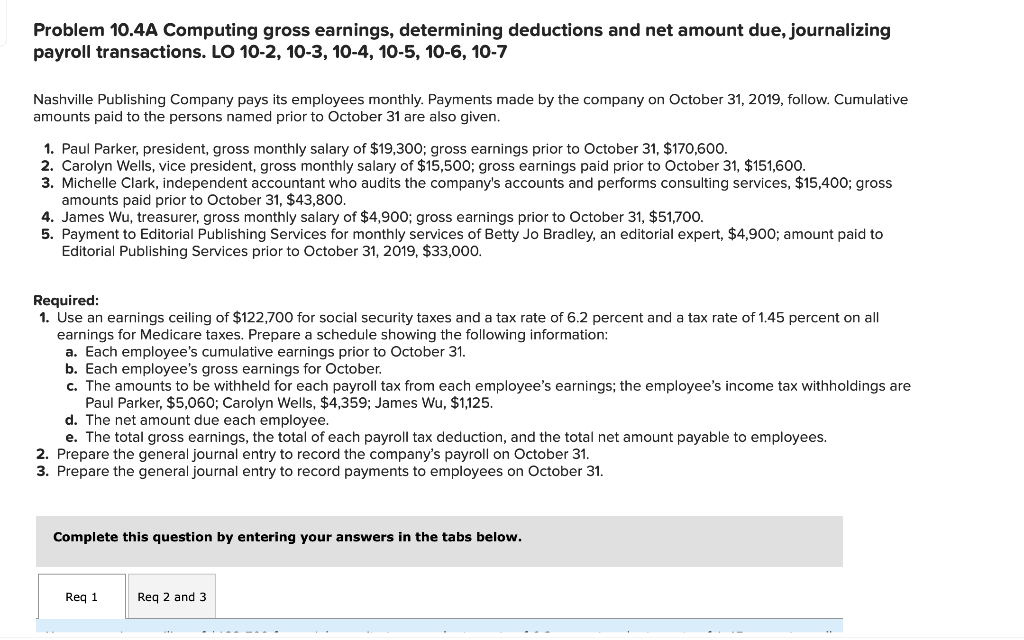

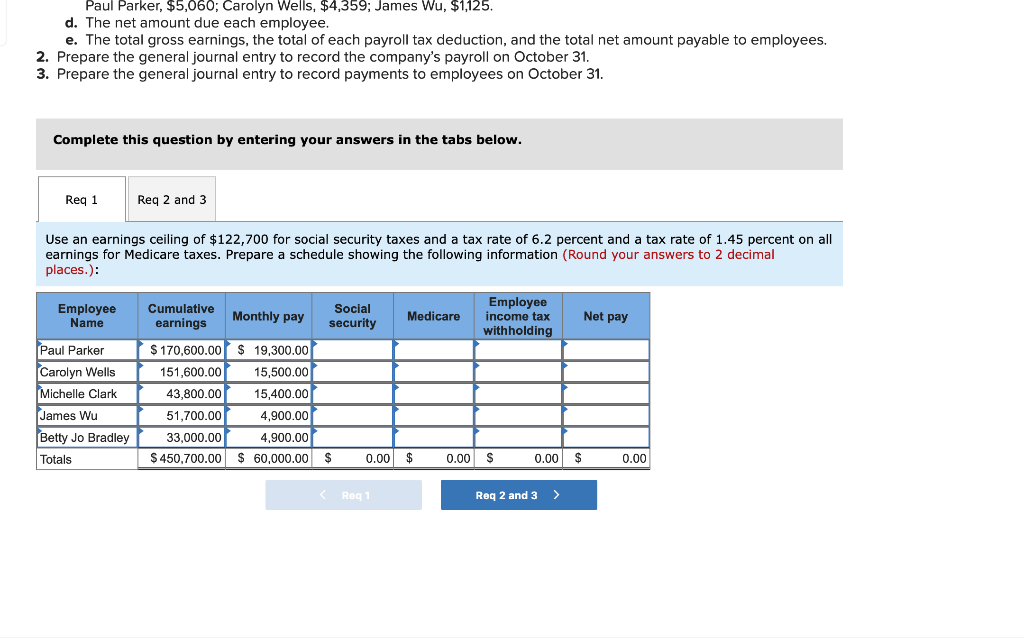

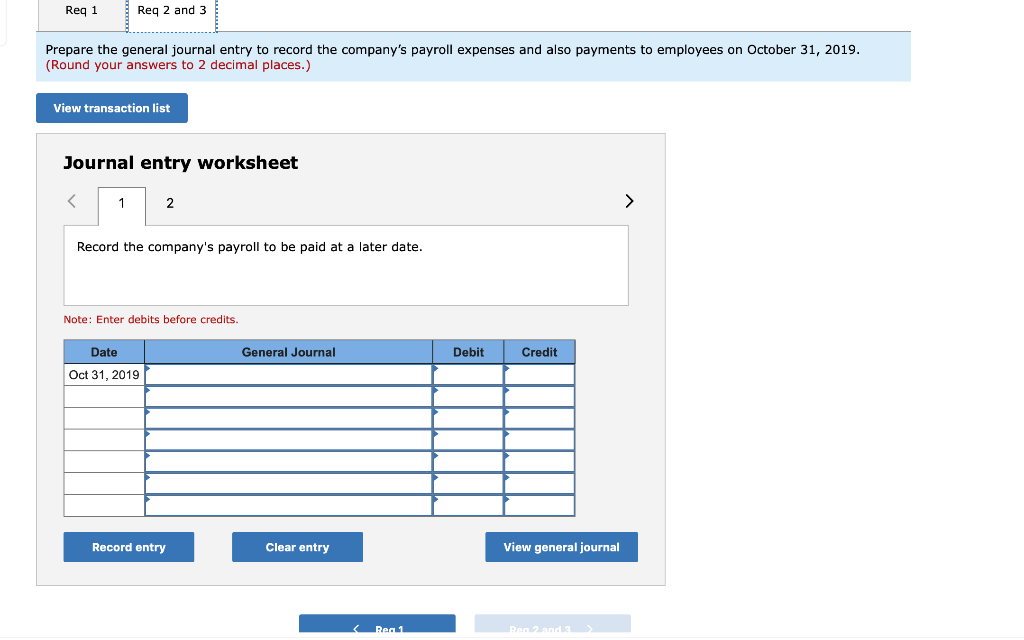

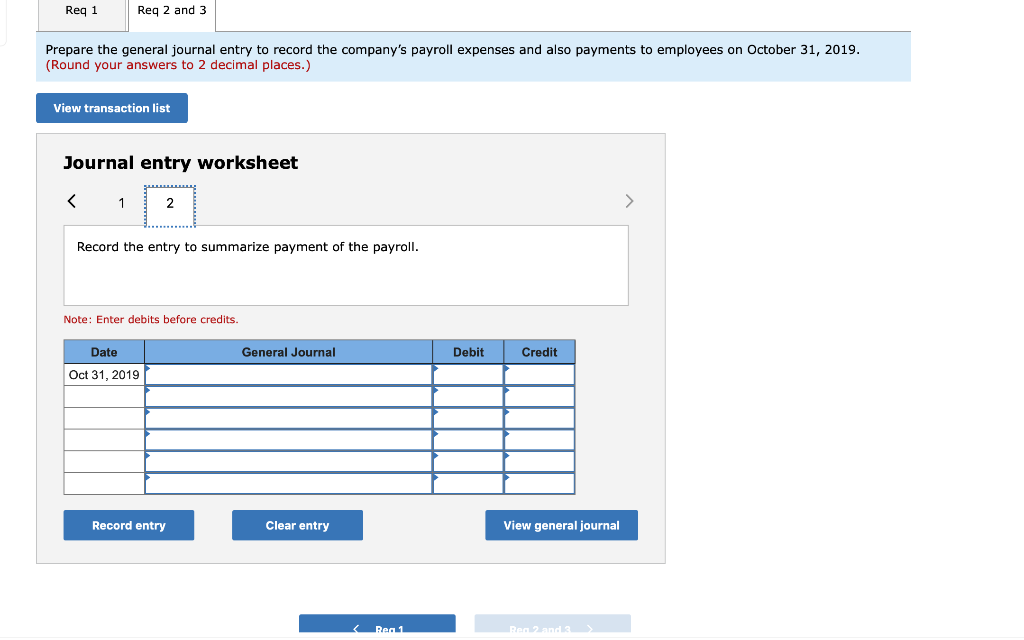

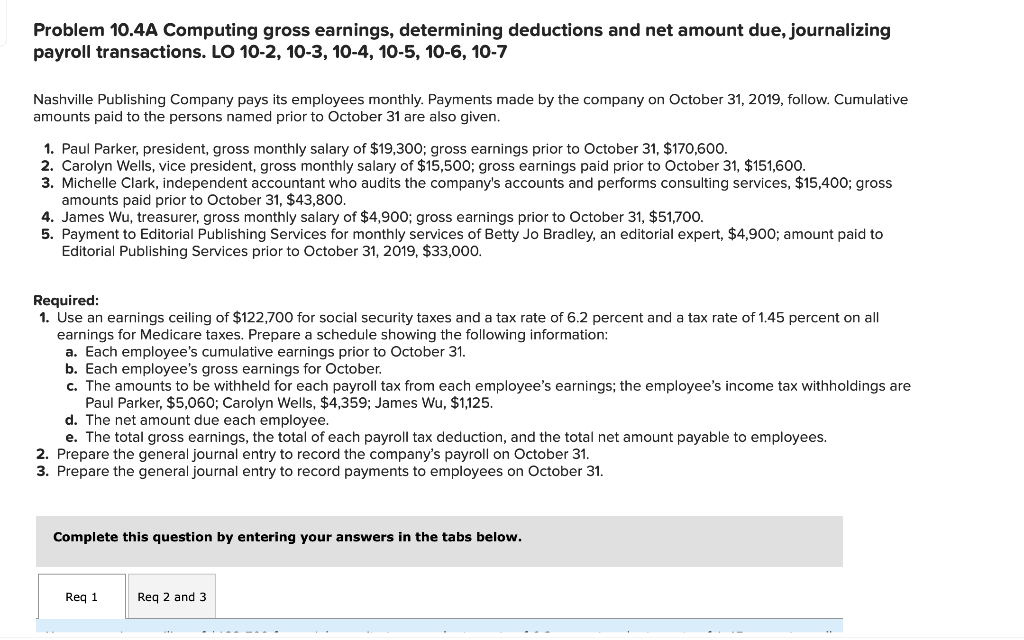

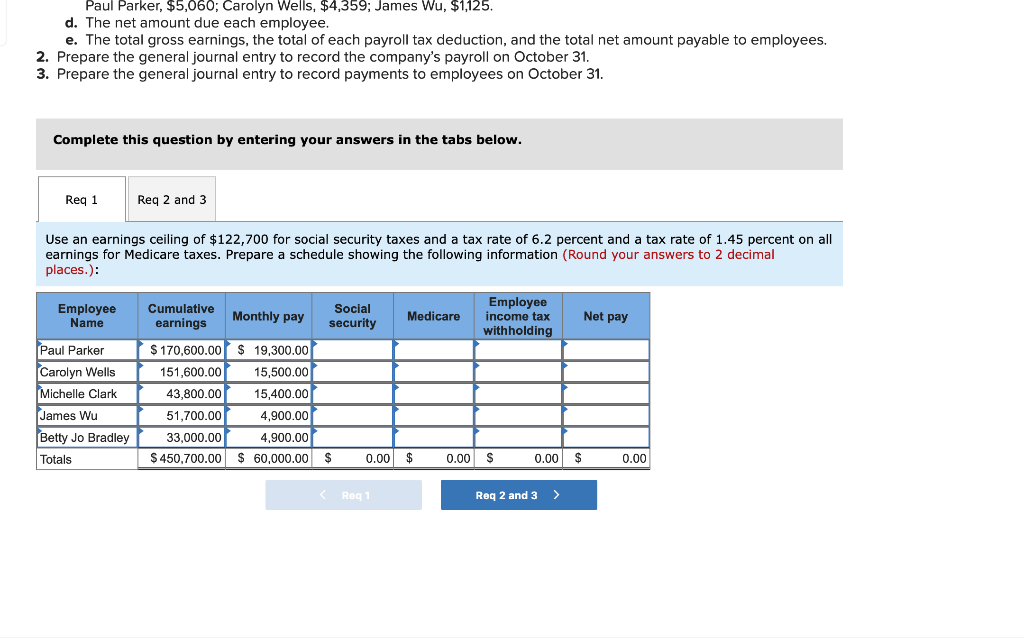

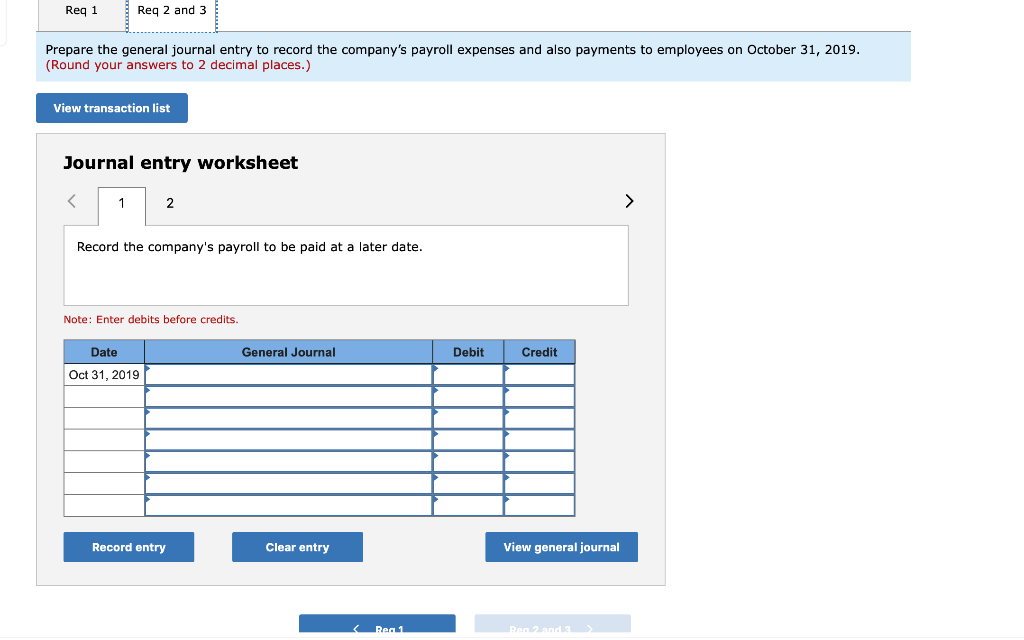

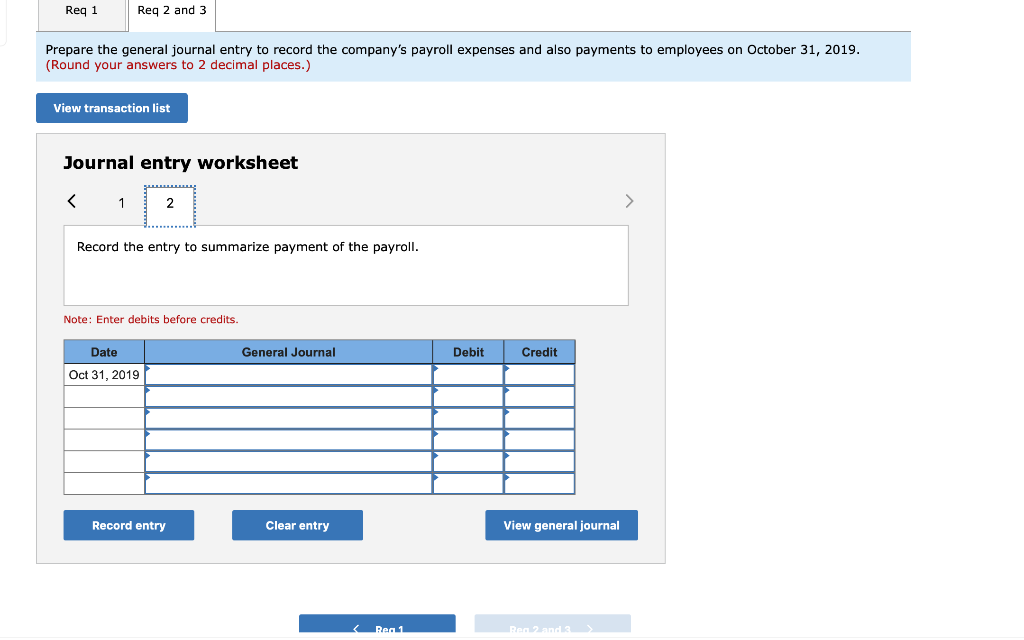

Problem 10.4A Computing gross earnings, determining deductions and net amount due, journalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5, 10-6, 10-7 Nashville Publishing Company pays its employees monthly. Payments made by the company on October 31, 2019, follow. Cumulative amounts paid to the persons named prior to October 31 are also given, 1. Paul Parker, president, gross monthly salary of $19,300; gross earnings prior to October 31, $170,600. 2. Carolyn Wells, vice president, gross monthly salary of $15,500; gross earnings paid prior to October 31, $151,600. 3. Michelle Clark, independent accountant who audits the company's accounts and performs consulting services, $15,400; gross amounts paid prior to October 31, $43,800. 4. James Wu, treasurer, gross monthly salary of $4,900; gross earnings prior to October 31, $51,700. 5. Payment to Editorial Publishing Services for monthly services of Betty Jo Bradley, an editorial expert, $4,900; amount paid to Editorial Publishing Services prior to October 31, 2019, $33,000. Required: 1. Use an earnings ceiling of $122,700 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all earnings for Medicare taxes. Prepare a schedule showing the following information: a. Each employee's cumulative earnings prior to October 31. b. Each employee's gross earnings for October. c. The amounts to be withheld for each payroll tax from each employee's earnings; the employee's income tax withholdings are Paul Parker, $5,060; Carolyn Wells, $4,359; James Wu, $1,125. d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees. 2. Prepare the general journal entry to record the company's payroll on October 31. 3. Prepare the general journal entry to record payments to employees on October 31. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Paul Parker, $5,060; Carolyn Wells, $4,359; James Wu, $1,125. d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees. 2. Prepare the general journal entry to record the company's payroll on October 31. 3. Prepare the general journal entry to record payments to employees on October 31. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Use an earnings ceiling of $122,700 for social security taxes and a tax rate of 6.2 percent and a tax rate of 1.45 percent on all earnings for Medicare taxes. Prepare a schedule showing the following information (Round your answers to 2 decimal places.): Employee Name Monthly pay Employee income tax withholding Net pay Paul Parker Carolyn Wells Michelle Clark James Wu Betty Jo Bradley Totals Cumulative Social Medicare earnings security $ 170,600.00 $ 19,300.00 151,600.00 15,500.00 43,800.00 15,400.00 51,700.00 4,900.00 33,000.00 4,900.00 $ 450,700.00 $ 60,000.00 $ 0.00 $ 0.00 S 0.00 $ 0.00 Record the company's payroll to be paid at a later date. Note: Enter debits before credits General Journal Debit Credit Date Oct 31, 2019 Record entry Clear entry View general journal Rec1 Ren2 and Req 1 Req 2 and 3 Prepare the general journal entry to record the company's payroll expenses and also payments to employees on October 31, 2019. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet