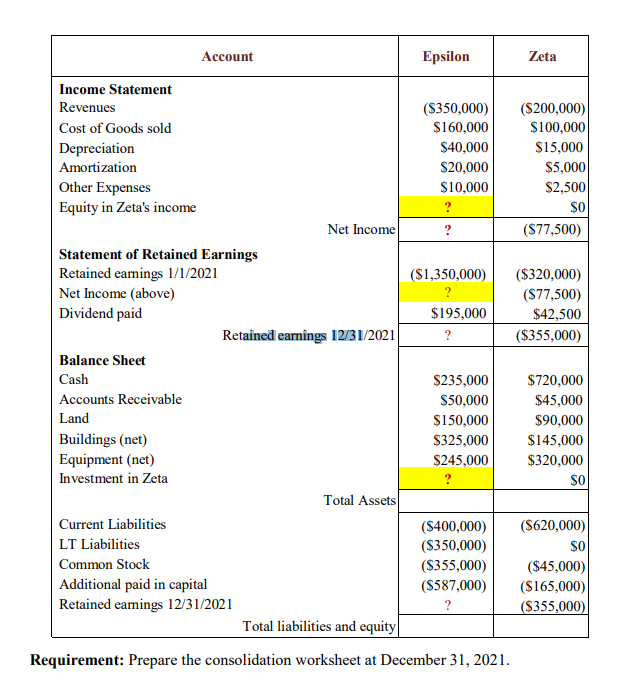

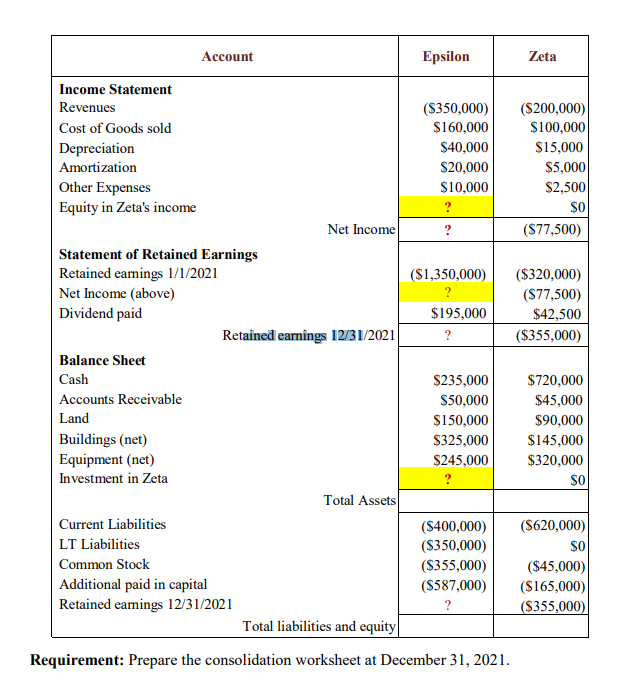

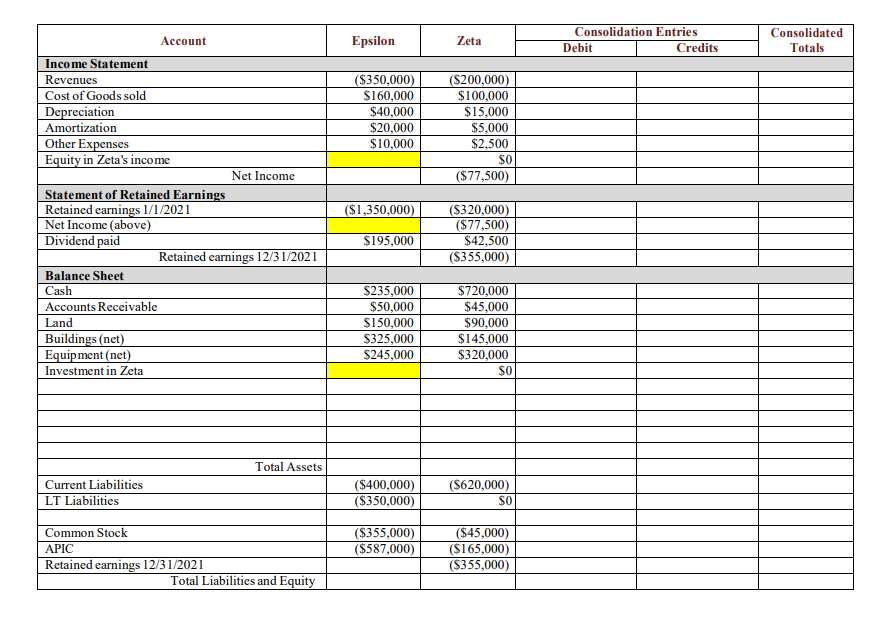

Problem 1 (Recommended: review slides 2-32) Epsilon acquired 100% of Zeta on January 1, 2021, by issuing 15,000 shares of its $10 par value common stock with a fair value of $45 per share, issuing $200,000 in debt and paying $200,000 in cash. On January 1, 2021, the book value of Zetas Accounts Receivable differs from the fair value by $5,000 (undervalued). Also, Zeta's land was undervalued by $140,000, its buildings were overvalued by $15,000, and equipment was undervalued by $125,000. The useful life of the land is indefinite. The turnover of short-term assets and liabilities is less than one year. The buildings have a 15-year life and the equipment has a 10-year life. $50,000 of the ECOBV was attributed to an unrecorded trademark with a 16-year remaining life. Additionally, during the due-diligence process, Epsilon found out that Zeta has unrecorded liabilities for product warranties for $10,000 that will be likely exercised over 4 years starting January 1, 2021. Epsilon uses the equity method to account for the investment account. Following are selected accounts for Epsilon and Zeta Company as of December 31, 2021. Several accounts have been omitted.

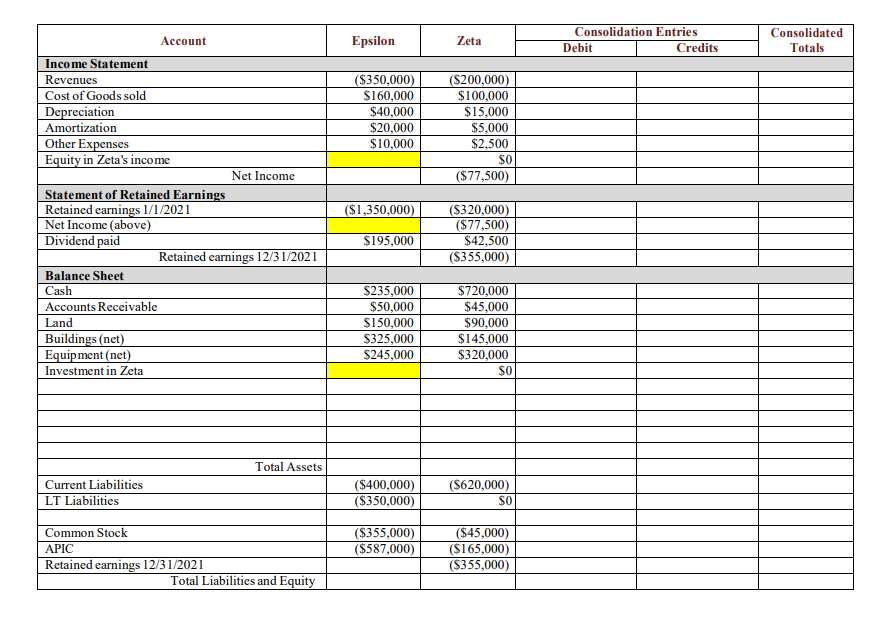

Account Epsilon Zeta Income Statement Revenues ($350,000) ($200,000) Cost of Goods sold $160,000 $100,000 Depreciation $40,000 $15,000 Amortization $20,000 $5,000 Other Expenses $10,000 $2,500 Equity in Zeta's income $0 Net Income ? ($77,500) Statement of Retained Earnings Retained earnings 1/1/2021 ($1,350,000) ($320,000) Net Income (above) (S77,500) Dividend paid $195,000 $42,500 Retained earnings 12/31/2021 ? ($355,000) Balance Sheet Cash $235,000 $720,000 Accounts Receivable $50,000 $45,000 Land $150,000 $90,000 Buildings (net) $325,000 $145,000 Equipment (net) $245,000 $320,000 Investment in Zeta Total Assets Current Liabilities ($400,000) (5620,000) LT Liabilities ($350,000) $0 Common Stock ($355,000) ($45,000) Additional paid in capital ($587,000) ($165,000) Retained earnings 12/31/2021 ? ($355,000) Total liabilities and equity Requirement: Prepare the consolidation worksheet at December 31, 2021. Sol Account Epsilon Zeta Consolidation Entries Debit Credits Consolidated Totals ($350,000) $160,000 $40,000 $20,000 $10,000 ($200,000) $100,000 $15,000 $5,000 $2,500 SO ($77,500) Income Statement Revenues Cost of Goods sold Depreciation Amortization Other Expenses Equity in Zeta's income Net Income Statement of Retained Earnings Retained earnings 1/1/2021 Net Income (above) Dividend paid Retained earnings 12/31/2021 Balance Sheet Cash Accounts Receivable Land Buildings (net) Equipment (net) Investment in Zeta ($1,350,000) $195,000 ($320,000) ($77,500) $42,500 (5355,000) $235,000 $50,000 $150,000 $325,000 $245,000 $720,000 $45,000 $90,000 $145,000 $320,000 SO Total Assets Current Liabilities LT Liabilities ($400,000) ($350,000) ($620,000) SO ($355,000) ($587,000) Common Stock APIC Retained earnings 12/31/2021 Total Liabilities and Equity ($45,000) ($165,000) ($355,000) Account Epsilon Zeta Income Statement Revenues ($350,000) ($200,000) Cost of Goods sold $160,000 $100,000 Depreciation $40,000 $15,000 Amortization $20,000 $5,000 Other Expenses $10,000 $2,500 Equity in Zeta's income $0 Net Income ? ($77,500) Statement of Retained Earnings Retained earnings 1/1/2021 ($1,350,000) ($320,000) Net Income (above) (S77,500) Dividend paid $195,000 $42,500 Retained earnings 12/31/2021 ? ($355,000) Balance Sheet Cash $235,000 $720,000 Accounts Receivable $50,000 $45,000 Land $150,000 $90,000 Buildings (net) $325,000 $145,000 Equipment (net) $245,000 $320,000 Investment in Zeta Total Assets Current Liabilities ($400,000) (5620,000) LT Liabilities ($350,000) $0 Common Stock ($355,000) ($45,000) Additional paid in capital ($587,000) ($165,000) Retained earnings 12/31/2021 ? ($355,000) Total liabilities and equity Requirement: Prepare the consolidation worksheet at December 31, 2021. Sol Account Epsilon Zeta Consolidation Entries Debit Credits Consolidated Totals ($350,000) $160,000 $40,000 $20,000 $10,000 ($200,000) $100,000 $15,000 $5,000 $2,500 SO ($77,500) Income Statement Revenues Cost of Goods sold Depreciation Amortization Other Expenses Equity in Zeta's income Net Income Statement of Retained Earnings Retained earnings 1/1/2021 Net Income (above) Dividend paid Retained earnings 12/31/2021 Balance Sheet Cash Accounts Receivable Land Buildings (net) Equipment (net) Investment in Zeta ($1,350,000) $195,000 ($320,000) ($77,500) $42,500 (5355,000) $235,000 $50,000 $150,000 $325,000 $245,000 $720,000 $45,000 $90,000 $145,000 $320,000 SO Total Assets Current Liabilities LT Liabilities ($400,000) ($350,000) ($620,000) SO ($355,000) ($587,000) Common Stock APIC Retained earnings 12/31/2021 Total Liabilities and Equity ($45,000) ($165,000) ($355,000)