Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 10-11 Number 1 a. Compute the price and quantity variances. PLEASE SHOW ALL WORK Compute the materials price variance for the plates purchased last

PROBLEM 10-11

Number 1 a. Compute the price and quantity variances.

PLEASE SHOW ALL WORK

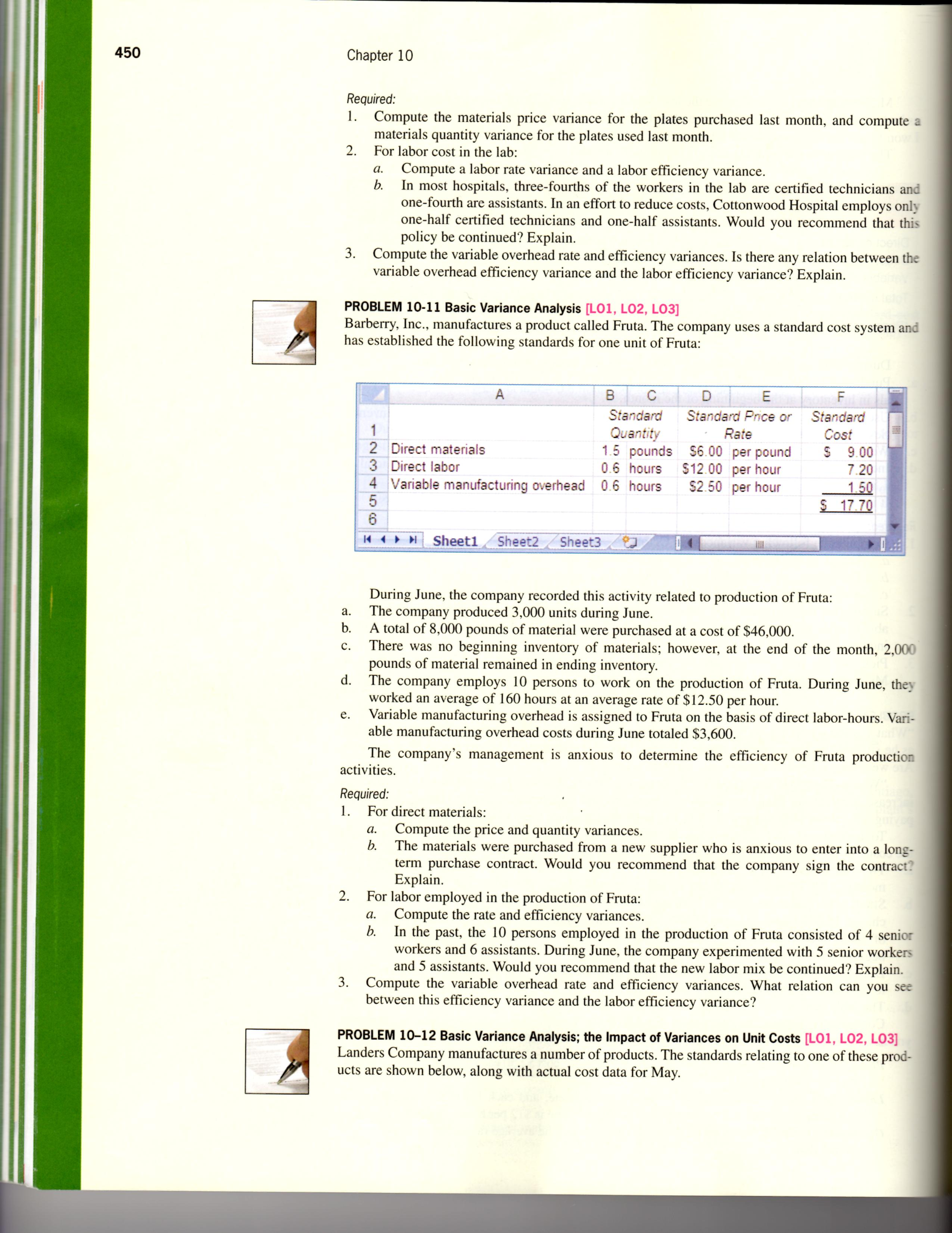

Compute the materials price variance for the plates purchased last month, and compute a materials quantity variance for the plates used last month. For labor cost in the lab: Compute a labor rate variance and a labor efficiency variance. In most hospitals, three-fourths of the workers in the lab are certified technicians and one-fourth are assistants. In an effort to reduce costs, Cottonwood Hospital employs only one-half certified technicians and one-half assistants. Would you recommend that this policy be continued? Explain. Compute the variable overhead rate and efficiency variances. Is there any relation between the variable overhead efficiency variance and the labor efficiency variance? Explain. Basic Variance Analysis [L01, L02, L03] Barberry, Inc., manufactures a product called Fruta. The company uses a standard cost system and has established the following standards for one unit of Fruta: During June, the company recorded this activity related to production of Fruta: The company produced 3,000 units during June. A total of 8,000 pounds of material were purchased at a cost of $46,000. There was no beginning inventory of materials; however, at the end of the month, 2,000 pounds of material remained in ending inventory. The company employs 10 persons to work on the production of Fruta. During June, they worked an average of 160 hours at an average rate of $12.50 per hour. Variable manufacturing overhead is assigned to Fruta on the basis of direct labor-hours. Variable manufacturing overhead costs during June totaled $3,600. The company's management is anxious to determine the efficiency of Fruta production activities. Required: For direct materials: Compute the price and quantity variances. The materials were purchased from a new supplier who is anxious to enter into a longterm purchase contract. Would you recommend that the company sign the contract? Explain. For labor employed in the production of Fruta: Compute the rate and efficiency variances. In the past, the 10 persons employed in the production of Fruta consisted of 4 senior workers and 6 assistants. During June, the company experimented with 5 senior workers and 5 assistants. Would you recommend that the new labor mix be continued? Explain. Compute the variable overhead rate and efficiency variances. What relation can you see between this efficiency variance and the labor efficiency variance? Basic Variance Analysis; the Impact of Variances on Unit Costs [L01, L02, L03] Landers Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Compute the materials price variance for the plates purchased last month, and compute a materials quantity variance for the plates used last month. For labor cost in the lab: Compute a labor rate variance and a labor efficiency variance. In most hospitals, three-fourths of the workers in the lab are certified technicians and one-fourth are assistants. In an effort to reduce costs, Cottonwood Hospital employs only one-half certified technicians and one-half assistants. Would you recommend that this policy be continued? Explain. Compute the variable overhead rate and efficiency variances. Is there any relation between the variable overhead efficiency variance and the labor efficiency variance? Explain. Basic Variance Analysis [L01, L02, L03] Barberry, Inc., manufactures a product called Fruta. The company uses a standard cost system and has established the following standards for one unit of Fruta: During June, the company recorded this activity related to production of Fruta: The company produced 3,000 units during June. A total of 8,000 pounds of material were purchased at a cost of $46,000. There was no beginning inventory of materials; however, at the end of the month, 2,000 pounds of material remained in ending inventory. The company employs 10 persons to work on the production of Fruta. During June, they worked an average of 160 hours at an average rate of $12.50 per hour. Variable manufacturing overhead is assigned to Fruta on the basis of direct labor-hours. Variable manufacturing overhead costs during June totaled $3,600. The company's management is anxious to determine the efficiency of Fruta production activities. Required: For direct materials: Compute the price and quantity variances. The materials were purchased from a new supplier who is anxious to enter into a longterm purchase contract. Would you recommend that the company sign the contract? Explain. For labor employed in the production of Fruta: Compute the rate and efficiency variances. In the past, the 10 persons employed in the production of Fruta consisted of 4 senior workers and 6 assistants. During June, the company experimented with 5 senior workers and 5 assistants. Would you recommend that the new labor mix be continued? Explain. Compute the variable overhead rate and efficiency variances. What relation can you see between this efficiency variance and the labor efficiency variance? Basic Variance Analysis; the Impact of Variances on Unit Costs [L01, L02, L03] Landers Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for MayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started