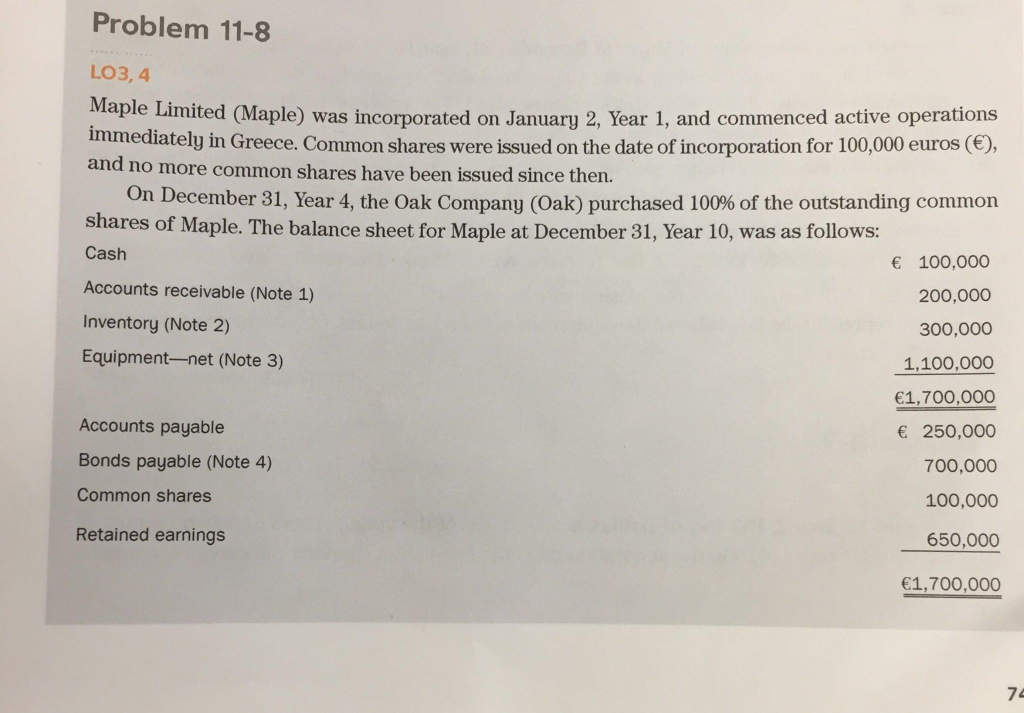

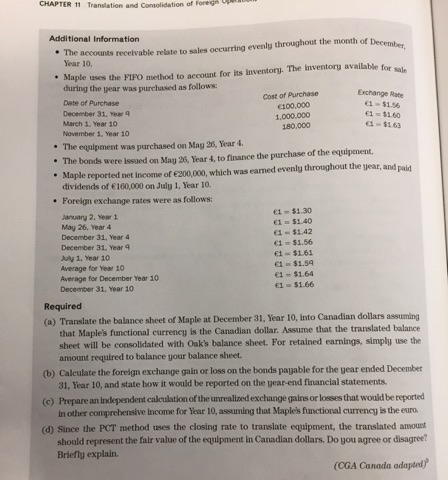

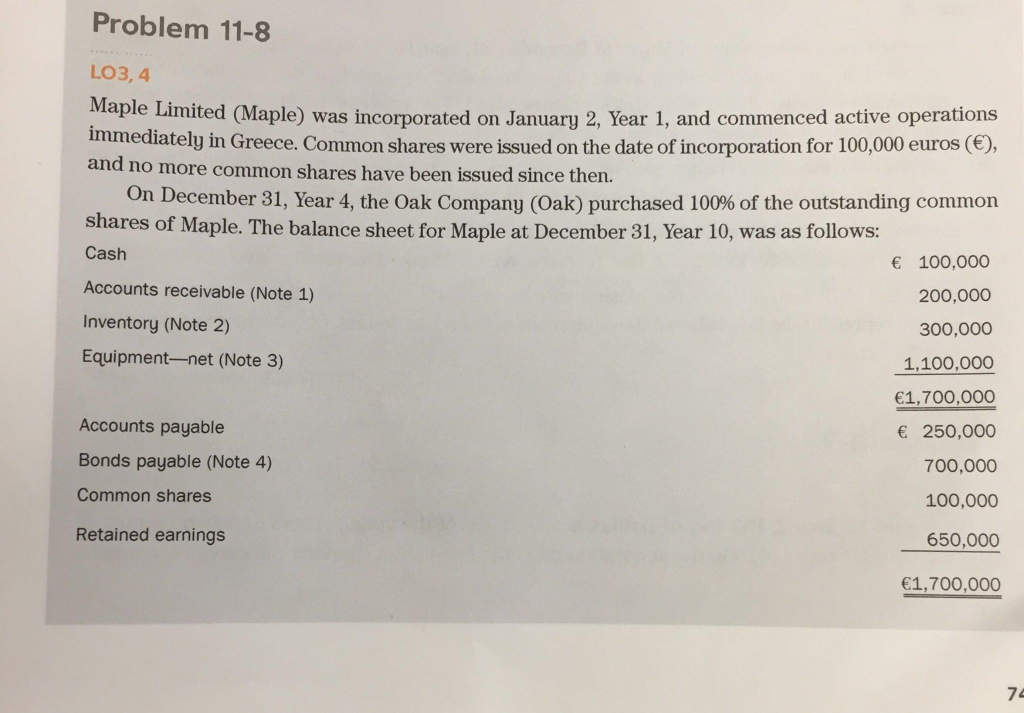

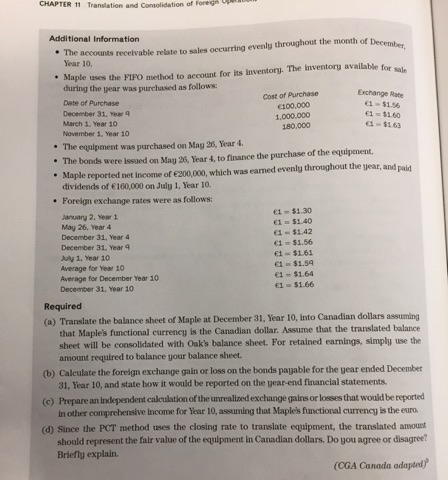

Problem 11-8 LO3,4 Maple Limited Maple) was incorporated on January 2, Year 1, and or immediately in Greece. Common shares were issued on the date of incorporation for 100,000 euros (E), and no more common shares have been issued since then. On December 31, Year 4, the Oak Company (Oak) purchased 100% of the outstanding common shares of Maple. The balance sheet for Maple at December 31, Year 10, was as follows: Cash Accounts receivable (Note 1) Inventory (Note 2) Equipment-net (Note 3) 100,000 200,000 300,000 1,100,000 1,700,000 250,000 700,000 100,000 650,000 1,700,000 Accounts payable Bonds payable (Note 4) Common shares Retained earnings 74 CHAPTER 11 Translation and Consolidation of Foreg Additional Information accounts recelvable relate to sales occurring evenlg throughout the month of December Year 10. * Maple uses the FIPO method to account for its inventory. The inventory available for sale during the year was purchased as follows Date of Purchase December 31, Year q March 1. Year 10 November 1, Year 10 Exchange Rate 1 $1.56 Cost of Purchase 100,000 1 $1.60 1 $1.63 180,000 * The equipment was purchased on May 20, Year 4. " The bonds were issued on May 26, Year 4, to finance the purchase of the equipment. Maple reported net income of 200,000, which was earned evenly throughout the year, and paid dividends of 160,000 on Julg 1, Year 10 Foreign exchange rates were as follows: 1-$1.30 January 2. Year 1 May 26, Year 4 December 31, Year 4 December 31, Year q Auy 1. Year 10 Average for Year 10 Average for December Year 10 December 31, Year 10 $1.40 e1- $1.42 1 $ 1.56 1-$161 1 $1.5 1-$1.64 1-$1.66 Required (a) Translate the balance sheet of Maple at December 31, Year 10, into Canadian dollars assuming that Maple's functional curreney is the Canadian dollar. Assume that the translated balance sheet will be consolidated with Oak's balance sheet. For retained earnings, simply use the amount required to balance your balance sheet (b) Calculate the foreign exchange gain or loss on the bonds pagable for the year ended December (c) Prepare an independent caleulation of the unrealized exchange gains or losses that would be reported (d) Since the PCT method uses the closing rate to translate equipment, the translated amount 31, Year 10, and state how it would be reported on the year-end financial statements. in other comprebensive Income for Year 10, assuming that Maple's functional currency is the euro. should represent the falr value of the equipment in Canadian dollars. Do you agree or disagree? Briefly explain. (CGA Canada adapted Problem 11-8 LO3,4 Maple Limited Maple) was incorporated on January 2, Year 1, and or immediately in Greece. Common shares were issued on the date of incorporation for 100,000 euros (E), and no more common shares have been issued since then. On December 31, Year 4, the Oak Company (Oak) purchased 100% of the outstanding common shares of Maple. The balance sheet for Maple at December 31, Year 10, was as follows: Cash Accounts receivable (Note 1) Inventory (Note 2) Equipment-net (Note 3) 100,000 200,000 300,000 1,100,000 1,700,000 250,000 700,000 100,000 650,000 1,700,000 Accounts payable Bonds payable (Note 4) Common shares Retained earnings 74 CHAPTER 11 Translation and Consolidation of Foreg Additional Information accounts recelvable relate to sales occurring evenlg throughout the month of December Year 10. * Maple uses the FIPO method to account for its inventory. The inventory available for sale during the year was purchased as follows Date of Purchase December 31, Year q March 1. Year 10 November 1, Year 10 Exchange Rate 1 $1.56 Cost of Purchase 100,000 1 $1.60 1 $1.63 180,000 * The equipment was purchased on May 20, Year 4. " The bonds were issued on May 26, Year 4, to finance the purchase of the equipment. Maple reported net income of 200,000, which was earned evenly throughout the year, and paid dividends of 160,000 on Julg 1, Year 10 Foreign exchange rates were as follows: 1-$1.30 January 2. Year 1 May 26, Year 4 December 31, Year 4 December 31, Year q Auy 1. Year 10 Average for Year 10 Average for December Year 10 December 31, Year 10 $1.40 e1- $1.42 1 $ 1.56 1-$161 1 $1.5 1-$1.64 1-$1.66 Required (a) Translate the balance sheet of Maple at December 31, Year 10, into Canadian dollars assuming that Maple's functional curreney is the Canadian dollar. Assume that the translated balance sheet will be consolidated with Oak's balance sheet. For retained earnings, simply use the amount required to balance your balance sheet (b) Calculate the foreign exchange gain or loss on the bonds pagable for the year ended December (c) Prepare an independent caleulation of the unrealized exchange gains or losses that would be reported (d) Since the PCT method uses the closing rate to translate equipment, the translated amount 31, Year 10, and state how it would be reported on the year-end financial statements. in other comprebensive Income for Year 10, assuming that Maple's functional currency is the euro. should represent the falr value of the equipment in Canadian dollars. Do you agree or disagree? Briefly explain. (CGA Canada adapted