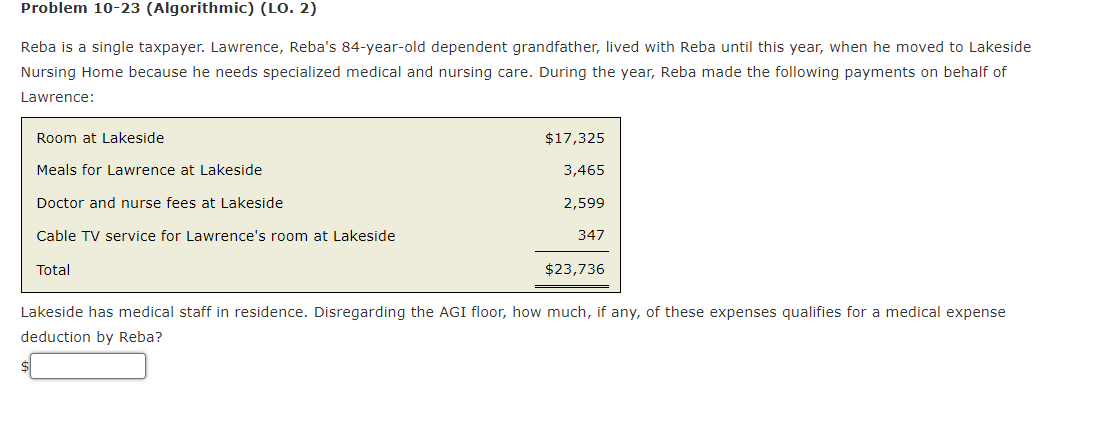

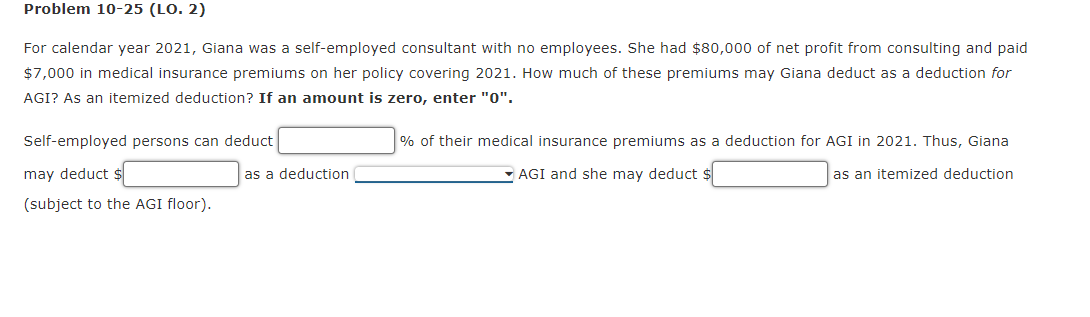

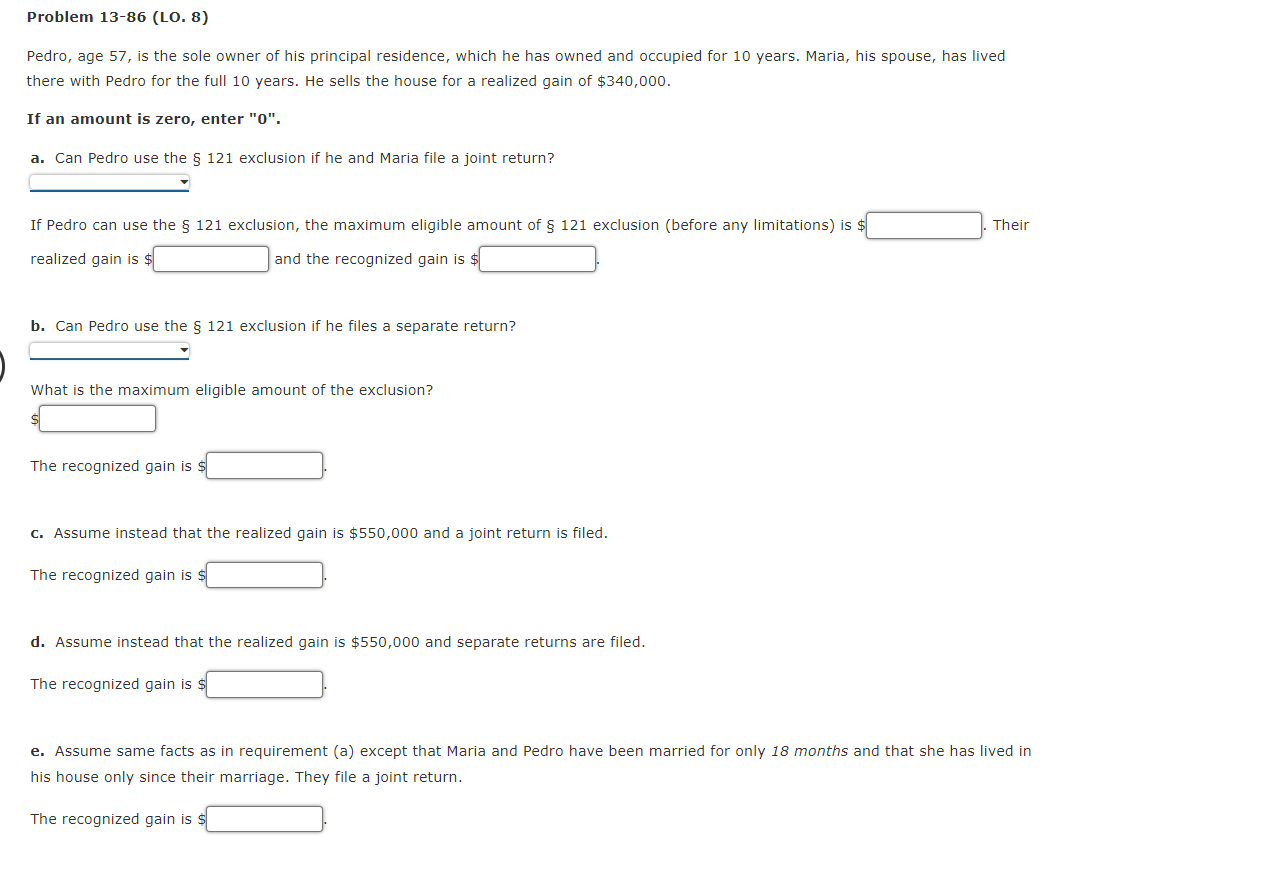

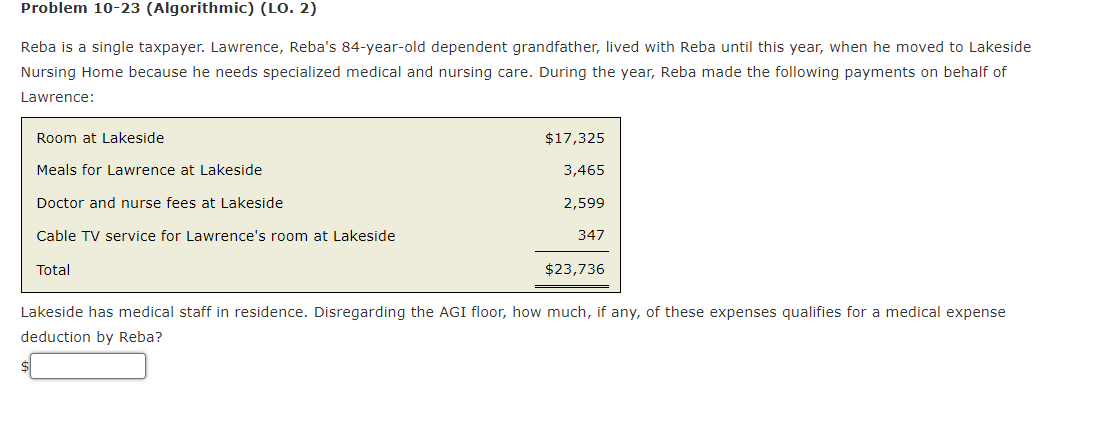

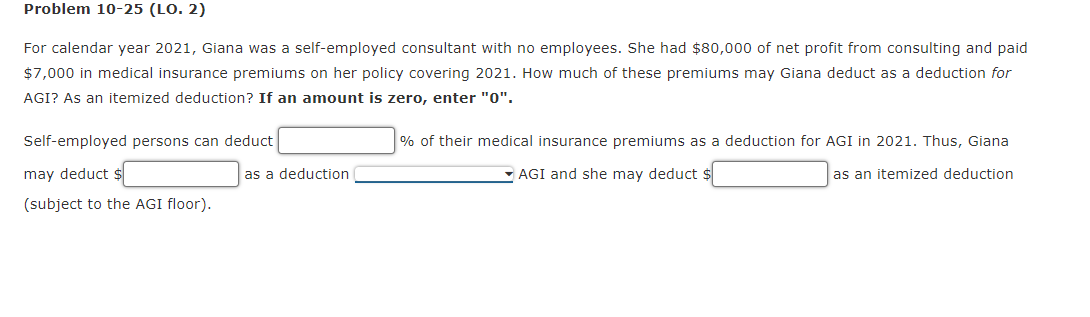

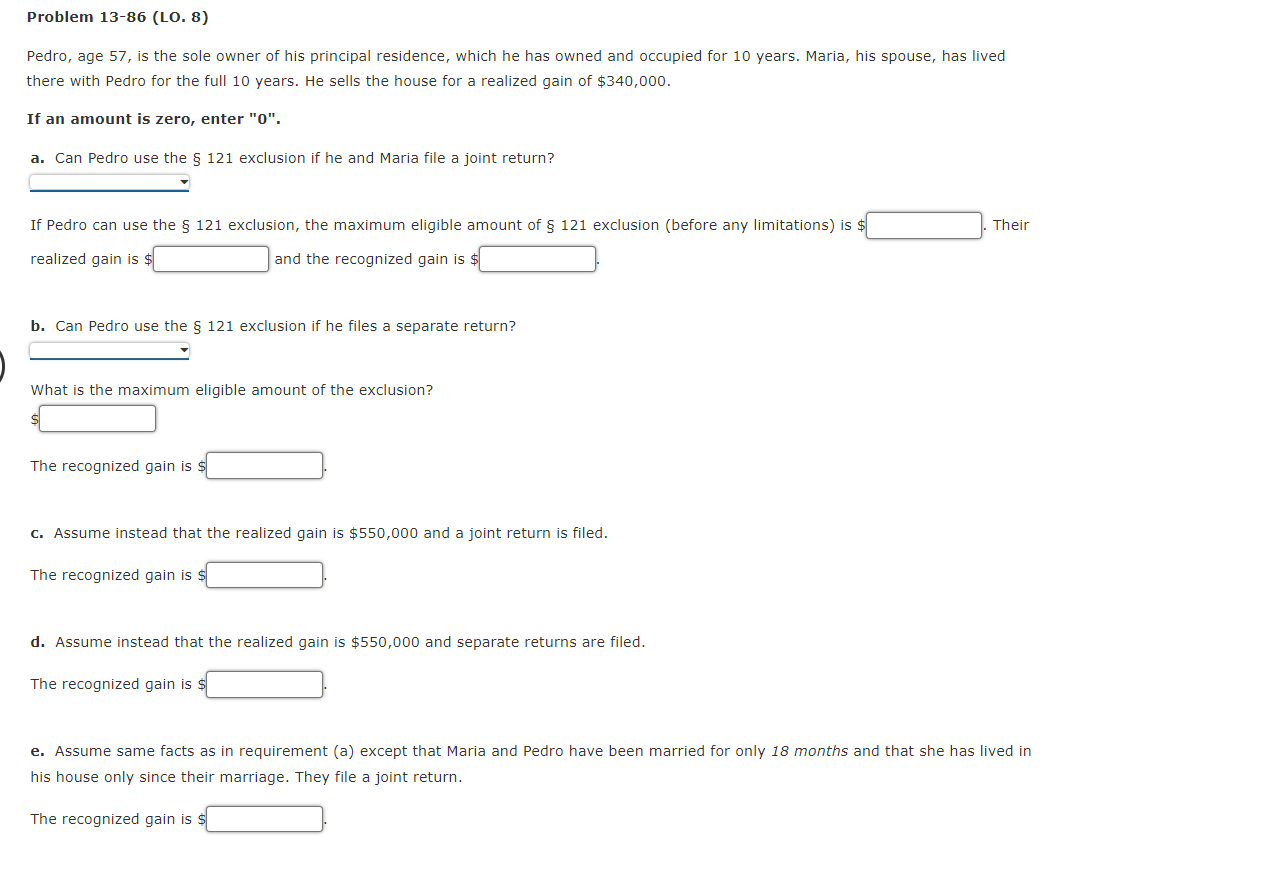

Problem 10-23 (Algorithmic) (LO. 2) Reba is a single taxpayer. Lawrence, Reba's 84-year-old dependent grandfather, lived with Reba until this year, when he moved to Lakeside Nursing Home because he needs specialized medical and nursing care. During the year, Reba made the following payments on behalf of Lawrence: Room at Lakeside $17,325 Meals for Lawrence at Lakeside 3,465 Doctor and nurse fees at Lakeside 2,599 Cable TV service for Lawrence's room at Lakeside 347 Total $23,736 Lakeside has medical staff in residence. Disregarding the AGI floor, how much, if any, of these expenses qualifies for a medical expense deduction by Reba? Problem 10-25 (LO. 2) For calendar year 2021, Giana was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2021. How much of these premiums may Giana deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct % of their medical insurance premiums as a deduction for AGI in 2021. Thus, Giana may deducts as a deduction AGI and she may deduct $ as an itemized deduction (subject to the AGI floor). Problem 13-86 (LO. 8) Pedro, age 57, is the sole owner of his principal residence, which he has owned and occupied for 10 years. Maria, his spouse, has lived there with Pedro for the full 10 years. He sells the house for a realized gain of $340,000. If an amount is zero, enter "0". a. Can Pedro use the 121 exclusion if he and Maria file a joint return? If Pedro can use the 121 exclusion, the maximum eligible amount of 121 exclusion (before any limitations) is Their realized gain is $1 and the recognized gain is $ b. Can Pedro use the $ 121 exclusion if he files a separate return? What is the maximum eligible amount of the exclusion? The recognized gain is C. Assume instead that the realized gain is $550,000 and a joint return is filed. The recognized gain is $ d. Assume instead that the realized gain is $550,000 and separate returns are filed. The recognized gain is $ e. Assume same facts as in requirement (a) except that Maria and Pedro have been married for only 18 months and that she has lived in his house only since their marriage. They file a joint return. The recognized gain is s