Answered step by step

Verified Expert Solution

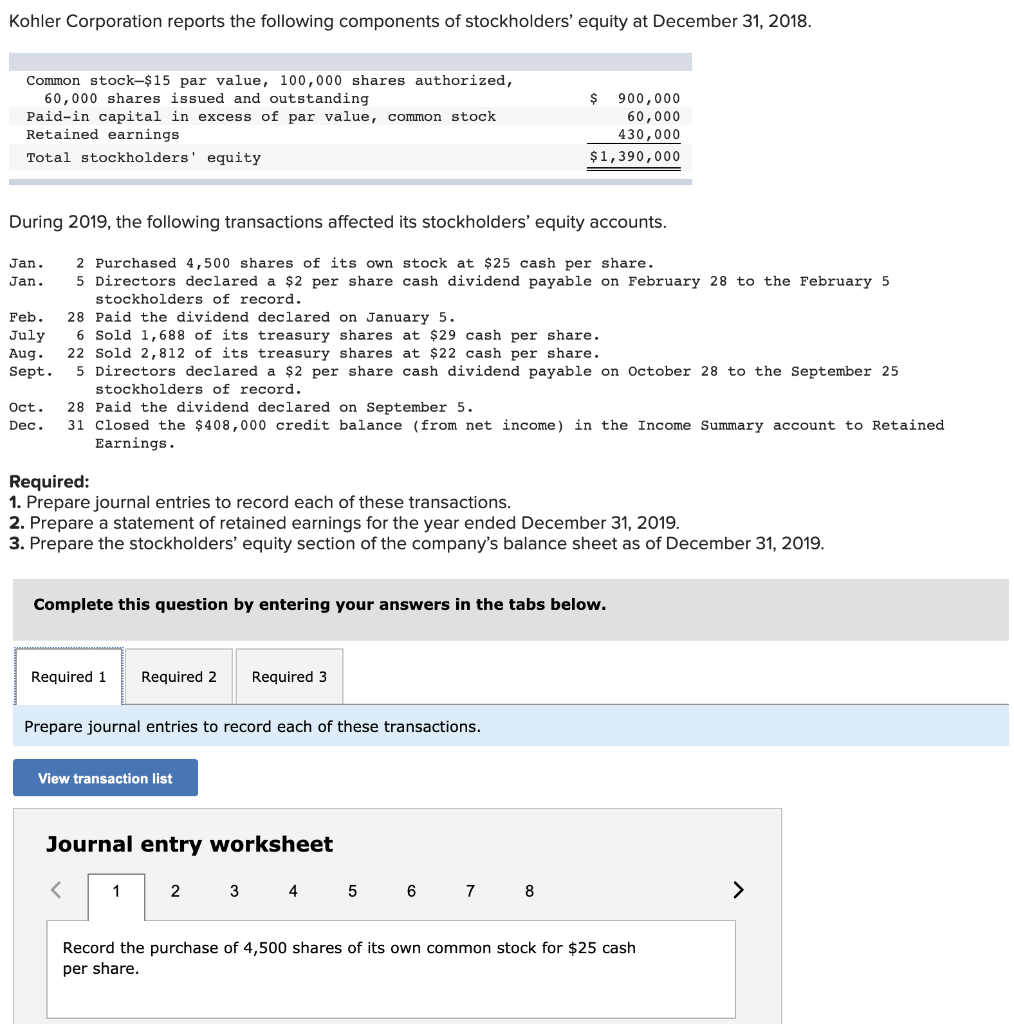

Question

1 Approved Answer

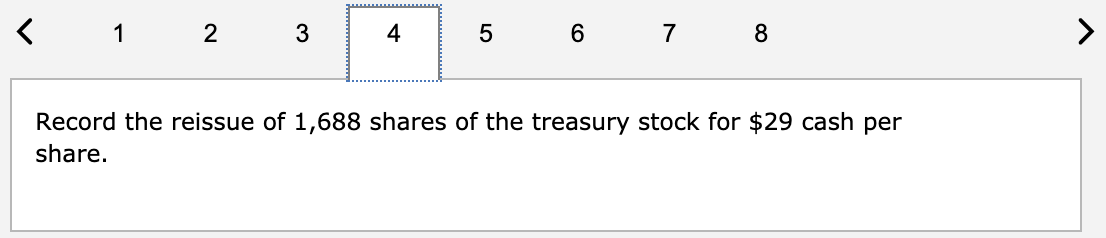

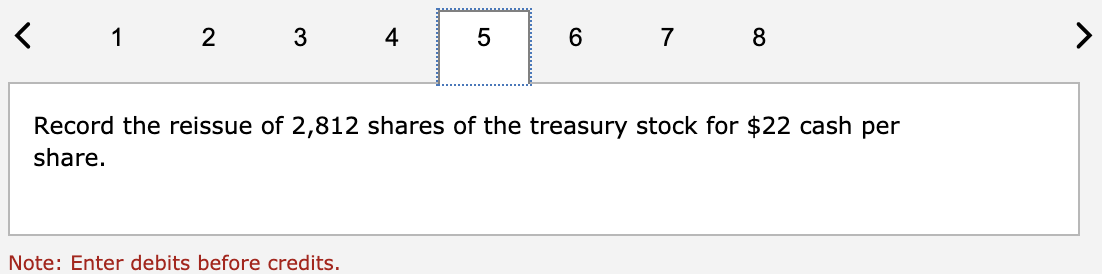

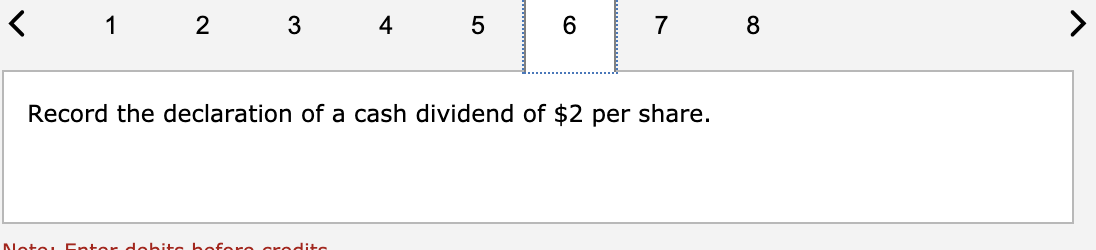

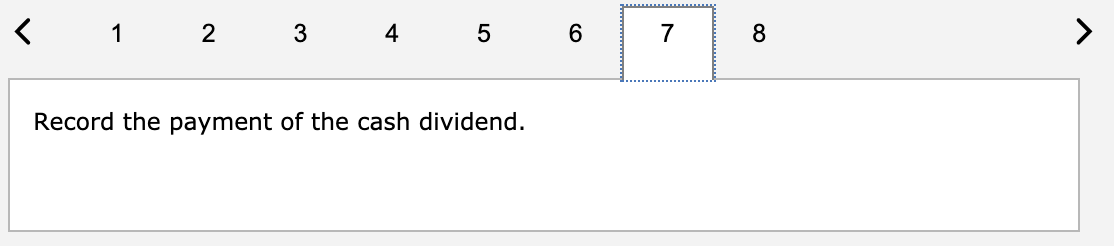

This is all one question, so please don't ask to post this all individually. As you can see there's 3 requirements for 1 questions. Thank

This is all one question, so please don't ask to post this all individually. As you can see there's 3 requirements for 1 questions. Thank you!

Step by Step Solution

There are 3 Steps involved in it

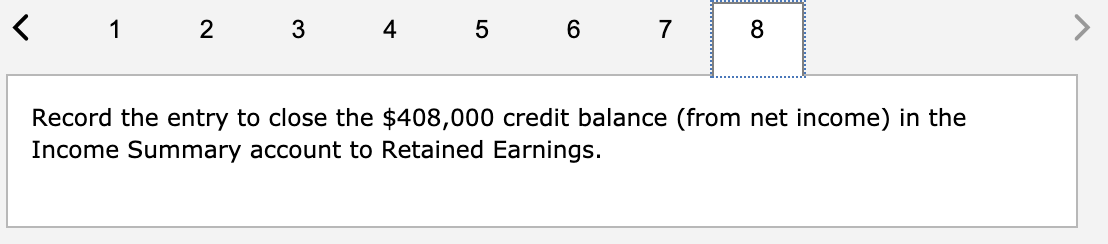

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

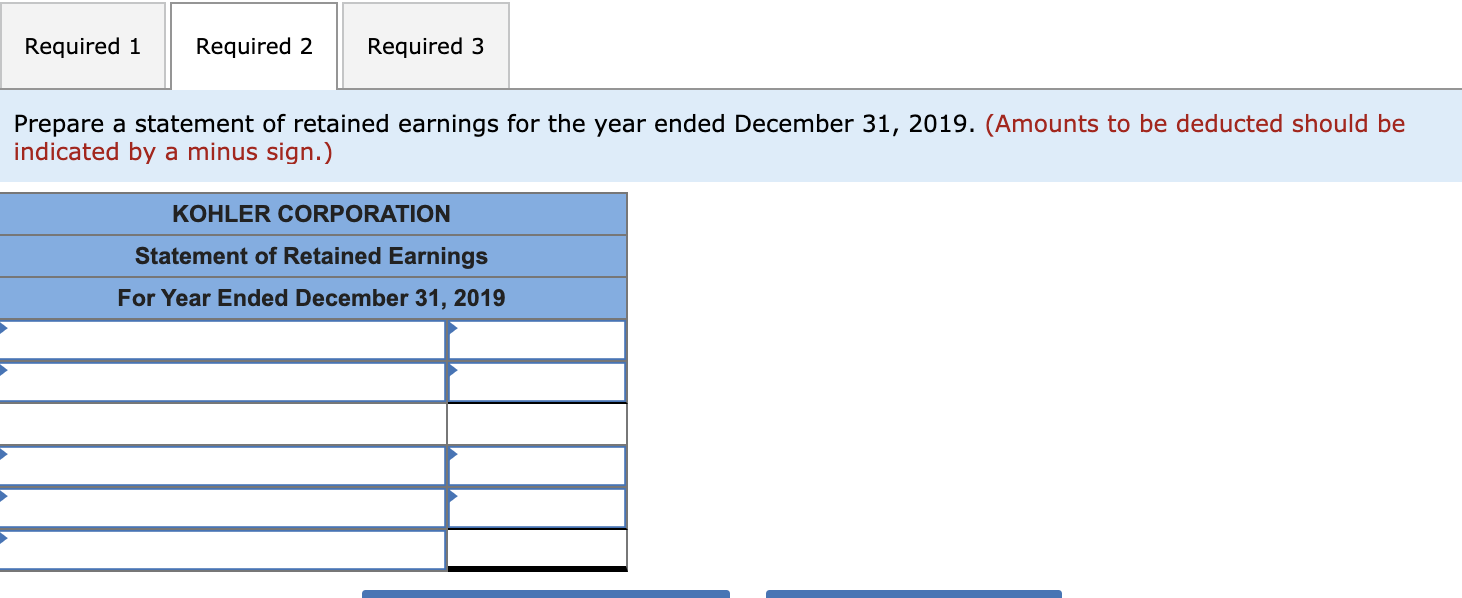

Step: 2

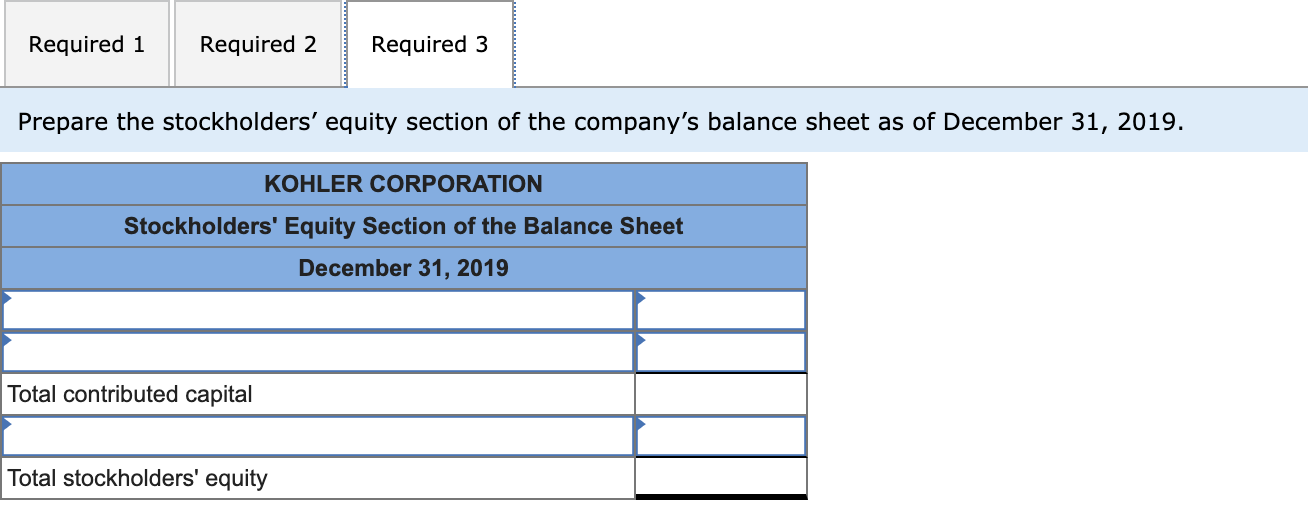

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started