Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM #1 The aim of the exercise is to compare three existing mutual funds managed by Goldman Sachs or Morgan Stanley in the United States:

PROBLEM #1

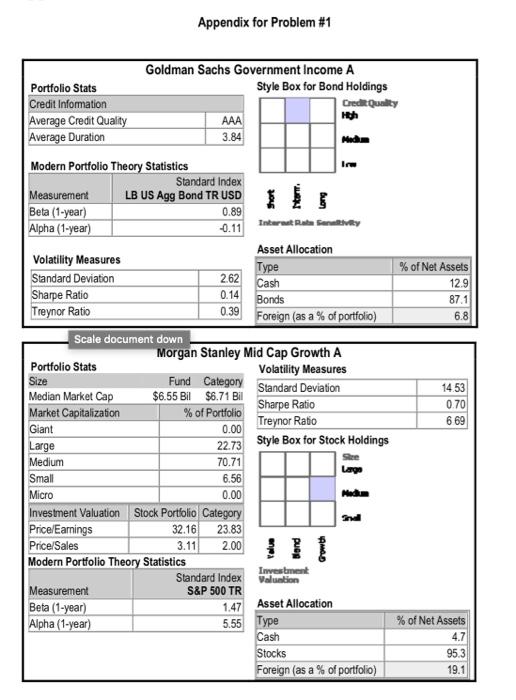

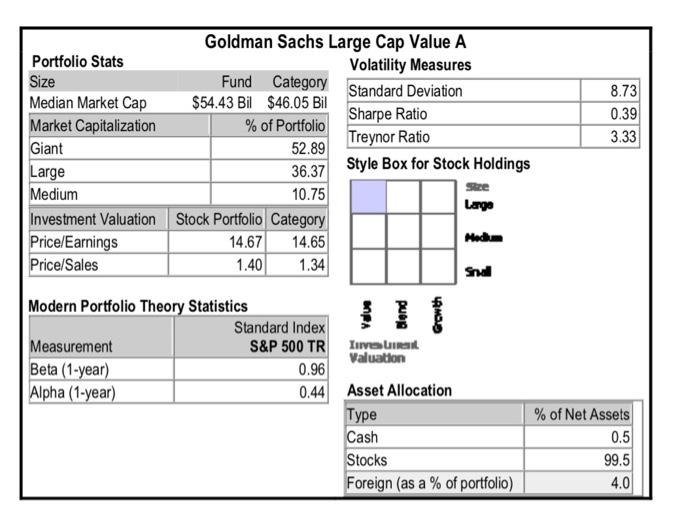

The aim of the exercise is to compare three existing mutual funds managed by Goldman Sachs or Morgan Stanley in the United States:

- Goldman Sachs Large Cap Value A,

- Goldman Sachs Government Income A,

- Morgan Stanley Mid Cap Growth A.

Browsing on the Internet, you found the characteristics for each of those four funds. Those characteristics, given in the appendix, are to be carefully read before you start answering any question.

1) What main differences do you make between GS Large Cap Value A and MS Mid Cap Growth A? Explain clearly how you may differentiate the two funds. What does it imply in terms of risk and return? Use all possible figures to justify your opinion.

2) What main differences do you make between GS Large Cap Value A and GS Government Income A? Explain clearly how you may differentiate the two funds. What does it imply in terms of risk and return? Use all possible figures to justify your opinion.

3) Give an interpretation of the Beta and Alpha values obtained for the funds GS Large Cap Value A

4) The S&P 500 is a value-weighted average of the stocks of 500 largest listed companies in the United States. What advantages do you find compared to a price-weighted average index?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started