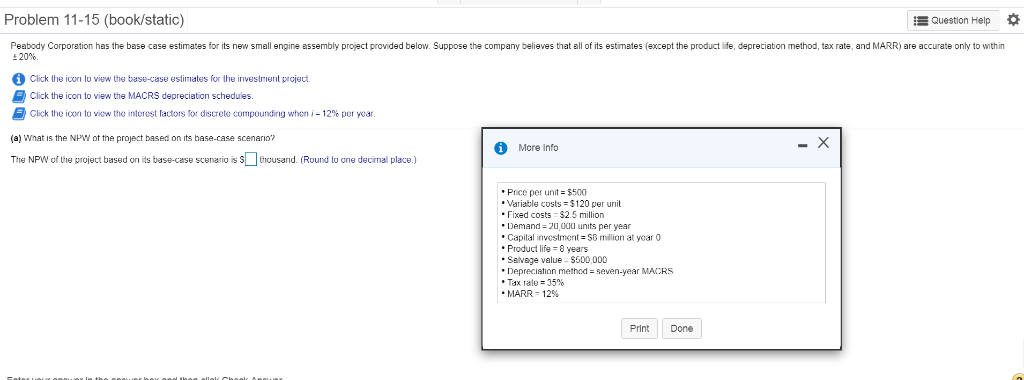

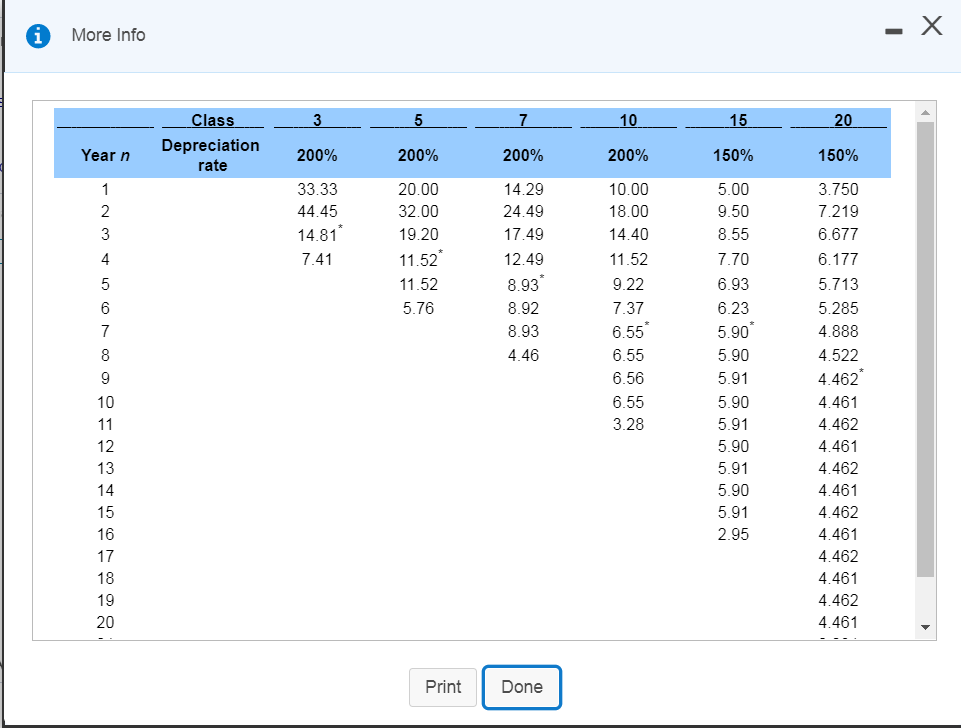

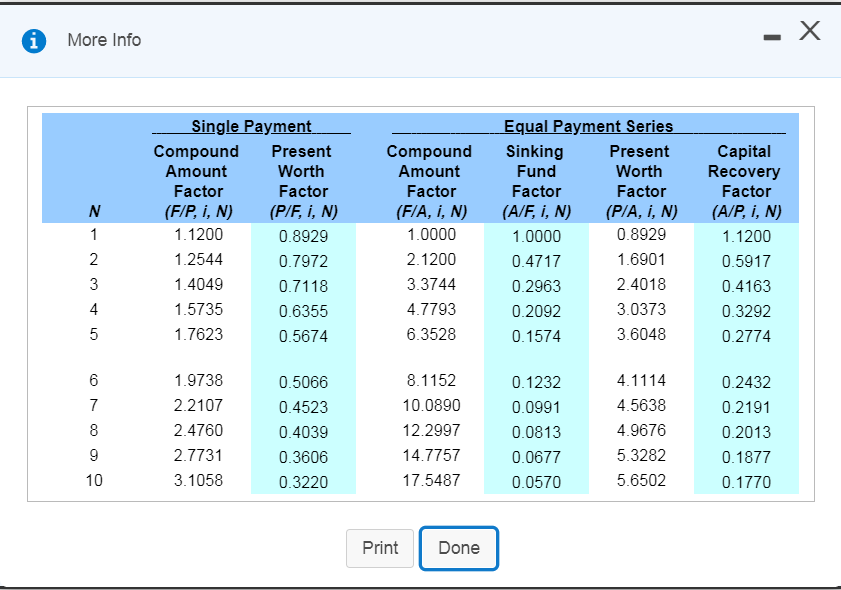

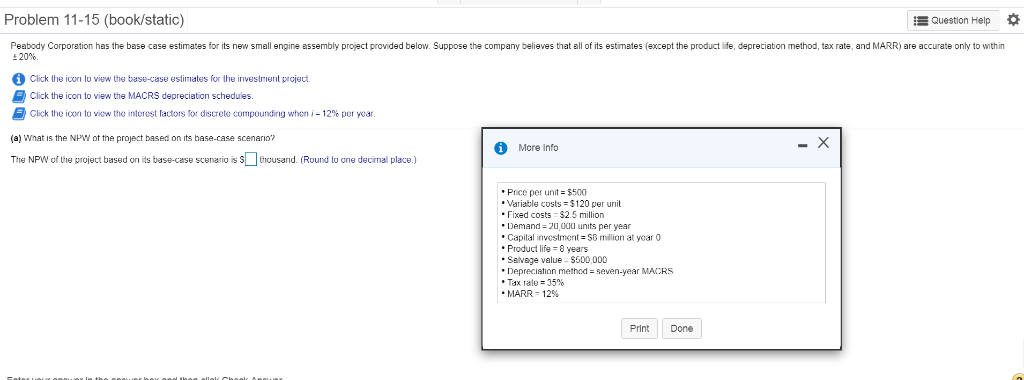

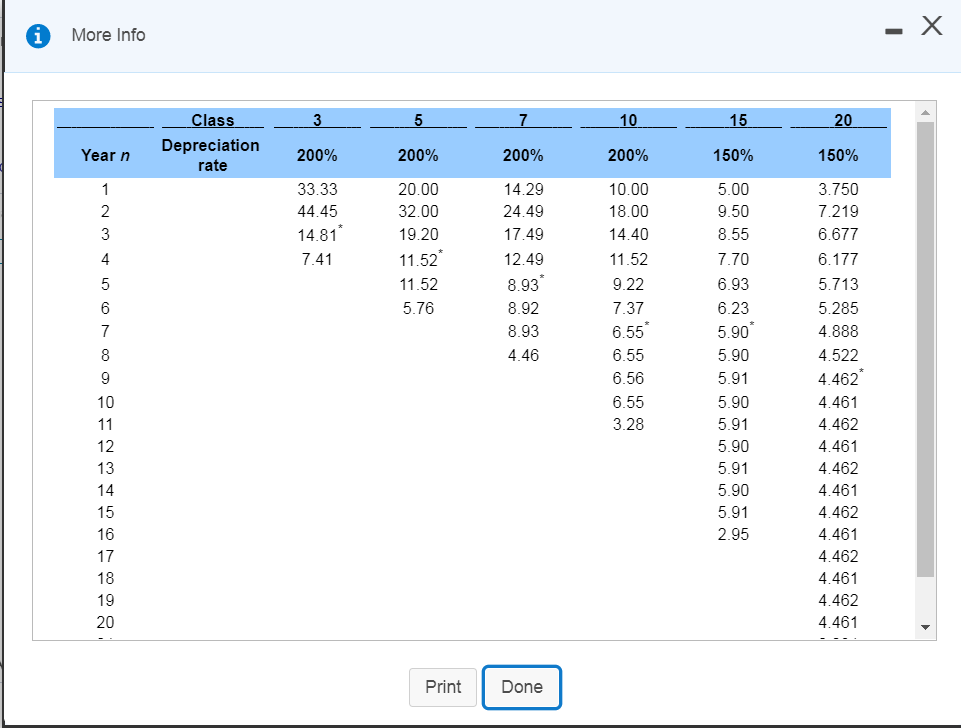

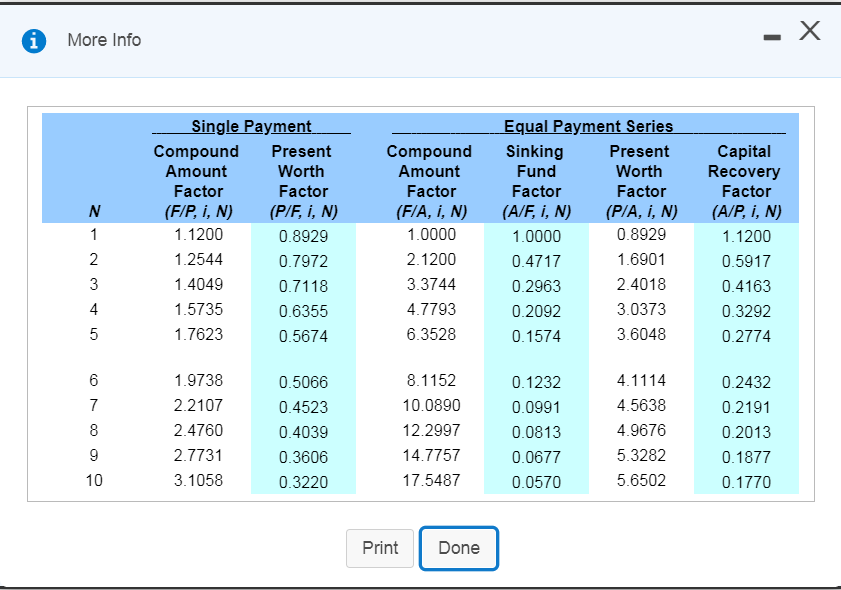

Problem 11-15 (book/static) Question Help Peabody Corporation has the base case estimates for its new small enineassembly project provided below. Suppose the company believes that all of its estimates (except the product ife, depreciation method, tax rate, and MARR) are accurate only to within 20%. Click the icorn to view the base-case eslimates for the investmient projett Click the icon to view the MACRS depreciation schedules. Click the ioon to vow the in orest factors for discrete compounding when ,-12% per year (a) What is the NPW ot the project based on its base-case scenario? More Info The NPW of the project based ori its base-case scenario is Sthcusarnd. (Round to orie decimal place.) Price per unit $500 Variable costs $120 per unit Fixed costs- $2.5 million Demand-2u ci units per year Capital investment-S0 million at year 0 Product life-8 years Selvage value $500,000 Depreciation method-seven-year MACRS . Tax rate: 35% . MARR-12% Print Done 3582212121212121 1882666666666666 72617285444444444444 1 37665544444444444444 2051 5 % 005033.0 0 1 0 1 0 1 0 15 0 0557929999999999 5987665555555552 0045 0 0841 755 355 2 2 9766663 2444,3 2 3 6 9994 % 9999* 0 4472 2 1211 8884 00022 00255 76 2 23111 35*1 3481 % 0 344 2341 sit re a 123456789 01234567890 More Info Single Payment qual Payment Series Present Worth Factor Compound Sinking Present Worth Factor (P/A, , N) 0.8929 1.6901 2.4018 3.0373 3.6048 Capital Recovery Factor (A/P, i, N) 1.1200 0.5917 0.4163 0.3292 0.2774 Compound Amount Factor 1.1200 1.2544 1.4049 1.5735 1.7623 0.8929 0.7972 0.7118 0.6355 0.5674 Amount Factor (FIA, N) 1.0000 2.1200 3.3744 4.7793 6.3528 Fund Factor (AF, i, N) 1.0000 0.4717 0.2963 0.2092 0.1574 1.9738 2.2107 2.4760 2.7731 3.1058 0.5066 0.4523 0.4039 0.3606 0.3220 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 4.1114 4.5638 4.9676 5.3282 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 PrintDone (a) What is the NPW of the project based on its base-case scenario? (b) What is the NPW of the project based on its best-case scenario? (c) What is the worst-case scenario? d) What conclusion would you make about the project after seeing the scenario analyses? Problem 11-15 (book/static) Question Help Peabody Corporation has the base case estimates for its new small enineassembly project provided below. Suppose the company believes that all of its estimates (except the product ife, depreciation method, tax rate, and MARR) are accurate only to within 20%. Click the icorn to view the base-case eslimates for the investmient projett Click the icon to view the MACRS depreciation schedules. Click the ioon to vow the in orest factors for discrete compounding when ,-12% per year (a) What is the NPW ot the project based on its base-case scenario? More Info The NPW of the project based ori its base-case scenario is Sthcusarnd. (Round to orie decimal place.) Price per unit $500 Variable costs $120 per unit Fixed costs- $2.5 million Demand-2u ci units per year Capital investment-S0 million at year 0 Product life-8 years Selvage value $500,000 Depreciation method-seven-year MACRS . Tax rate: 35% . MARR-12% Print Done 3582212121212121 1882666666666666 72617285444444444444 1 37665544444444444444 2051 5 % 005033.0 0 1 0 1 0 1 0 15 0 0557929999999999 5987665555555552 0045 0 0841 755 355 2 2 9766663 2444,3 2 3 6 9994 % 9999* 0 4472 2 1211 8884 00022 00255 76 2 23111 35*1 3481 % 0 344 2341 sit re a 123456789 01234567890 More Info Single Payment qual Payment Series Present Worth Factor Compound Sinking Present Worth Factor (P/A, , N) 0.8929 1.6901 2.4018 3.0373 3.6048 Capital Recovery Factor (A/P, i, N) 1.1200 0.5917 0.4163 0.3292 0.2774 Compound Amount Factor 1.1200 1.2544 1.4049 1.5735 1.7623 0.8929 0.7972 0.7118 0.6355 0.5674 Amount Factor (FIA, N) 1.0000 2.1200 3.3744 4.7793 6.3528 Fund Factor (AF, i, N) 1.0000 0.4717 0.2963 0.2092 0.1574 1.9738 2.2107 2.4760 2.7731 3.1058 0.5066 0.4523 0.4039 0.3606 0.3220 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 4.1114 4.5638 4.9676 5.3282 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 PrintDone (a) What is the NPW of the project based on its base-case scenario? (b) What is the NPW of the project based on its best-case scenario? (c) What is the worst-case scenario? d) What conclusion would you make about the project after seeing the scenario analyses