Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 1 - provide all values to the nearest whole dollar. A business, Davis Wreckers, is considering a project that will require the company

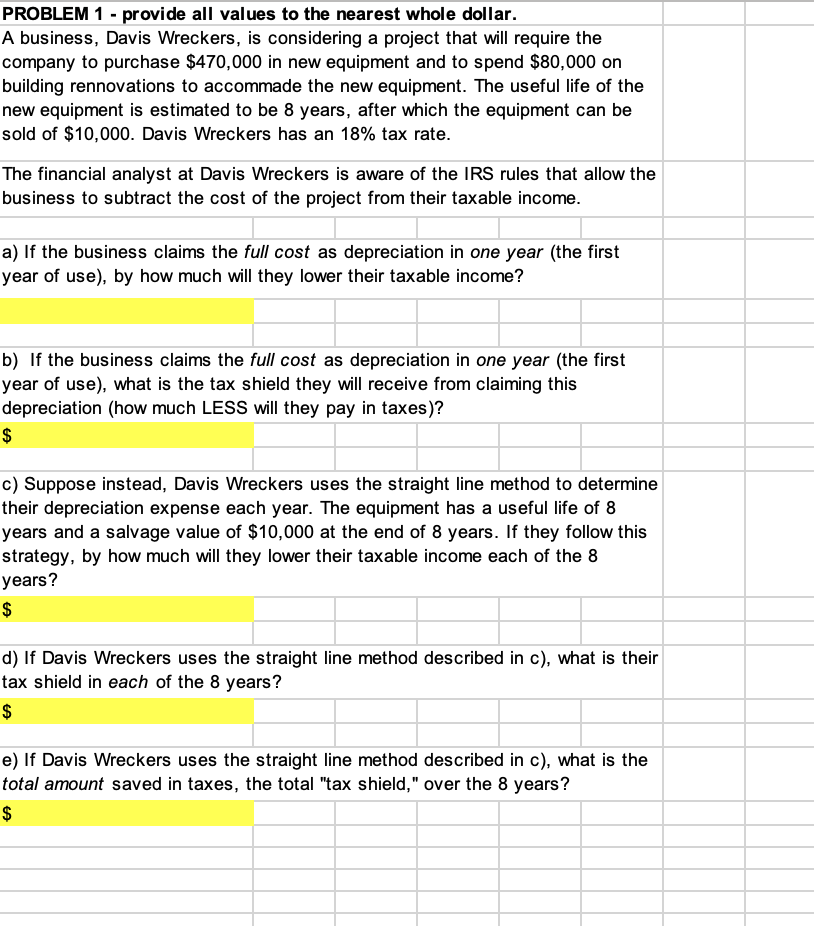

PROBLEM 1 - provide all values to the nearest whole dollar. A business, Davis Wreckers, is considering a project that will require the company to purchase $470,000 in new equipment and to spend $80,000 on building rennovations to accommade the new equipment. The useful life of the new equipment is estimated to be 8 years, after which the equipment can be sold of $10,000. Davis Wreckers has an 18% tax rate. The financial analyst at Davis Wreckers is aware of the IRS rules that allow the business to subtract the cost of the project from their taxable income. a) If the business claims the full cost as depreciation in one year (the first year of use), by how much will they lower their taxable income? b) If the business claims the full cost as depreciation in one year (the first year of use), what is the tax shield they will receive from claiming this depreciation (how much LESS will they pay in taxes)? $ c) Suppose instead, Davis Wreckers uses the straight line method to determine their depreciation expense each year. The equipment has a useful life of 8 years and a salvage value of $10,000 at the end of 8 years. If they follow this strategy, by how much will they lower their taxable income each of the 8 years? $ d) If Davis Wreckers uses the straight line method described in c), what is their tax shield in each of the 8 years? $ e) If Davis Wreckers uses the straight line method described in c), what is the total amount saved in taxes, the total "tax shield," over the 8 years? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started