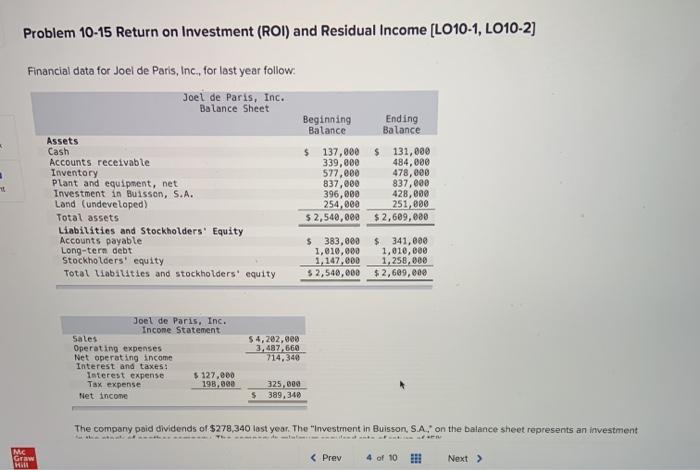

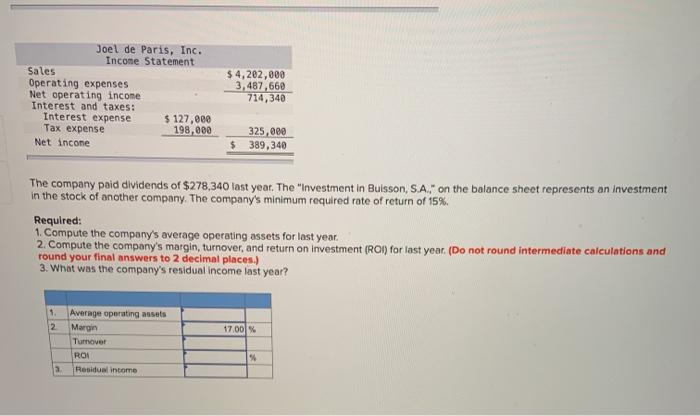

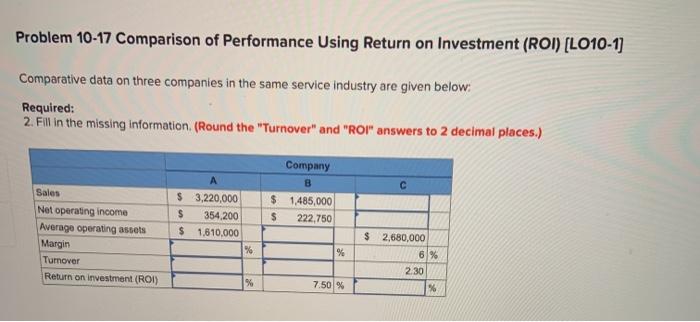

Problem 10-15 Return on Investment (ROI) and Residual Income [LO10-1, LO10-2] Financial data for Joel de Paris, Inc., for last year follow Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net Investment in Buisson, S.A. Land (undeveloped) Total assets Liabilities and Stockholders' Equity Accounts payable Long-tern debt Stockholders' equity Total liabilities and stockholders' equity 137,000 339,800 577,000 837,000 396,000 254,000 $ 2,540,000 $ 131,000 484,000 478,000 837,000 428,000 251,800 $ 2,609,000 $ 383,000 1,010,000 1,147,000 $ 2,540,000 $ 341,600 1,010,000 1,258,000 $ 2,609,000 Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $ 127,000 Tax expense 198,00 Net income $4,202,000 3,487,660 714.340 325,000 $ 389, 340 The company paid dividends of $278,340 last year. The "Investment in Buisson, S.A.on the balance sheet represents an investment Me Graw Hill Joel de Paris, Inc. Income Statement Sales Operating expenses Net operating income Interest and taxes: Interest expense $ 127,000 Tax expense 198,000 Net income $ 4,202,000 3,487,660 714,340 325,000 $ 389,340 The company paid dividends of $278,340 last year. The "Investment in Bulsson, S.A." on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%. Required: 1. Compute the company's average operating assets for last year. 2. Compute the company's margin, turnover, and return on investment (ROI) for last year (Do not round intermediate calculations and round your final answers to 2 decimal places.) 3. What was the company's residual income last year? 1. 2 17,00 % Average operating assets Margin Turnover ROI Residual income % a Problem 10-17 Comparison of Performance Using Return on Investment (ROI) (LO10-1] Comparative data on three companies in the same service industry are given below: Required: 2. Fill in the missing information (Round the "Turnover" and "ROI answers to 2 decimal places.) Company B $ 1,485.000 $ 222,750 Sales Net operating income Average operating assets Margin Turnover Return on investment (ROI) $ 3,220,000 $ 354,200 $ 1.610.000 % % $ 2,680,000 6 % 2.30 % % 7.50%