Answered step by step

Verified Expert Solution

Question

1 Approved Answer

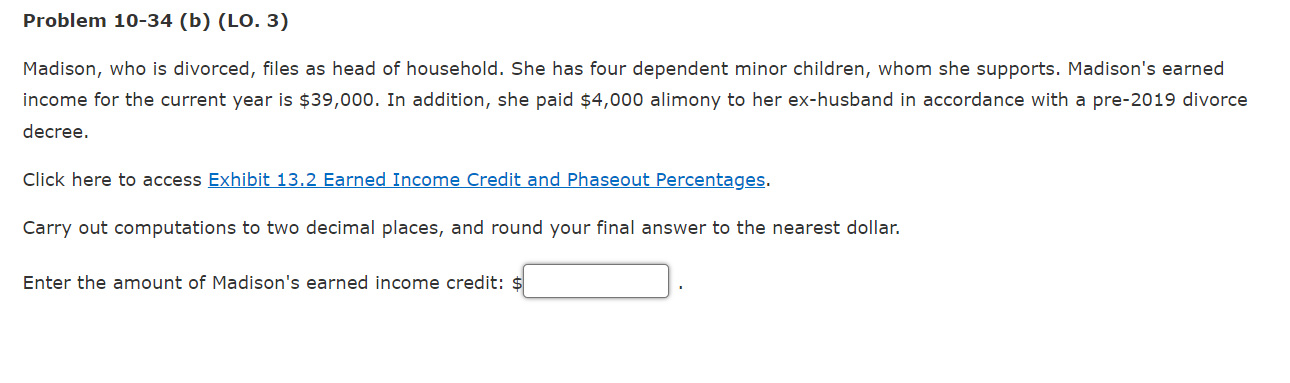

Problem 10-34 (b) (LO. 3) Madison, who is divorced, files as head of household. She has four dependent minor children, whom she supports. Madison's

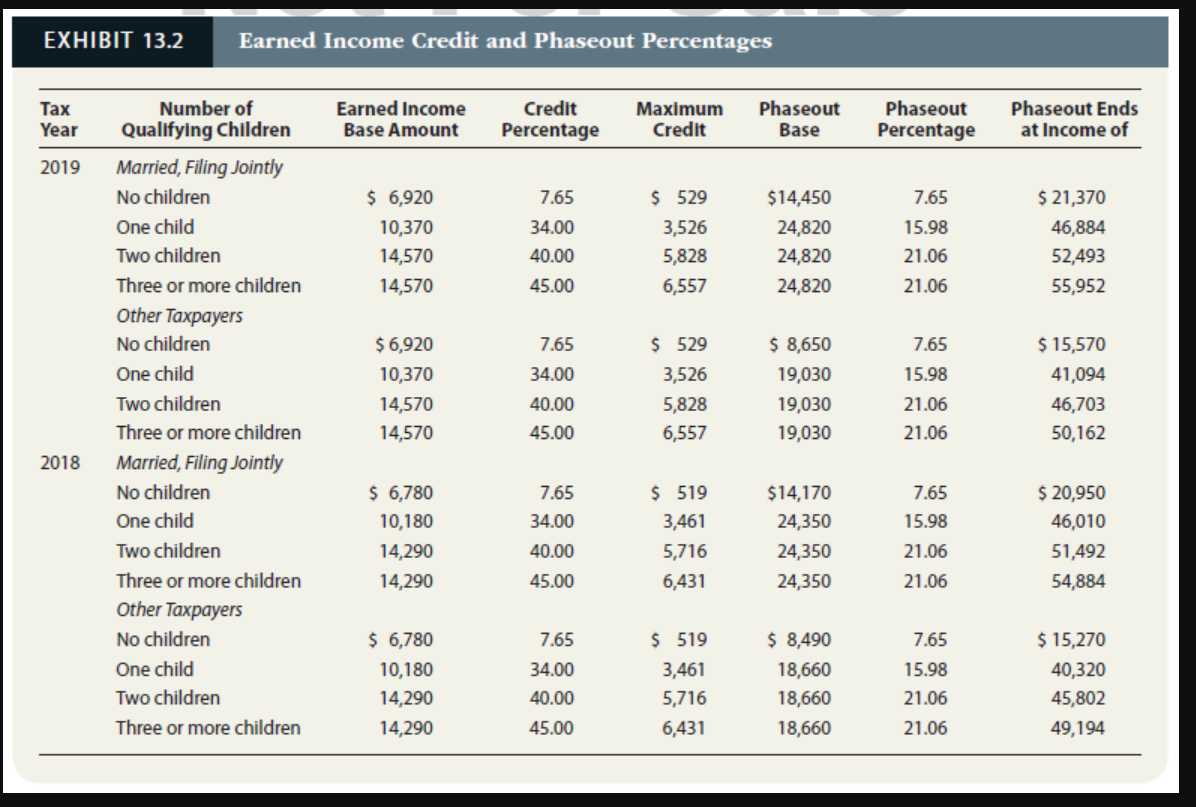

Problem 10-34 (b) (LO. 3) Madison, who is divorced, files as head of household. She has four dependent minor children, whom she supports. Madison's earned income for the current year is $39,000. In addition, she paid $4,000 alimony to her ex-husband in accordance with a pre-2019 divorce decree. Click here to access Exhibit 13.2 Earned Income Credit and Phaseout Percentages. Carry out computations to two decimal places, and round your final answer to the nearest dollar. Enter the amount of Madison's earned income credit: $ EXHIBIT 13.2 Earned Income Credit and Phaseout Percentages Tax Year Number of Qualifying Children Earned Income Base Amount Credit Percentage Maximum Phaseout Credit Base Phaseout Percentage Phaseout Ends at Income of 2019 Married, Filing Jointly No children $ 6,920 7.65 $ 529 $14,450 7.65 $ 21,370 One child 10,370 34.00 3,526 24,820 15.98 46,884 Two children 14,570 40.00 5,828 24,820 21.06 52,493 Three or more children 14,570 45.00 6,557 24,820 21.06 55,952 Other Taxpayers No children $6,920 7.65 $ 529 $ 8,650 7.65 $ 15,570 One child 10,370 34.00 3,526 19,030 15.98 41,094 Two children 14,570 40.00 5,828 19,030 21.06 46,703 Three or more children 14,570 45.00 6,557 19,030 21.06 50,162 2018 Married, Filing Jointly No children $ 6,780 7.65 $ 519 $14,170 7.65 $ 20,950 One child 10,180 34.00 3,461 24,350 15.98 46,010 Two children 14,290 40.00 5,716 24,350 21.06 51,492 Three or more children 14,290 45.00 6,431 24,350 21.06 54,884 Other Taxpayers No children $ 6,780 7.65 $ 519 $ 8,490 7.65 $ 15,270 One child 10,180 34.00 3,461 18,660 15.98 40,320 Two children 14,290 40.00 5,716 18,660 21.06 45,802 Three or more children 14,290 45.00 6,431 18,660 21.06 49,194

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve for Madisons Earned Income Credit EIC for the year we need to follow these steps 1 Determin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started