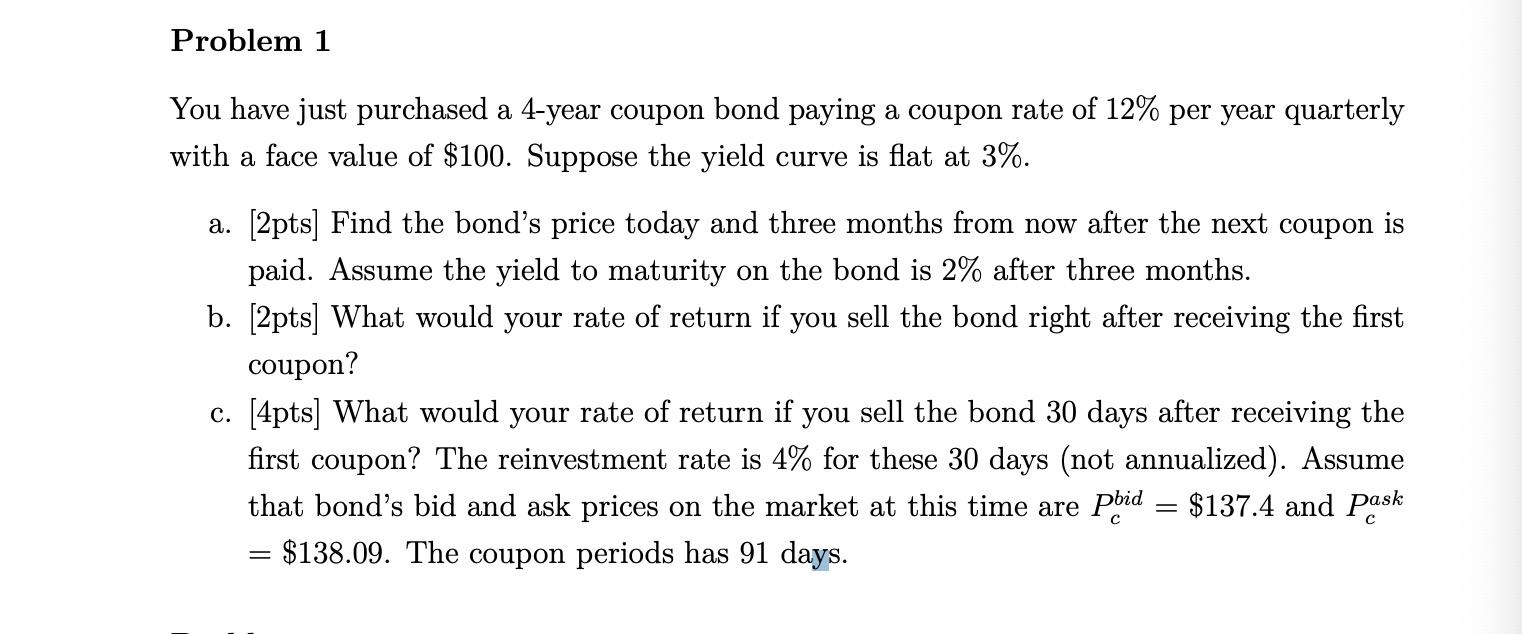

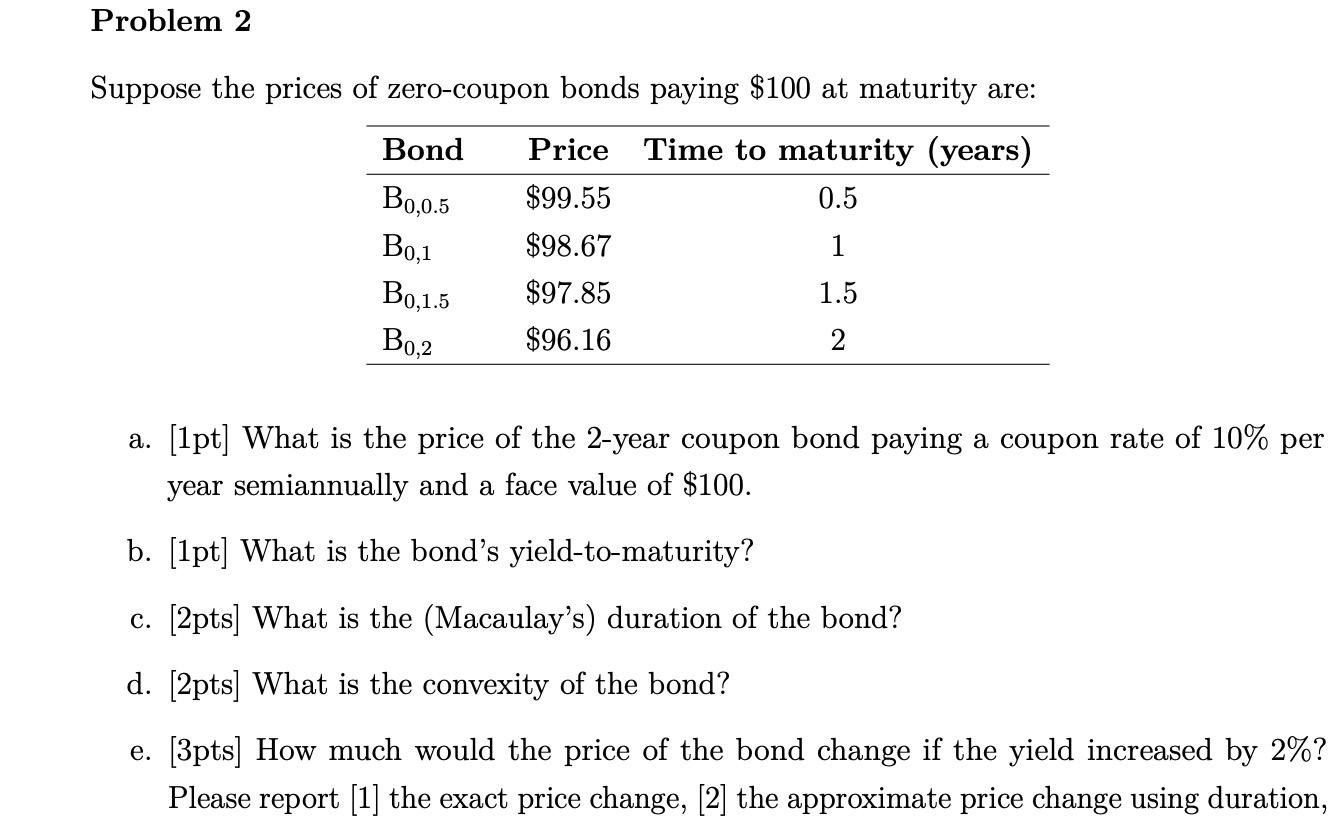

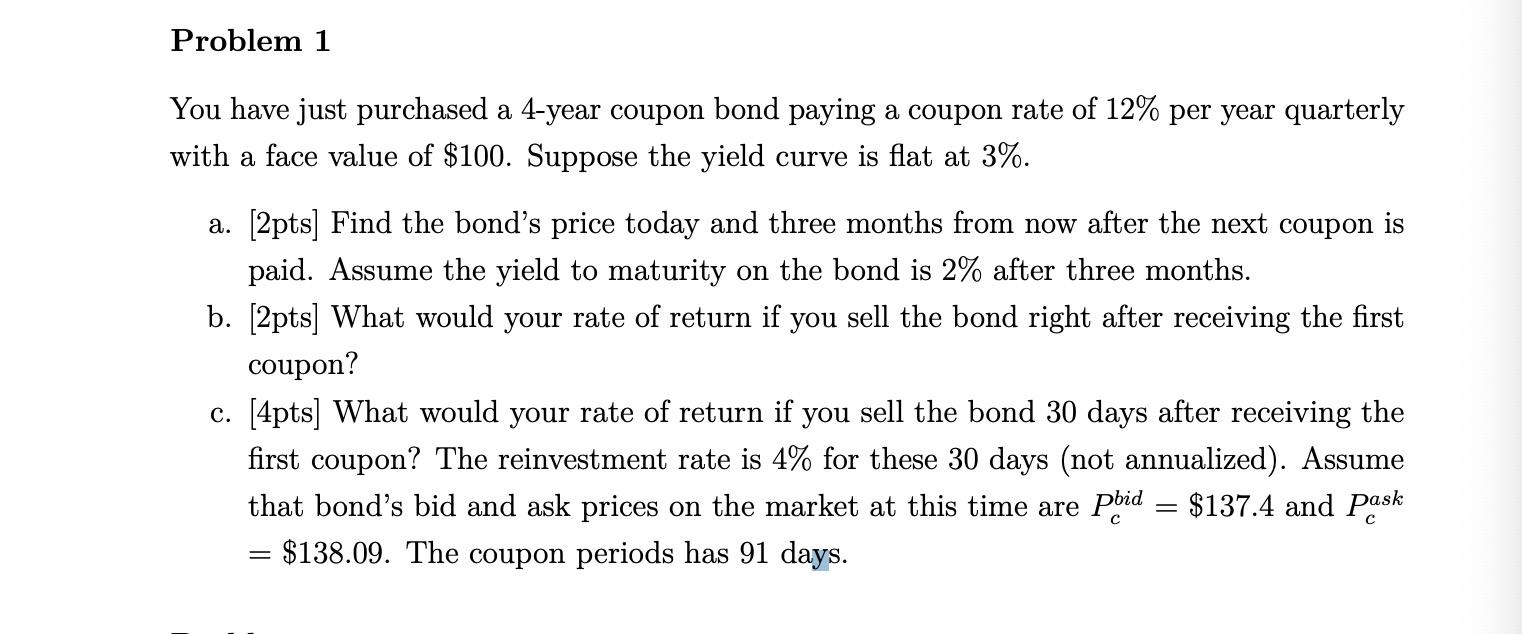

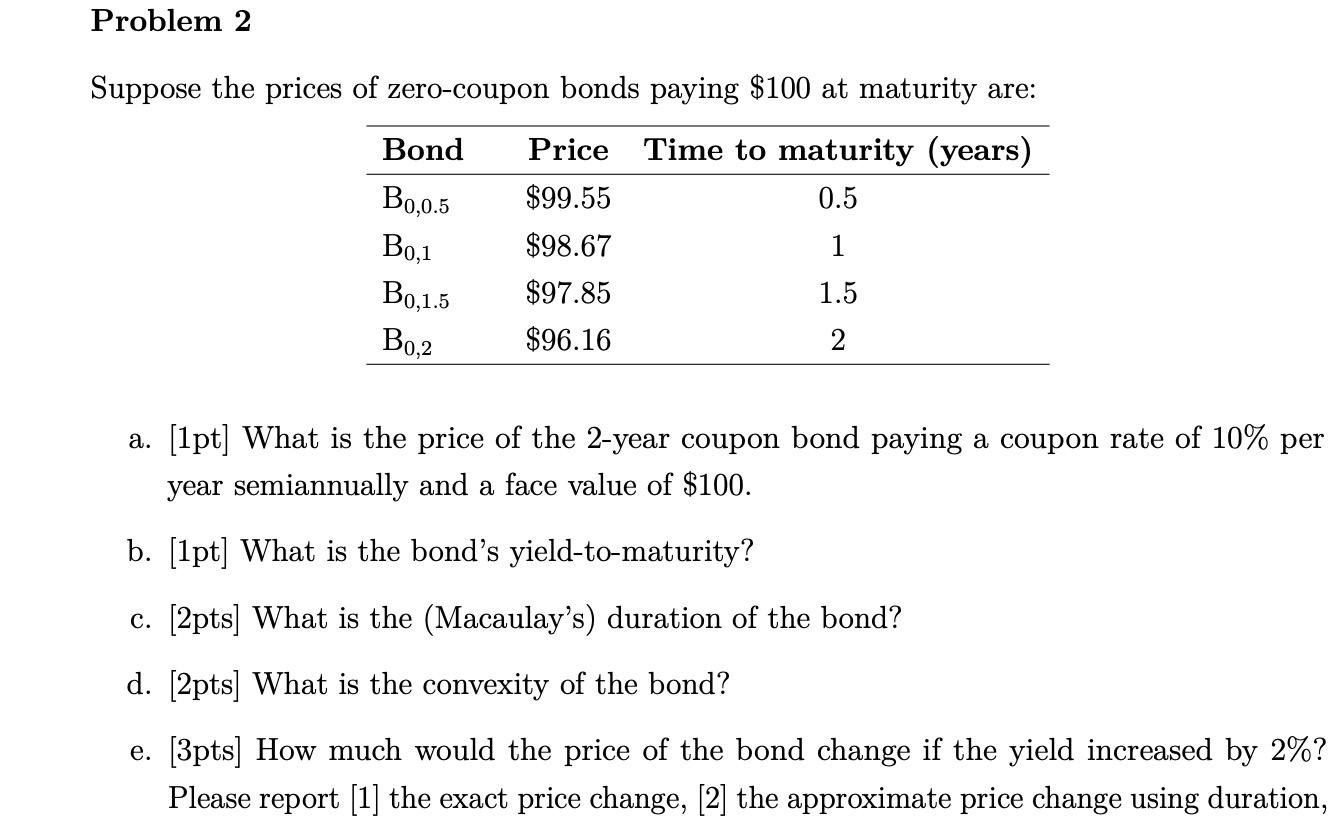

Problem 1 You have just purchased a 4-year coupon bond paying a coupon rate of 12% per year quarterly with a face value of $100. Suppose the yield curve is flat at 3%. a. [2pts) Find the bond's price today and three months from now after the next coupon is paid. Assume the yield to maturity on the bond is 2% after three months. b. [2pts] What would your rate of return if you sell the bond right after receiving the first coupon? c. [4pts] What would your rate of return if you sell the bond 30 days after receiving the first coupon? The reinvestment rate is 4% for these 30 days (not annualized). Assume that bond's bid and ask prices on the market at this time are pbid = $137.4 and pask = $138.09. The coupon periods has 91 days. Problem 2 Suppose the prices of zero-coupon bonds paying $100 at maturity are: Bond Price Time to maturity (years) 0.5 B0,0.5 B0,1 1 $99.55 $98.67 $97.85 $96.16 B0,1.5 1.5 B0,2 2 a. [1pt] What is the price of the 2-year coupon bond paying a coupon rate of 10% per year semiannually and a face value of $100. b. [1pt] What is the bond's yield-to-maturity? c. [2pts] What is the (Macaulay's) duration of the bond? d. [2pts] What is the convexity of the bond? e. [3pts) How much would the price of the bond change if the yield increased by 2%? Please report [1] the exact price change, [2] the approximate price change using duration, and [3] the approximate price change using duration and convexity. Problem 1 You have just purchased a 4-year coupon bond paying a coupon rate of 12% per year quarterly with a face value of $100. Suppose the yield curve is flat at 3%. a. [2pts) Find the bond's price today and three months from now after the next coupon is paid. Assume the yield to maturity on the bond is 2% after three months. b. [2pts] What would your rate of return if you sell the bond right after receiving the first coupon? c. [4pts] What would your rate of return if you sell the bond 30 days after receiving the first coupon? The reinvestment rate is 4% for these 30 days (not annualized). Assume that bond's bid and ask prices on the market at this time are pbid = $137.4 and pask = $138.09. The coupon periods has 91 days. Problem 2 Suppose the prices of zero-coupon bonds paying $100 at maturity are: Bond Price Time to maturity (years) 0.5 B0,0.5 B0,1 1 $99.55 $98.67 $97.85 $96.16 B0,1.5 1.5 B0,2 2 a. [1pt] What is the price of the 2-year coupon bond paying a coupon rate of 10% per year semiannually and a face value of $100. b. [1pt] What is the bond's yield-to-maturity? c. [2pts] What is the (Macaulay's) duration of the bond? d. [2pts] What is the convexity of the bond? e. [3pts) How much would the price of the bond change if the yield increased by 2%? Please report [1] the exact price change, [2] the approximate price change using duration, and [3] the approximate price change using duration and convexity