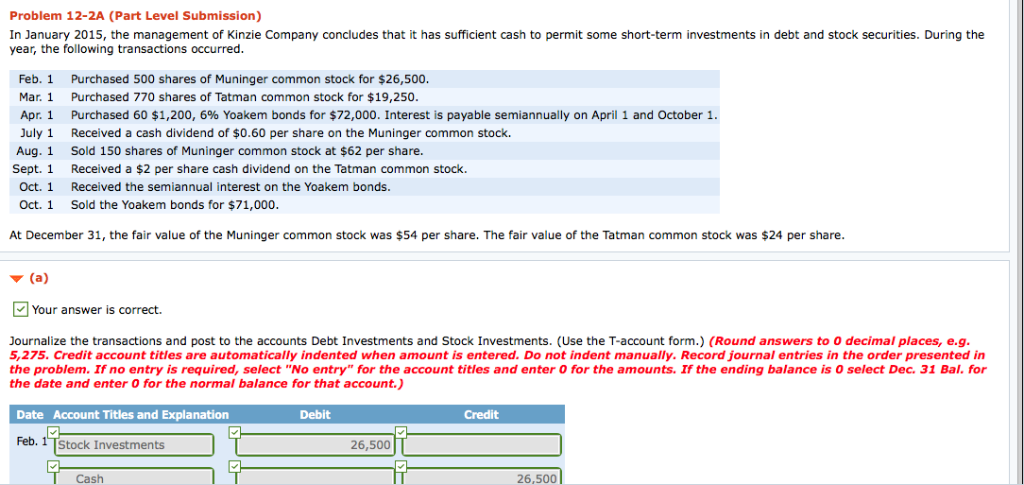

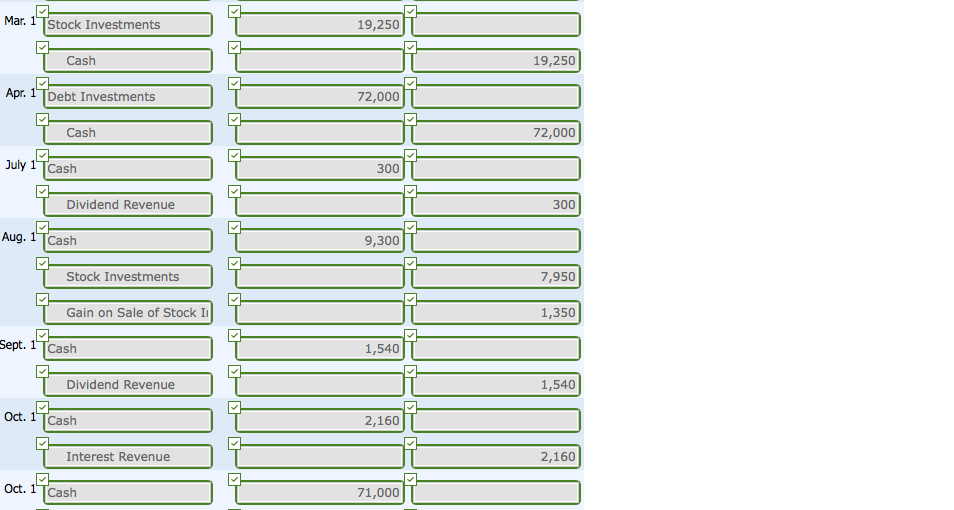

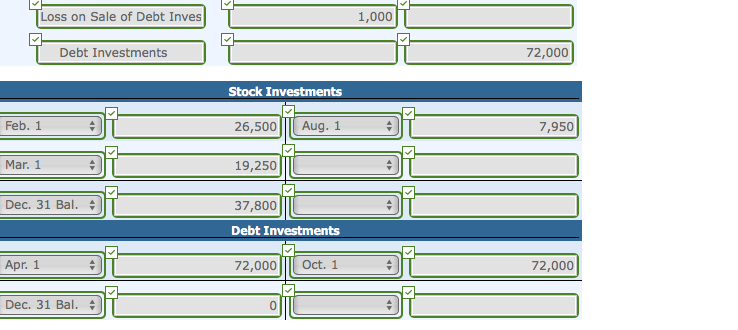

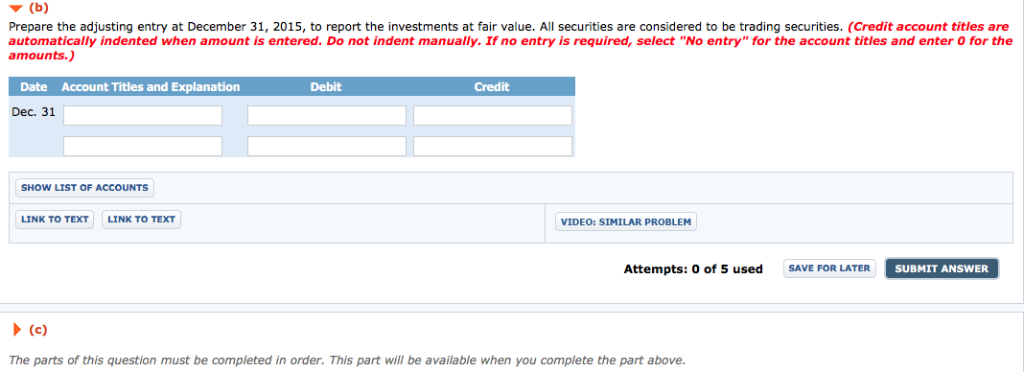

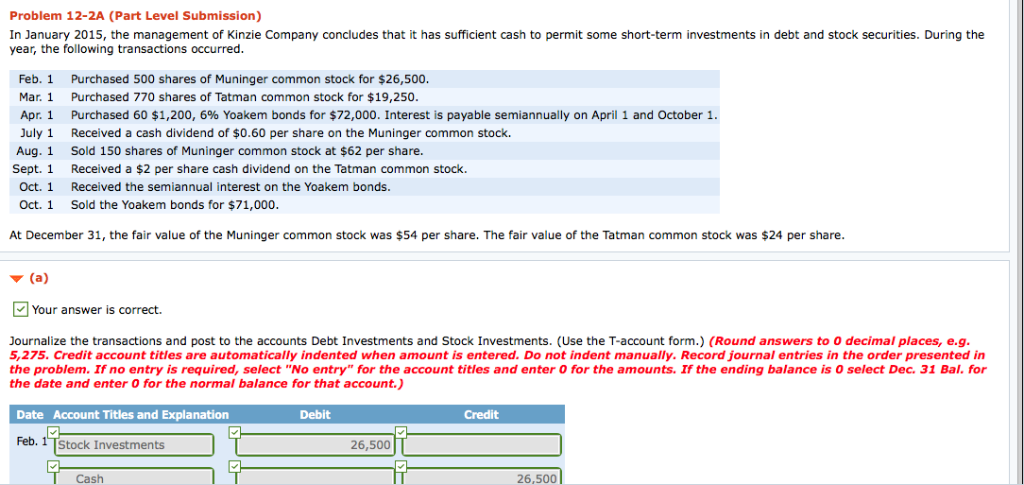

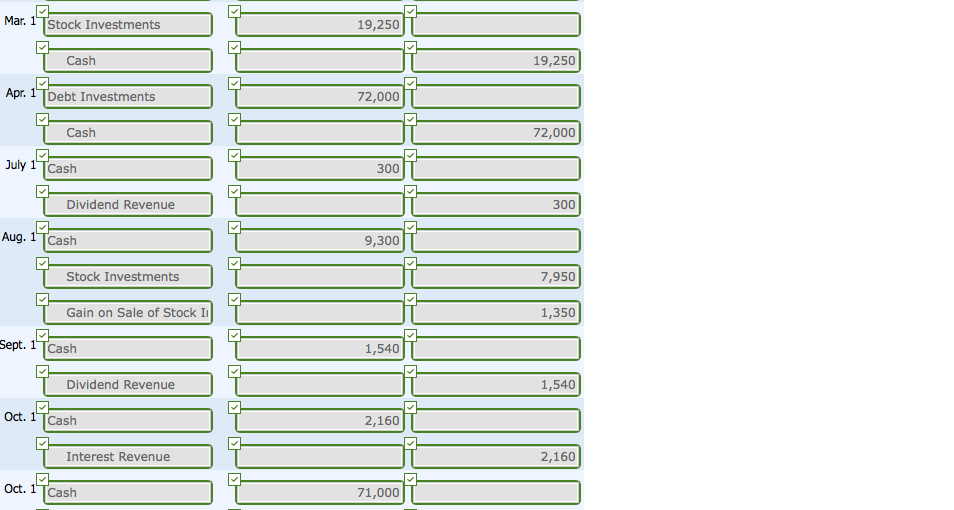

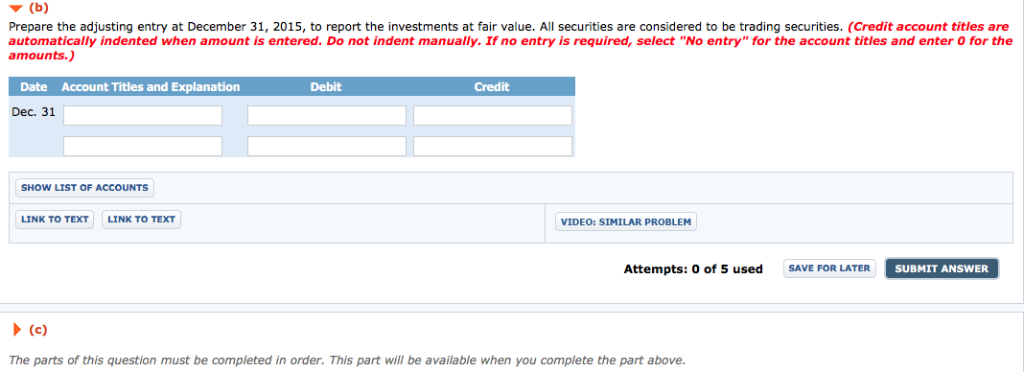

Problem 12-2A (Part Level Submission) In January 2015, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred. Feb. 1 Purchased 500 shares of Muninger common stock for $26,500 Mar. 1 Purchased 770 shares of Tatman common stock for $19,250. Apr 1 Purchased 60 $1,200, 6% Yoakem bonds for $72,000. Interest is payable semiannually on April 1 and October 1. July 1 Received a cash dividend of $0.60 per share on the Muninger common stock Aug. 1 Sold 150 shares of Muninger common stock at $62 per share. Sept. 1 Received a $2 per share cash dividend on the Tatman common stock. Received the semiannual interest on the Yoakem bonds. Sold the Yoakem bonds for $71,000. Oct. 1 Oct. 1 At December 31, the fair value of the Muninger common stock was $54 per share. The fair value of the Tatman common stock was $24 per share. Your answer is correct. Journalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use the T-account form.) (Round answers to O decimal places, e.g 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No entry" for the account titles and enter O for the amounts. If the ending balance is O select Dec. 31 Bal. for the date and enter 0 for the normal balance for that account.) Date Account Titles and Explanation Debit Credit Feb. 1 TStock Investments 26,500 26,500 Cash 19,250 Mar. 1TStock Investments 19,250 Cash 72,000 Apr. 1 TDebt Investments 72,000 Cash July 1TCash 300 300 Dividend Revenue Aug1Cash 9,300 7,950 Stock Investments 1,350 Gain on Sale of Stock I Sept. 1TCash 1,540 1,540 Dividend Revenue Oct. 1 TCash 2,160 2,160 Interest Revenue 71,000 Oct. 1 TCash Loss on Sale of Debt Inves 1,000 72,000 Debt Investments Stock Investments Feb. 1 26,500Aug. 1 7,950 Mar. 1 19,250 Dec. 31 Bal. 37,800 Debt Investments 72,000 Oct. 1 Apr. 1 72,000 Dec. 31 Bal. 0 (b) Prepare the adjusting entry at December 31, 2015, to report the investments at fair value. All securities are considered to be trading securities. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT VIDEO: SIMILAR PROBLEM Attempts: 0 of S used SAVE rOR LATER SUBMIT ANSWER SUBMIT ANSWER The parts of this question must be completed in order. This part will be available when you complete the part above