Question

Problem 12-11 (Algorithmic) Over a five-year period, the quarterly change in the price per share of common stock for a major oil company ranged from

Problem 12-11 (Algorithmic)

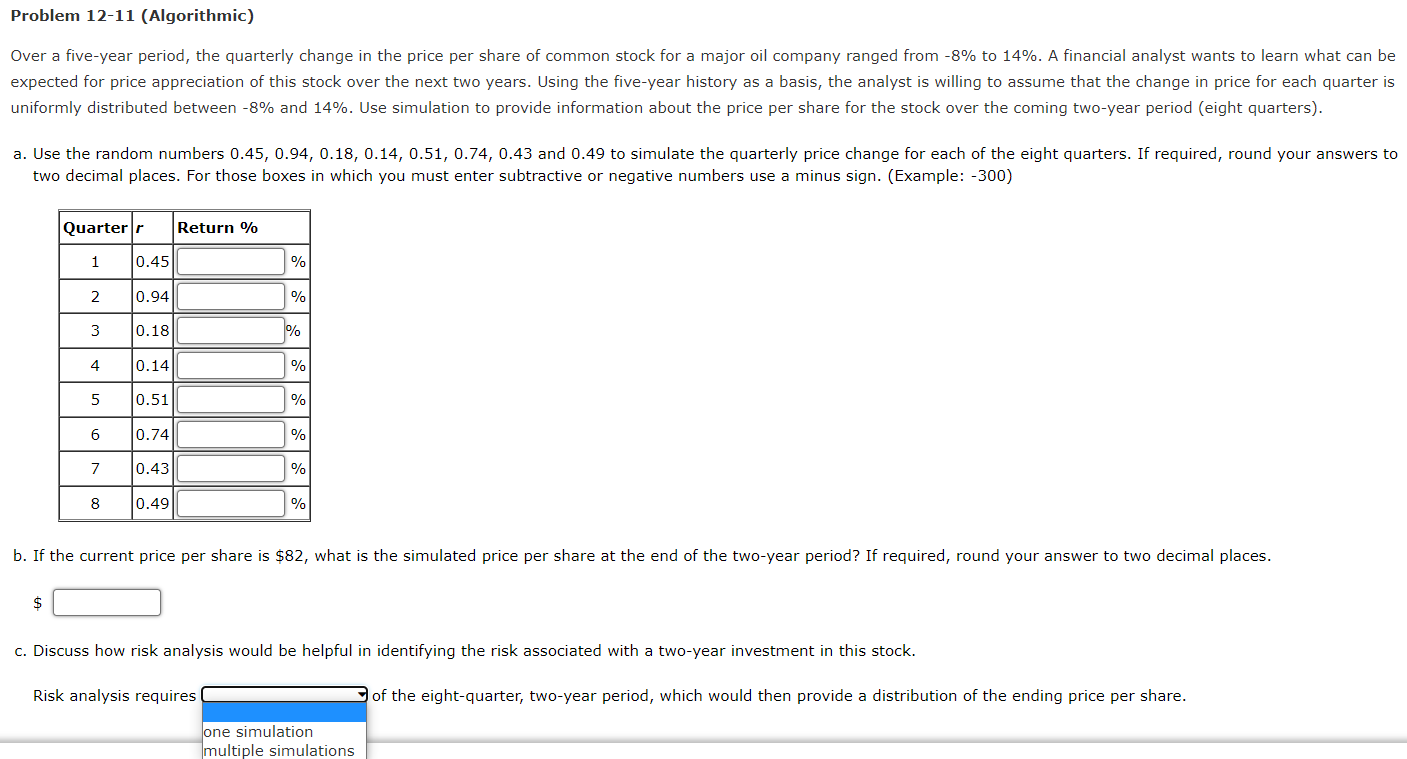

Over a five-year period, the quarterly change in the price per share of common stock for a major oil company ranged from -8% to 14%. A financial analyst wants to learn what can be expected for price appreciation of this stock over the next two years. Using the five-year history as a basis, the analyst is willing to assume that the change in price for each quarter is uniformly distributed between -8% and 14%. Use simulation to provide information about the price per share for the stock over the coming two-year period (eight quarters).

- Use the random numbers 0.45, 0.94, 0.18, 0.14, 0.51, 0.74, 0.43 and 0.49 to simulate the quarterly price change for each of the eight quarters. If required, round your answers to two decimal places. For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300)

Quarter r Return % 1 0.45 fill in the blank 1 % 2 0.94 fill in the blank 2 % 3 0.18 fill in the blank 3% 4 0.14 fill in the blank 4 % 5 0.51 fill in the blank 5 % 6 0.74 fill in the blank 6 % 7 0.43 fill in the blank 7 % 8 0.49 fill in the blank 8 % - If the current price per share is $82, what is the simulated price per share at the end of the two-year period? If required, round your answer to two decimal places. $ fill in the blank 9

- Discuss how risk analysis would be helpful in identifying the risk associated with a two-year investment in this stock. Risk analysis requires (one simulation or multiple simulations) of the eight-quarter, two-year period, which would then provide a distribution of the ending price per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started