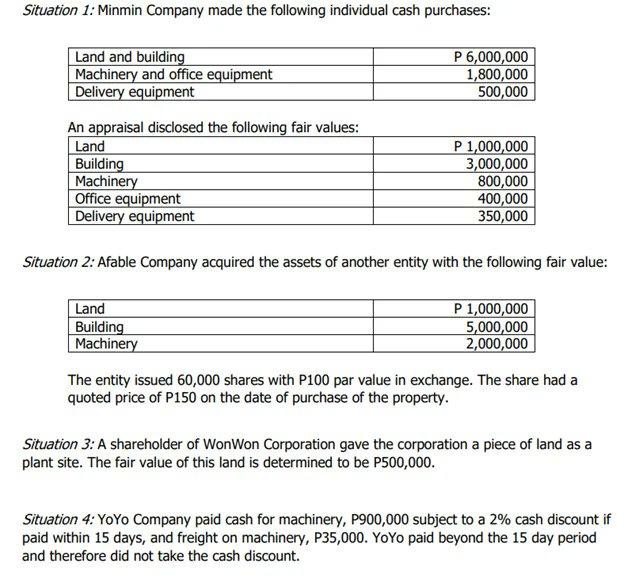

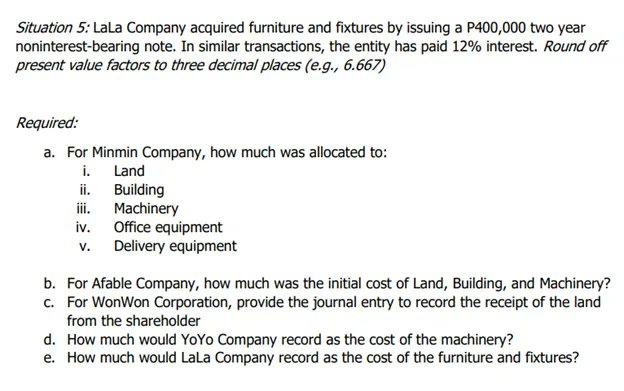

Situation 1: Minmin Company made the following individual cash purchases: Land and building Machinery and office equipment Delivery equipment An appraisal disclosed the following fair values: Land Building Machinery Office equipment Delivery equipment P 6,000,000 1,800,000 500,000 Land Building Machinery P 1,000,000 3,000,000 800,000 400,000 350,000 Situation 2: Afable Company acquired the assets of another entity with the following fair value: P 1,000,000 5,000,000 2,000,000 The entity issued 60,000 shares with P100 par value in exchange. The share had a quoted price of P150 on the date of purchase of the property. Situation 3: A shareholder of WonWon Corporation gave the corporation a piece of land as a plant site. The fair value of this land is determined to be P500,000. Situation 4: YoYo Company paid cash for machinery, P900,000 subject to a 2% cash discount if paid within 15 days, and freight on machinery, P35,000. YoYo paid beyond the 15 day period and therefore did not take the cash discount.

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a For Minmin Company the allocation of costs for the assets is as follows i Land P6000000 ii Buildin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started