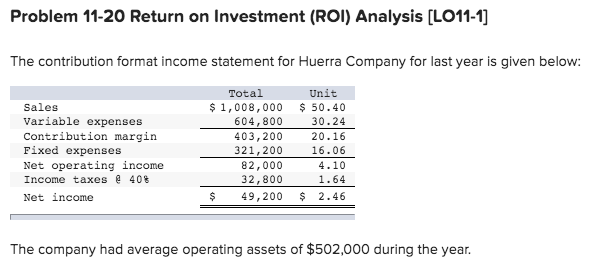

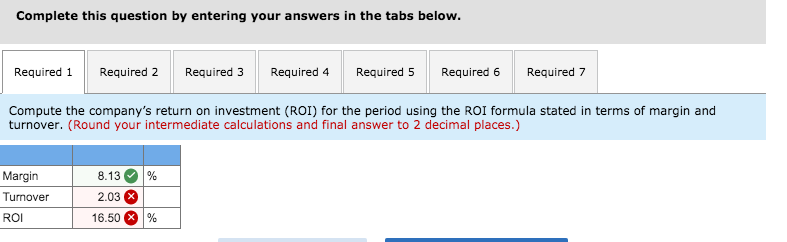

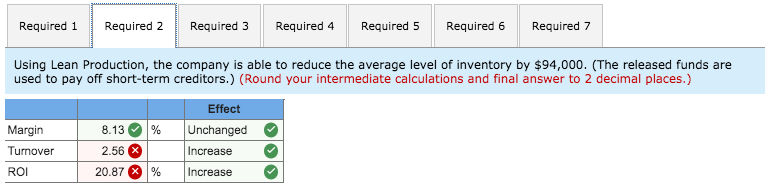

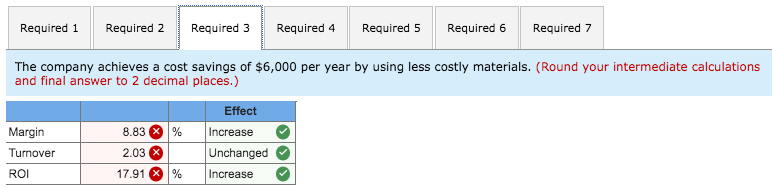

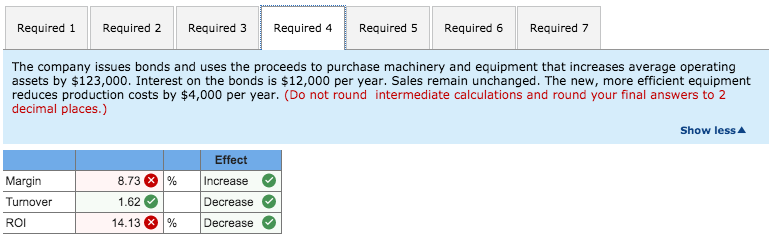

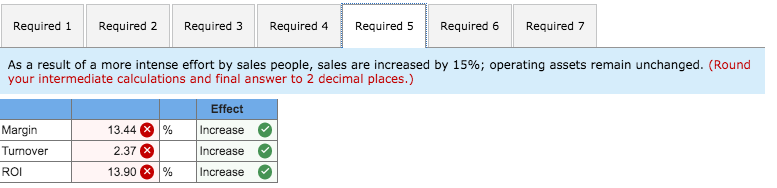

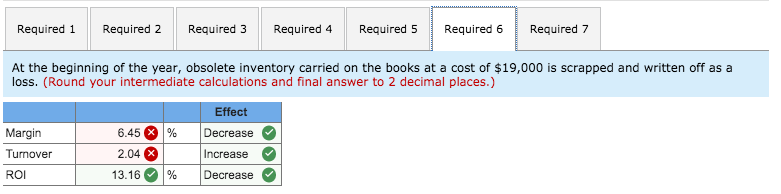

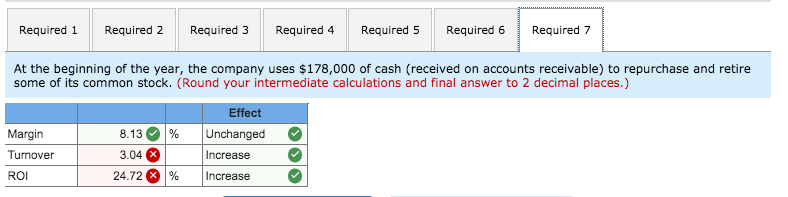

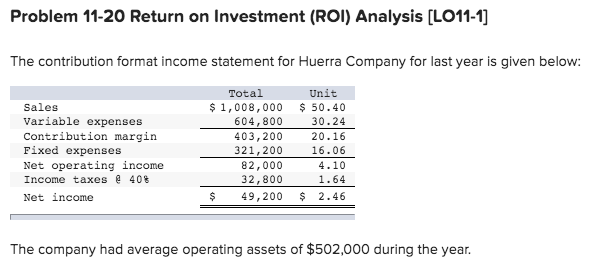

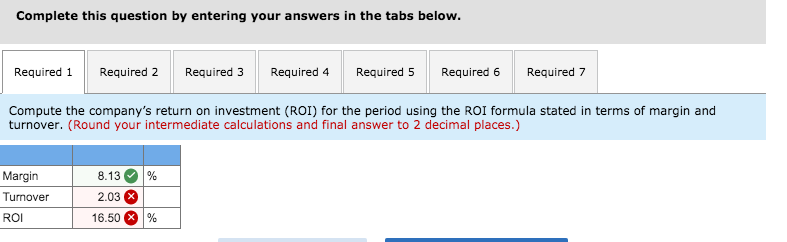

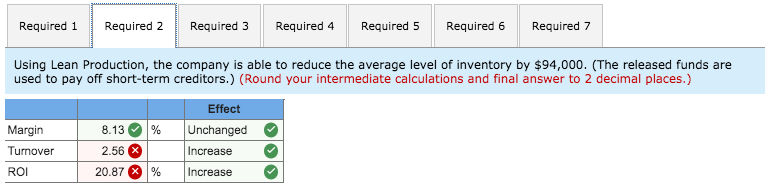

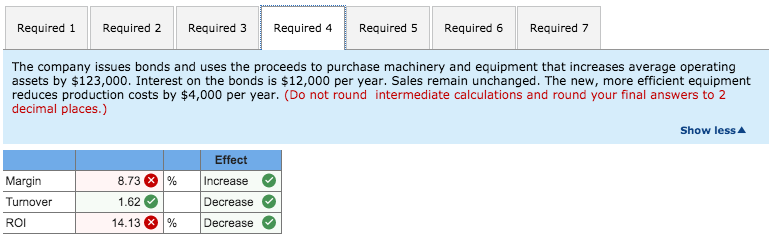

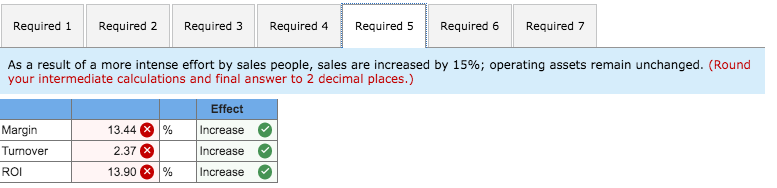

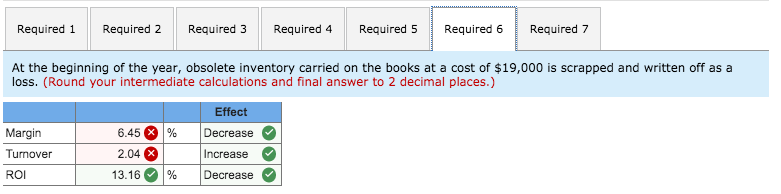

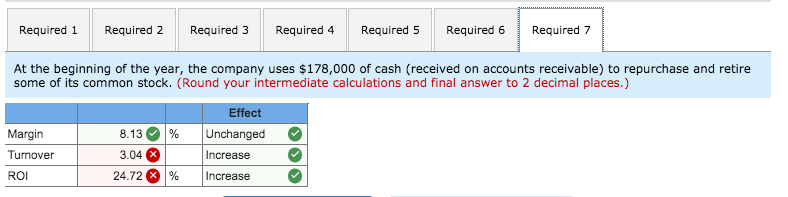

Problem 11-20 Return on Investment (ROI) Analysis [LO11-1] The contribution format income statement for Huerra Company for last year is given below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes @ 40% Net income Total $ 1,008,000 604,800 403,200 321,200 82,000 32,800 $ 49,200 Unit $ 50.40 30.24 20.16 16.06 4.10 1.64 $ 2.46 The company had average operating assets of $502,000 during the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. (Round your intermediate calculations and final answer to 2 decimal places.) % Margin Turnover ROI 8.13 2.03 16.50 X % Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Using Lean Production, the company is able to reduce the average level of inventory by $94,000. (The released funds are used to pay off short-term creditors.) (Round your intermediate calculations and final answer to 2 decimal places.) Effect % Margin Turnover ROI 8.13 2.56 X 20.87 % Unchanged Increase Increase % Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 The company achieves a cost savings of $6,000 per year by using less costly materials. (Round your intermediate calculations and final answer to 2 decimal places.) % Margin Turnover ROI 8.83 % 2.03 X 17.91 Effect Increase Unchanged Increase % Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $123,000. Interest on the bonds is $12,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by $4,000 per year. (Do not round intermediate calculations and round your final answers to 2 decimal places.) Show less % Margin Turnover ROI 8.73 % 1.62 14.13 % Effect Increase Decrease Decrease % Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 As a result of a more intense effort by sales people, sales are increased by 15%; operating assets remain unchanged. (Round your intermediate calculations and final answer to 2 decimal places.) % Margin Turnover ROI 13.44 % 2.37 13.90 Effect Increase Increase Increase % Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 At the beginning of the year, obsolete inventory carried on the books at a cost of $19,000 is scrapped and written off as a loss. (Round your intermediate calculations and final answer to 2 decimal places.) % Margin Turnover ROI 6.45 % 2.04 % 13.16 Effect Decrease Increase Decrease % Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 At the beginning of the year, the company uses $178,000 of cash (received on accounts receivable) to repurchase and retire some of its common stock. (Round your intermediate calculations and final answer to 2 decimal places.) % Margin Turnover ROI 8.13 3.04 24.72 % Effect Unchanged Increase Increase %