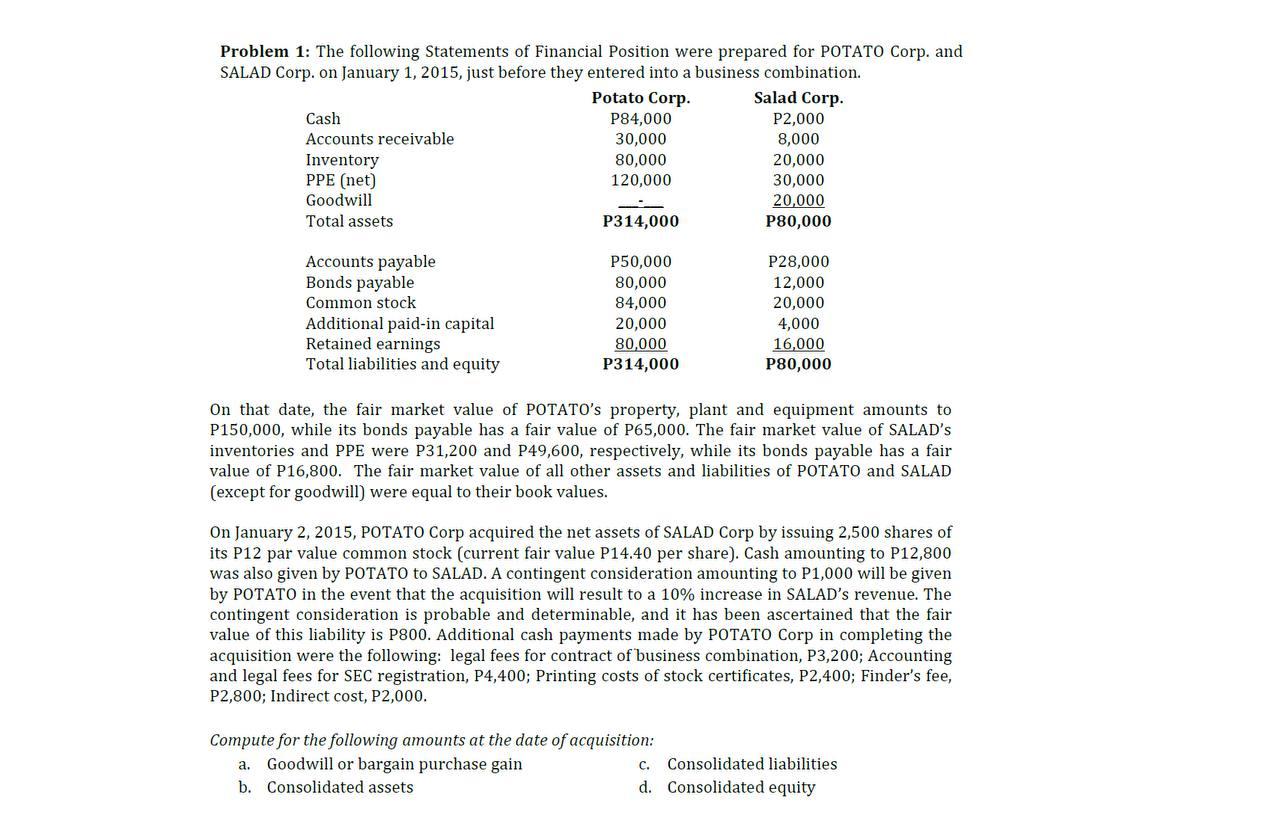

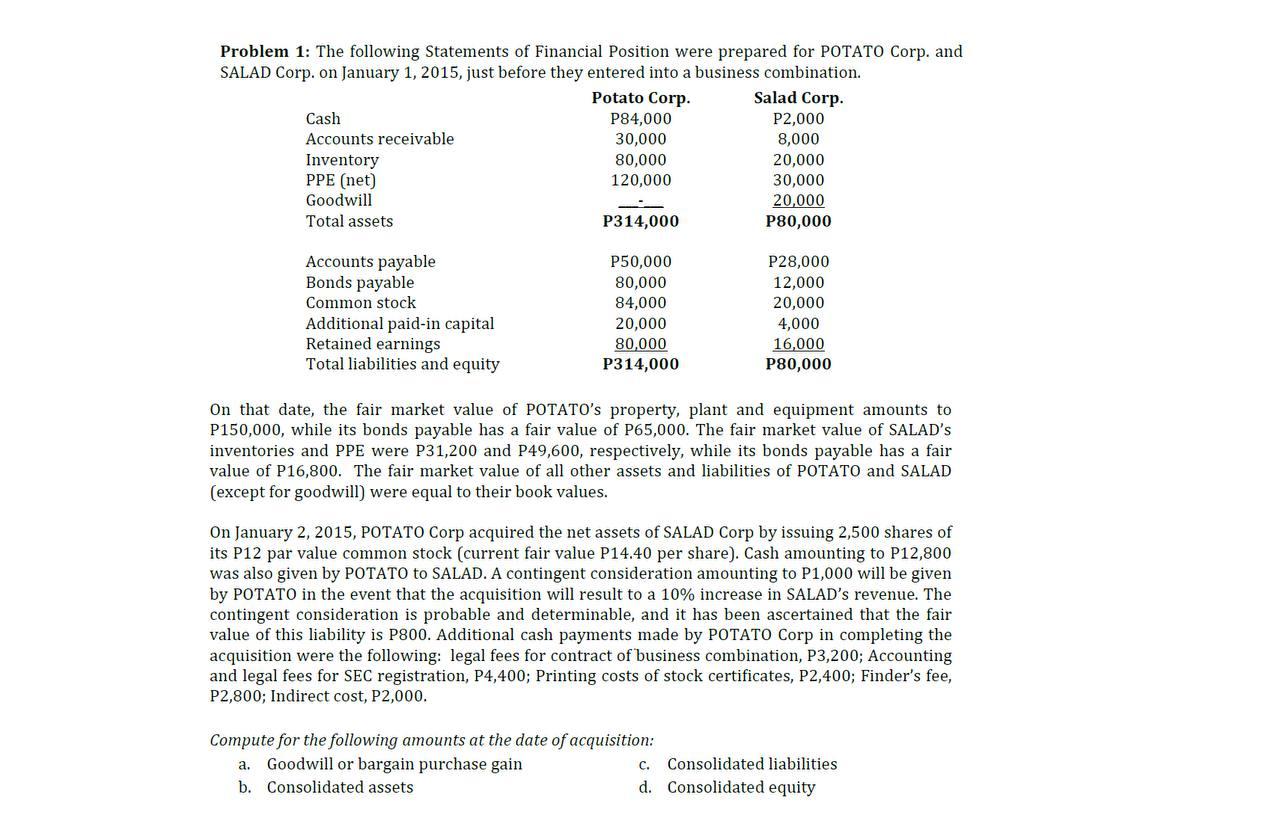

Problem 1: The following Statements of Financial Position were prepared for POTATO Corp. and SALAD Corp. on January 1, 2015, just before they entered into a business combination. On that date, the fair market value of POTATO's property, plant and equipment amounts to P150,000, while its bonds payable has a fair value of P65,000. The fair market value of SALAD's inventories and PPE were P31,200 and P49,600, respectively, while its bonds payable has a fair value of P16,800. The fair market value of all other assets and liabilities of POTATO and SALAD (except for goodwill) were equal to their book values. On January 2, 2015, POTATO Corp acquired the net assets of SALAD Corp by issuing 2,500 shares of its P12 par value common stock (current fair value P14.40 per share). Cash amounting to P12,800 was also given by POTATO to SALAD. A contingent consideration amounting to P1,000 will be given by POTATO in the event that the acquisition will result to a 10% increase in SALAD's revenue. The contingent consideration is probable and determinable, and it has been ascertained that the fair value of this liability is P800. Additional cash payments made by POTATO Corp in completing the acquisition were the following: legal fees for contract of business combination, P3,200; Accounting and legal fees for SEC registration, P4,400; Printing costs of stock certificates, P2,400; Finder's fee, P2,800; Indirect cost, P2,000. Compute for the following amounts at the date of acquisition: a. Goodwill or bargain purchase gain c. Consolidated liabilities b. Consolidated assets d. Consolidated equity Problem 1: The following Statements of Financial Position were prepared for POTATO Corp. and SALAD Corp. on January 1, 2015, just before they entered into a business combination. On that date, the fair market value of POTATO's property, plant and equipment amounts to P150,000, while its bonds payable has a fair value of P65,000. The fair market value of SALAD's inventories and PPE were P31,200 and P49,600, respectively, while its bonds payable has a fair value of P16,800. The fair market value of all other assets and liabilities of POTATO and SALAD (except for goodwill) were equal to their book values. On January 2, 2015, POTATO Corp acquired the net assets of SALAD Corp by issuing 2,500 shares of its P12 par value common stock (current fair value P14.40 per share). Cash amounting to P12,800 was also given by POTATO to SALAD. A contingent consideration amounting to P1,000 will be given by POTATO in the event that the acquisition will result to a 10% increase in SALAD's revenue. The contingent consideration is probable and determinable, and it has been ascertained that the fair value of this liability is P800. Additional cash payments made by POTATO Corp in completing the acquisition were the following: legal fees for contract of business combination, P3,200; Accounting and legal fees for SEC registration, P4,400; Printing costs of stock certificates, P2,400; Finder's fee, P2,800; Indirect cost, P2,000. Compute for the following amounts at the date of acquisition: a. Goodwill or bargain purchase gain c. Consolidated liabilities b. Consolidated assets d. Consolidated equity