Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 Suppose it is January and a speculator consider that a stock is likely to decrease in value over the next three months. The

Problem 1

Problem 1

Suppose it is January and a speculator consider that a stock is likely to decrease in value over the next three months. The stock price is currently $60, and a three-month put option with a strike price of $58 is currently selling for $2.00.

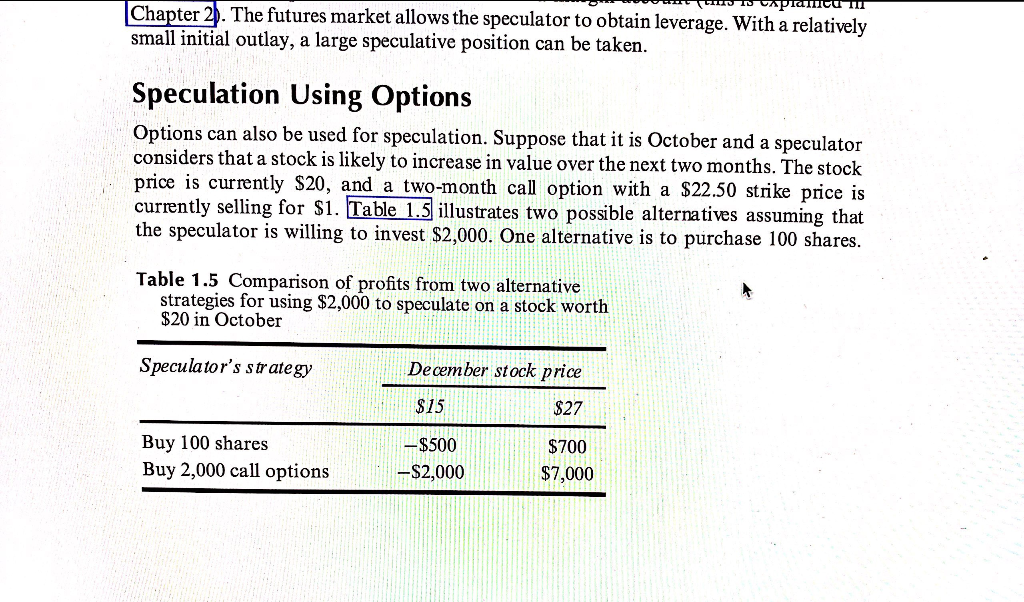

- Derive a table similar to Table 1.5 in the textbook which compares selling short 100 shares of stock and buying 3000 put options. Use April stock prices of $50 and $70.

- Present a figure similar to Figure 1.5 in the textbook outlining the profit or loss from the two strategies.

Table 1.5 is provided above the picture above is the table 1.5

Chapter 2). The futures market allows the speculator to obtain leverage. With a relatively small initial outlay, a large speculative position can be taken Speculation Using Options Options can also be used for speculation. Suppose that it is October and a speculator considers that a stock is likely to increase in value over the next two months. The stock price is currently S20, and a two-month call option with a S22.50 strike price is currently selling for S1. Table 1.5illustrates two possible alternati the speculator is willing to invest $2,000. One alternative is to purchase 100 shares Table 1.5 Comparison of profits from two alternative strategies for using $2,000 to speculate on a stock worth $20 in October Speculator's strategy December stock price 827 $700 $7,000 S15 $500 S2,000 Buy 100 shares Buy 2,000 call options Chapter 2). The futures market allows the speculator to obtain leverage. With a relatively small initial outlay, a large speculative position can be taken Speculation Using Options Options can also be used for speculation. Suppose that it is October and a speculator considers that a stock is likely to increase in value over the next two months. The stock price is currently S20, and a two-month call option with a S22.50 strike price is currently selling for S1. Table 1.5illustrates two possible alternati the speculator is willing to invest $2,000. One alternative is to purchase 100 shares Table 1.5 Comparison of profits from two alternative strategies for using $2,000 to speculate on a stock worth $20 in October Speculator's strategy December stock price 827 $700 $7,000 S15 $500 S2,000 Buy 100 shares Buy 2,000 call optionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started