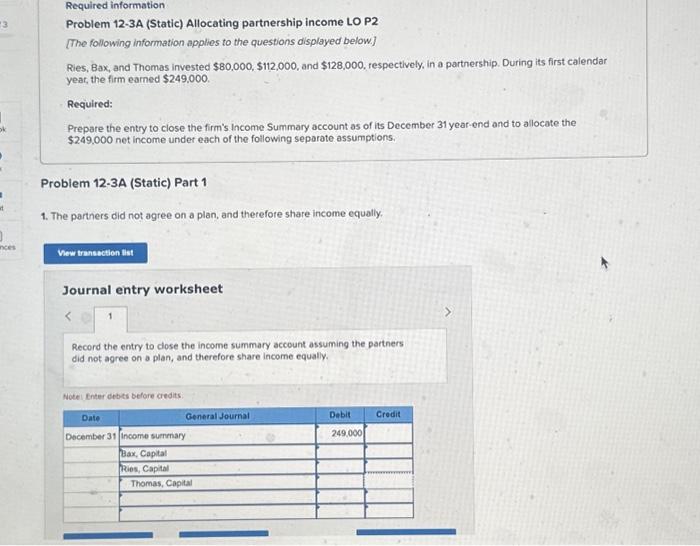

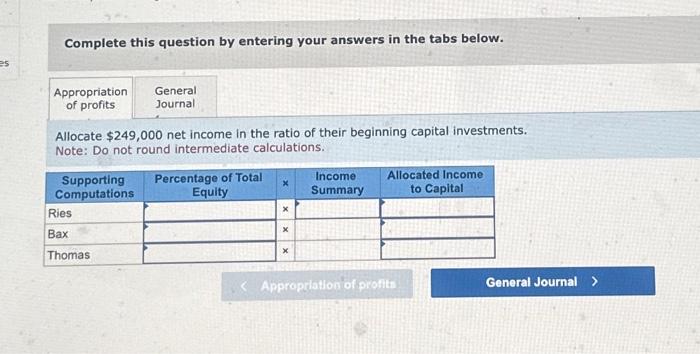

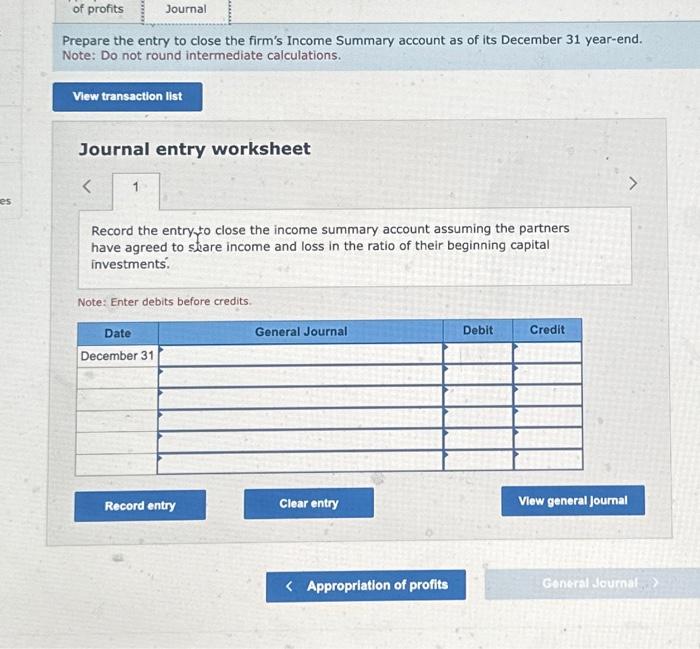

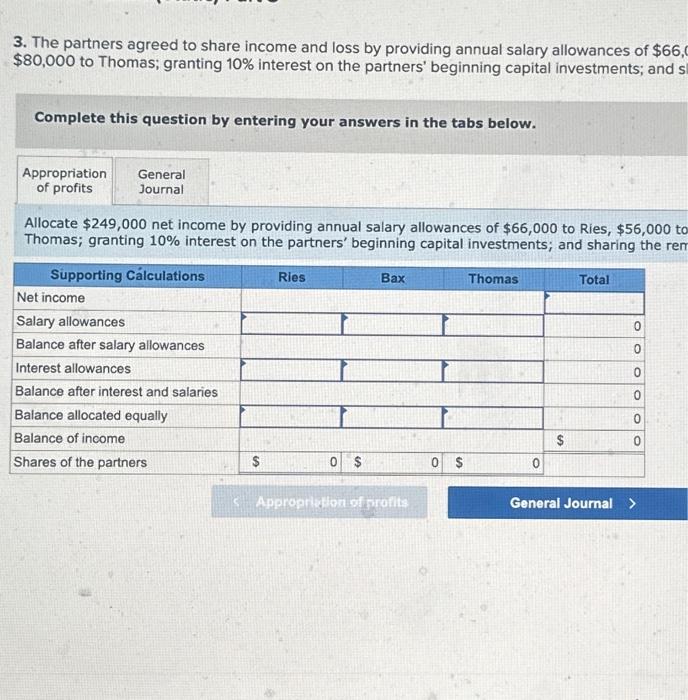

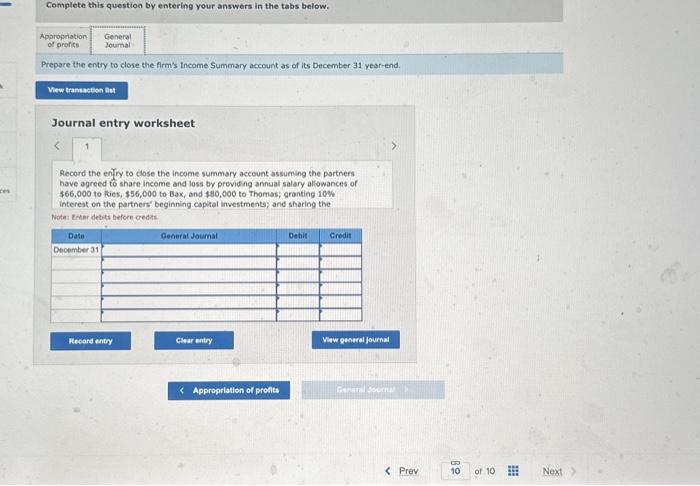

Problem 12-3A (Static) Allocating partnership income LO P2 [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $80,000,$112,000, and $128,000, respectlvely, in a partnership. During its first calendar year, the firm earned $249,000. Required: Prepare the entry to close the firm's income Summary account as of its December 31 year-end and to allocate the $249,000 net income under each of the following separate assumptions. Problem 12-3A (Static) Part 1 1. The parthers did not agree on a plan, and therefore share income equally. Journal entry worksheet Record the entry to close the income summary account assuming the partners did not agree on a plan, and therefore share income equally. Noeei Enter debits before credits. Complete this question by entering your answers in the tabs below. Allocate $249,000 net income in the ratio of their beginning capital investments. Note: Do not round intermediate calculations. Prepare the entry to close the firm's Income Summary account as of its December 31 year-end. Note: Do not round intermediate calculations. Journal entry worksheet Record the entry to close the income summary account assuming the partners have agreed to share income and loss in the ratio of their beginning capital investments. Note: Enter debits before credits. 3. The partners agreed to share income and loss by providing annual salary allowances of $66 $80,000 to Thomas; granting 10% interest on the partners' beginning capital investments; and s Complete this question by entering your answers in the tabs below. Allocate $249,000 net income by providing annual salary allowances of $66,000 to Ries, $56,000 to Thomas; granting 10% interest on the partners' beginning capital investments; and sharing the ren Complete this question by entering your answers in the tabs below. Prepare the entry to close the firm's income Summary account as of its December a1 year-end. Journal entry worksheet Aecord the enfry to close the income summary account assuming the porthers have agreed to share income and loss by providing annuat salary allowances of $66,000 to kies, $56,000 to Bax, and $80,000 to Thomas; granting 10% interest on the partners" beginning copital investments; and sharing the Nothi totar debts before credast