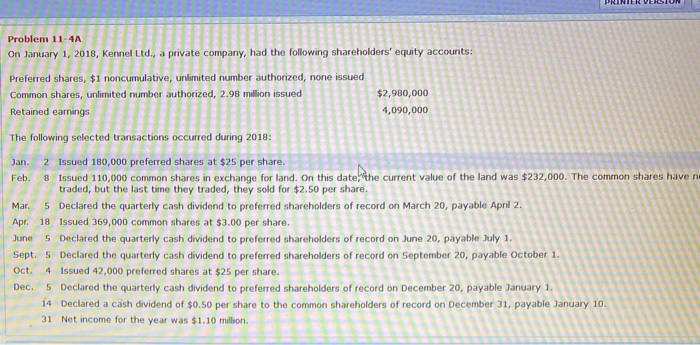

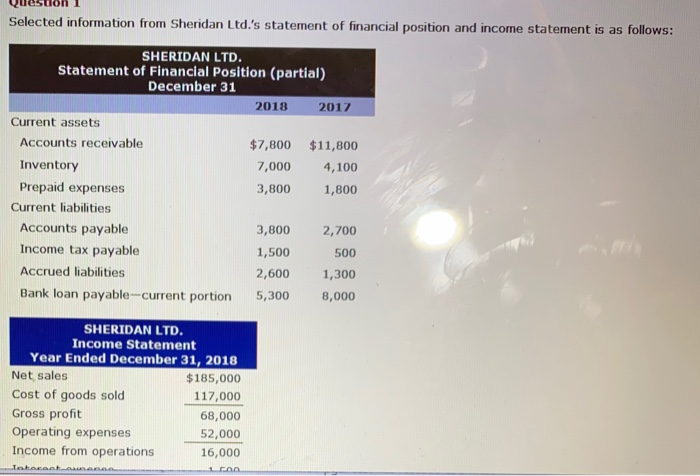

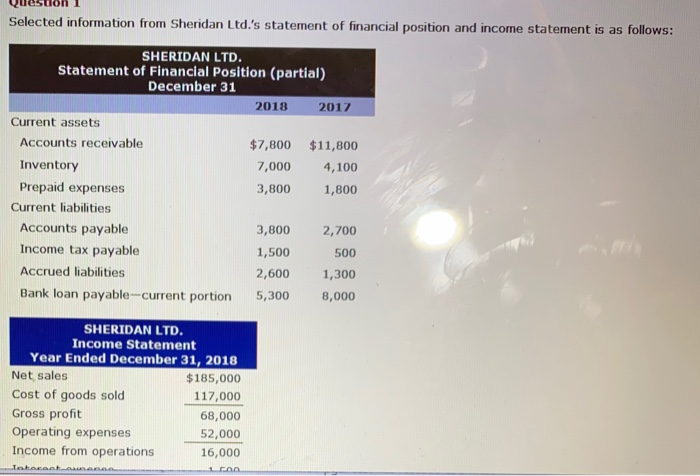

Problem 11-4A On January 1, 2018, Kennel Ltd., a private company, had the following shareholders' equity accounts: Preferred shares, $1 noncumulative, unlimited number authorized, none issued Common shares, unlimited number authorized, 2.98 million issued Retained earnings $2,980,000 4,090,000 Jan. Feb. The following selected transactions occurred during 2018: 2 Issued 180,000 preferred shares at $25 per share. 8 Issued 110,000 common shares in exchange for land. On this date, the current value of the land was $232,000. The common shares have ne traded, but the last time they traded, they sold for $2.50 per share. Mar. 5 Declared the quarterly cash dividend to preferred shareholders of record on March 20, payable April 2. Apr. 18 Issued 369,000 common shares at $3.00 per share. June 5 Declared the quarterly cash dividend to preferred shareholders of record on June 20, payable July 1. Sept. 5 Declared the quarterly cash dividend to preferred shareholders of record on September 20, payable October 1. 4 Issued 42,000 preferred shares at $25 per share. 5 Declared the quarterly cash dividend to preferred shareholders of record on December 20, payable January 1. 14 Declared a cash dividend of $0.50 per share to the common shareholders of record on December 31, payable January 10. 31 Net income for the year was $1.10 million. Oct. Dec. Selected information from Sheridan Ltd.'s statement of financial position and income statement is as follows: SHERIDAN LTD. Statement of Financial Position (partial) December 31 2018 2017 Current assets Accounts receivable $7,800 $11,800 Inventory 7,000 4,100 Prepaid expenses 3,800 1,800 Current liabilities Accounts payable 3,800 2,70 Income tax payable 1,500 500 Accrued liabilities 2,600 1,300 Bank loan payable-current portion 5,300 8,000 SHERIDAN LTD. Income Statement Year Ended December 31, 2018 Net sales $185,000 Cost of goods sold 117,000 Gross profit 68,000 Operating expenses 52,000 Income from operations 16,000 Lett un Problem 11-4A On January 1, 2018, Kennel Ltd., a private company, had the following shareholders' equity accounts: Preferred shares, $1 noncumulative, unlimited number authorized, none issued Common shares, unlimited number authorized, 2.98 million issued Retained earnings $2,980,000 4,090,000 Jan. Feb. The following selected transactions occurred during 2018: 2 Issued 180,000 preferred shares at $25 per share. 8 Issued 110,000 common shares in exchange for land. On this date, the current value of the land was $232,000. The common shares have ne traded, but the last time they traded, they sold for $2.50 per share. Mar. 5 Declared the quarterly cash dividend to preferred shareholders of record on March 20, payable April 2. Apr. 18 Issued 369,000 common shares at $3.00 per share. June 5 Declared the quarterly cash dividend to preferred shareholders of record on June 20, payable July 1. Sept. 5 Declared the quarterly cash dividend to preferred shareholders of record on September 20, payable October 1. 4 Issued 42,000 preferred shares at $25 per share. 5 Declared the quarterly cash dividend to preferred shareholders of record on December 20, payable January 1. 14 Declared a cash dividend of $0.50 per share to the common shareholders of record on December 31, payable January 10. 31 Net income for the year was $1.10 million. Oct. Dec. Selected information from Sheridan Ltd.'s statement of financial position and income statement is as follows: SHERIDAN LTD. Statement of Financial Position (partial) December 31 2018 2017 Current assets Accounts receivable $7,800 $11,800 Inventory 7,000 4,100 Prepaid expenses 3,800 1,800 Current liabilities Accounts payable 3,800 2,70 Income tax payable 1,500 500 Accrued liabilities 2,600 1,300 Bank loan payable-current portion 5,300 8,000 SHERIDAN LTD. Income Statement Year Ended December 31, 2018 Net sales $185,000 Cost of goods sold 117,000 Gross profit 68,000 Operating expenses 52,000 Income from operations 16,000 Lett un