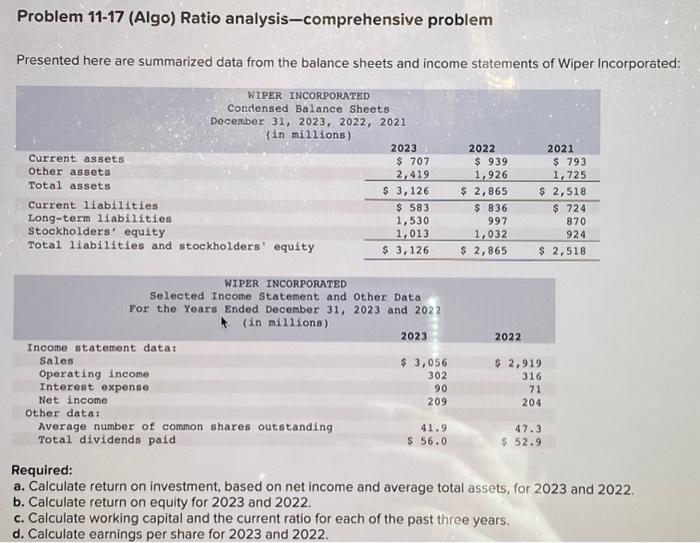

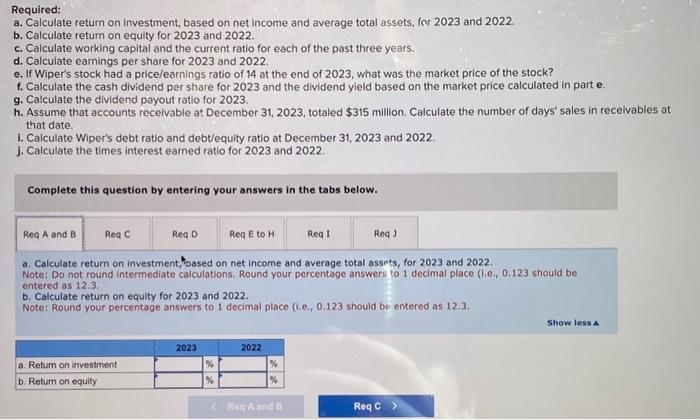

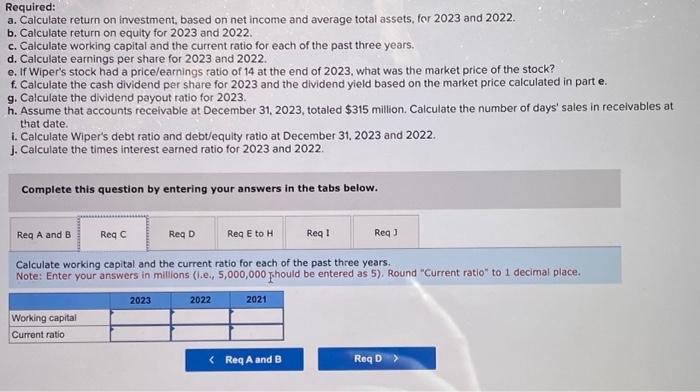

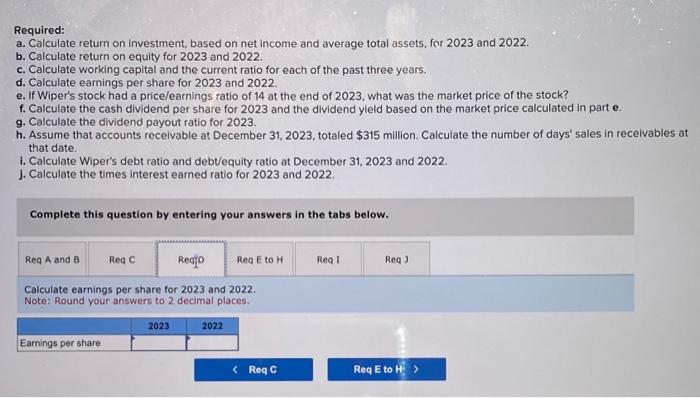

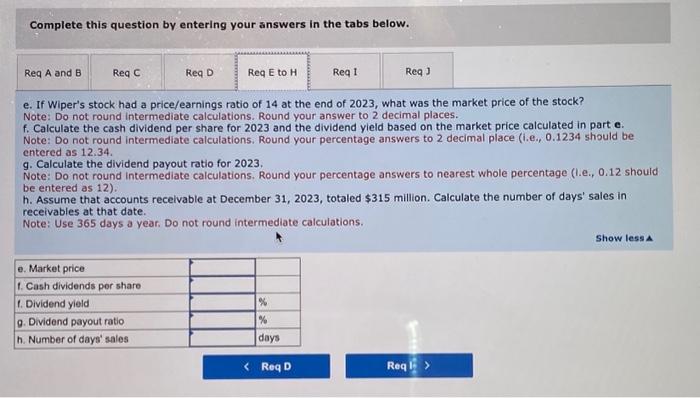

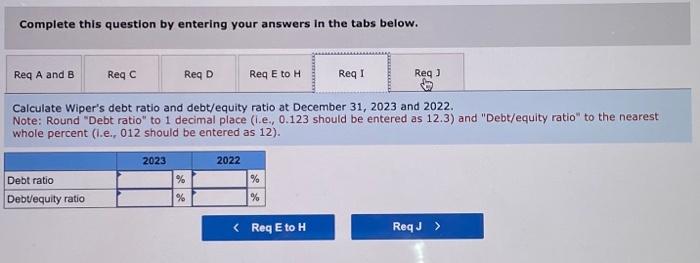

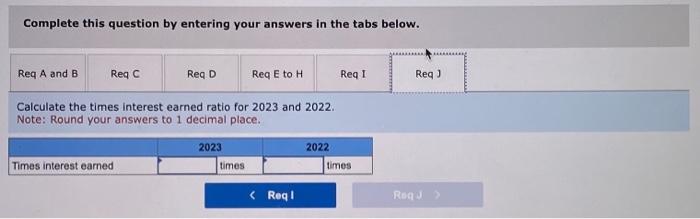

Problem 11-17 (Algo) Ratio analysis-comprehensive problem Presented here are summarized data from the balance sheets and income statements of Wiper Incorporated: Required: a. Calculate return on investment, based on net income and average total assets, for 2023 and 2022. b. Calculate return on equity for 2023 and 2022 . c. Calculate working capital and the current ratio for each of the past three years. d. Calculate earnings per share for 2023 and 2022 . Required: a. Calculate return on investment, based on net income and average total assets, fer 2023 and 2022. b. Calculate return on equity for 2023 and 2022 . c. Calculate working capital and the current ratio for each of the past three years. d. Calculate earnings per share for 2023 and 2022. e. If Wiper's stock had a pricelearnings ratio of 14 at the end of 2023 , what was the market price of the stock? f. Calculate the cash dividend per share for 2023 and the dividend yield based on the market price calculated in part e. g. Calculate the dividend payout ratio for 2023. h. Assume that accounts recelvable at December 31,2023 , totaled $315 million. Calculate the number of days' sales in recelvables at that date. 1. Calculate Wiper's debt ratio and debtequity ratio at December 31, 2023 and 2022. j. Calculate the times interest earned ratio for 2023 and 2022 . Complete this question by entering your answers in the tabs below. a. Calculate return on investment, toased on net income and average total assets, for 2023 and 2022. Note: Do not round intermediate calculations, Round your percentage answers to 1 decimal place (i.e., 0.123 should be entered as 12.3. b. Calculate return on equity for 2023 and 2022 . Note: Round your percentage answers to 1 decimal place (i.e., 0.123 should be entered as 12.3. Required: a. Calculate return on investment, based on net income and average total assets, fer 2023 and 2022 . b. Calculate return on equity for 2023 and 2022 . c. Calculate working capital and the current ratio for each of the past three years. d. Calculate earnings per share for 2023 and 2022. e. If Wiper's stock had a price/earnings ratio of 14 at the end of 2023 , what was the market price of the stock? f. Calculate the cash dividend per share for 2023 and the dividend yield based on the market price calculated in part e. g. Calculate the dividend payout ratio for 2023 . h. Assume that accounts recelvable at December 31,2023 , totaled $315 million. Calculate the number of days' sales in receivables at that date. i. Calculate Wiper's debt ratio and debt/equity ratio at December 31,2023 and 2022. j. Calculate the times interest earned ratio for 2023 and 2022 . Complete this question by entering your answers in the tabs below. Calculate working capital and the current ratio for each of the past three years. Note: Enter your answers in millions (l.e., 5,000,000 Fhould be entered as 5). Round "Current ratio" to 1 decimal place. Required: a. Calculate return on investment, based on net income and average total assets, for 2023 and 2022. b. Calculate return on equity for 2023 and 2022 . c. Calculate working capital and the current ratio for each of the past three years. d. Calculate earnings per share for 2023 and 2022. e. If Wiper's stock had a price/earnings ratio of 14 at the end of 2023 , what was the market price of the stock? f. Calculate the cash dividend per share for 2023 and the dividend yield based on the market price calculated in part e. g. Calculate the dividend payout ratio for 2023. h. Assume that accounts roceivable at December 31, 2023, totaled $315 million. Calculate the number of days' sales in receivables that date. 1. Calculate Wiper's debt ratio and debt/equity ratio at December 31, 2023 and 2022. j. Calculate the times interest earned ratio for 2023 and 2022. Complete this question by entering your answers in the tabs below. Calculate earnings per share for 2023 and 2022. Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below. e. If Wiper's stock had a price/earnings ratio of 14 at the end of 2023 , what was the market price of the stock? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. f. Calculate the cash dividend per share for 2023 and the dividend yield based on the market price calculated in part e. Note: Do not round intermediate calculations. Round your percentage answers to 2 decimal place (i.e., 0.1234 should be entered as 12.34. g. Calculate the dividend payout ratio for 2023. Note: Do not round intermediate calculations. Round your percentage answers to nearest whole percentage (i.e., 0.12 should be entered as 12). h. Assume that accounts recelvable at December 31, 2023, totaled $315 million. Calculate the number of days' sales in receivables at that date. Note: Use 365 days a year. Do not round intermediate calculations. Complete this question by entering your answers In the tabs below. Calculate Wiper's debt ratio and debt/equity ratio at December 31, 2023 and 2022. Note: Round "Debt ratio" to 1 decimal place (i.e., 0.123 should be entered as 12.3 ) and "Debt/equity ratio" to the nearest whole percent (i.e., 012 should be entered as 12 ). Complete this question by entering your answers in the tabs below. Calculate the times interest earned ratio for 2023 and 2022. Note: Round your answers to 1 decimal place