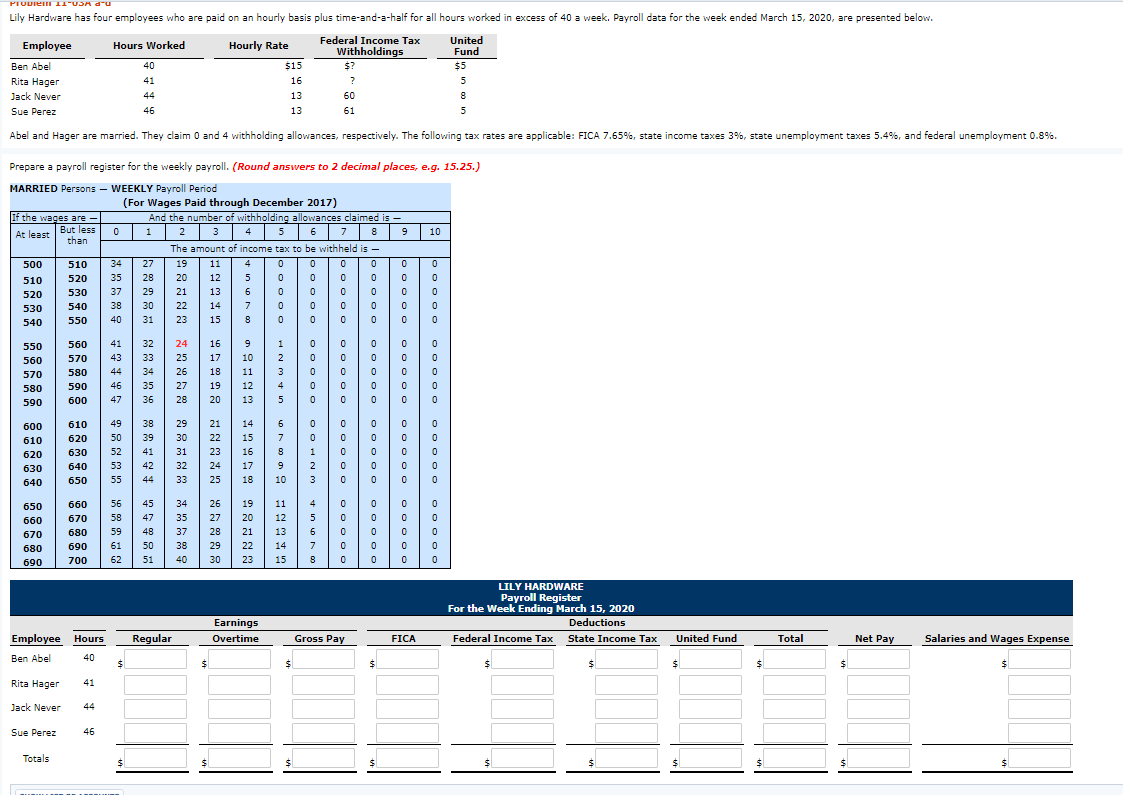

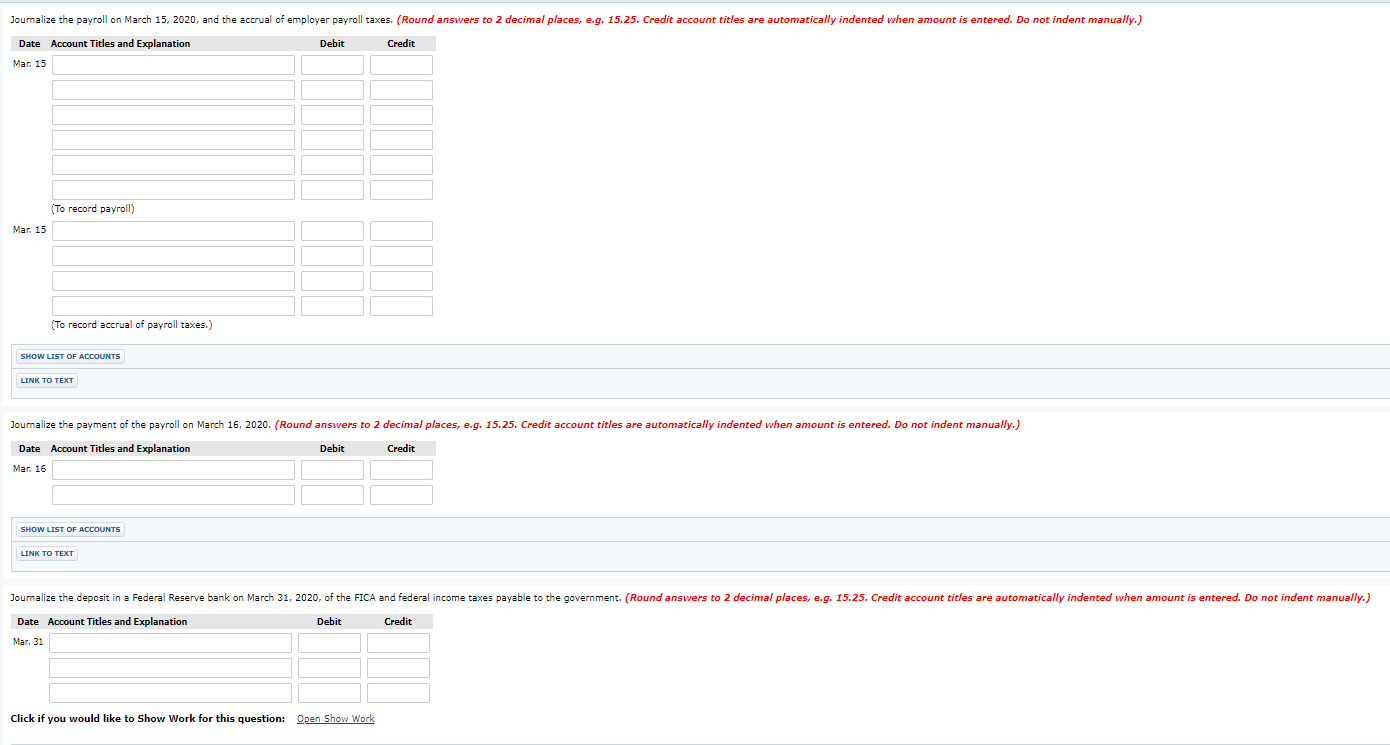

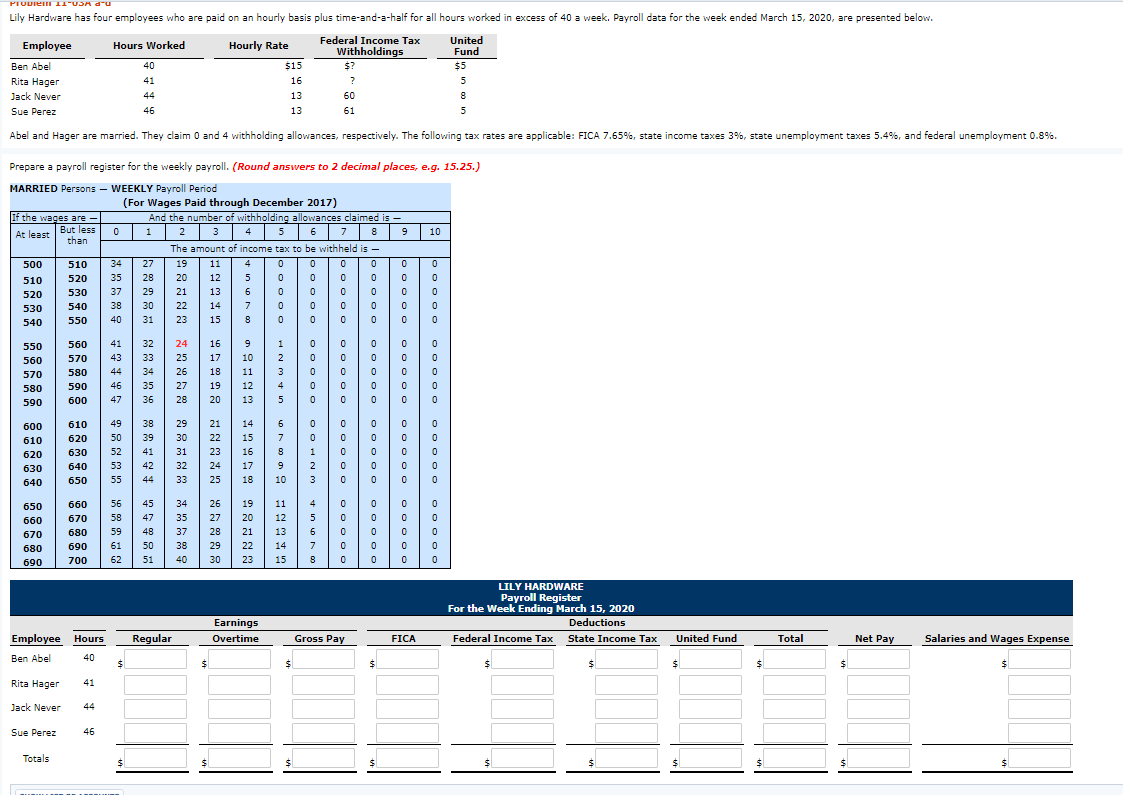

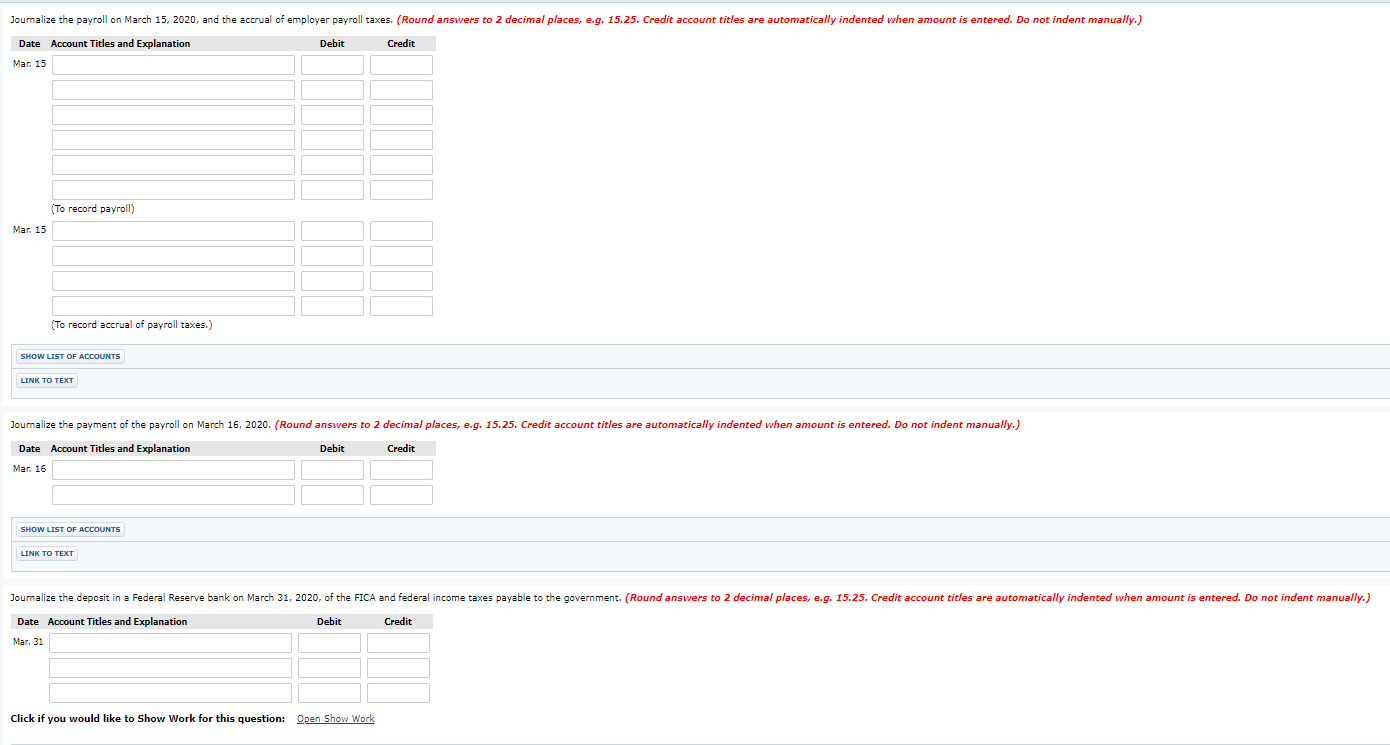

Problem 11 USA du Lily Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2020, are presented below. Hours Worked Hourly Rate Federal Income Tax Withholdings United Fund $5 $15 Employee Ben Abel Rita Hager Jack Never Sue Perez 60 61 46 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. 10 Prepare a payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) MARRIED Persons WEEKLY Payroll Period (For Wages Paid through December 2017) lif the wages are - And the number of withholding allowances claimed is - At least But less 0 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 than The amount of income tax to be withheld is - 500 510 19 510 520 520 530 530 540 540 550 550 560 560 570 580 590 .... oooo WNM+ in9 .... OO OOOOO OOHNM +no OOOOOOOOOOOOOOOOOOO 600 610 620 630 640 650 660 670 680 690 Oooooooooooooooo .... 9 670 680 690 700 ..... LILY HARDWARE Payroll Register For the Week Ending March 15, 2020 Deductions Federal Income Tax State Income Tax Regular Earnings Overtime Gross Pay FICA United Fund Total Net Pay Salaries and Wages Expense Employee Hours Ben Abel Rita Hager 41 Jack Never 44 Sue Perez Totals Journalize the payroll on March 15, 2020, and the accrual of employer payroll taxes. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Mar. 15 (To record payroll) Mar. 15 (To record accrual of payroll taxes.) SHOW LIST OF ACCOUNTS LINK TO TEXT Journalize the payment of the payroll on March 16, 2020. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Mar. 16 SHOW LIST OF ACCOUNTS LINK TO TEXT Joumalize the deposit in a Federal Reserve bank on March 31, 2020, of the FICA and federal income taxes payable to the government. (Round answers to 2 decimal places, e.q. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Mar. 31 Click if you would like to Show Work for this question: Open Show Work