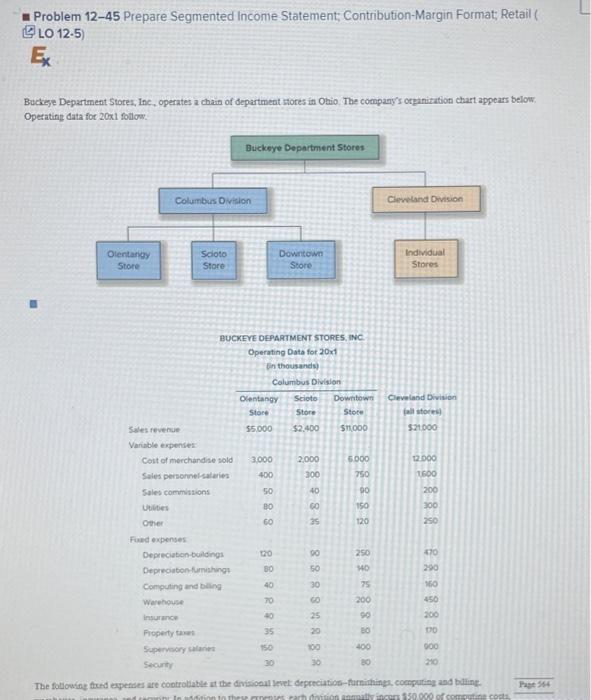

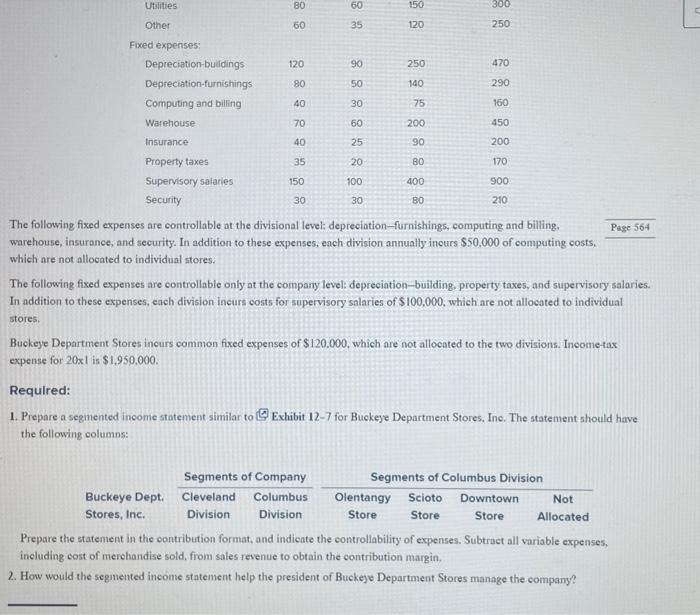

= Problem 12-45 Prepare Segmented Income Statement; Contribution-Margin Format; Retail ( (2) 12-5) = Buckeje Department Stores, Inc, operates a chain of departmeat stores in Ohio. The company's orpanitation chart appears below. Operating data for 20x1 follow. The foliowing ftred expenses are controliatet at the divisional Jerel depreciatios-furnithinge conryuting and batine: The following fixed expenses are controllable at the divisional level: depreciation-furnishings, computing and billing. warehouse, insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs. which are not allocated to individual stores. The following fixed expenses are controllable only at the company level: depreciation-building. property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $100,000, which are not allocated to individual stores. Buckeje Department Stores incurs common fixed expenses of $120.000, which are not allocated to the two divisions. Income-tax expense for 20xl is $1,950,000. Required: 1. Prepare a segmented income statement similar to (4 Exhibit 12-7 for Buckeye Department Stores, Ine. The statement should have the following columns: Prepare the statement in the contribution format, and indicate the controllability of expenses. Subtract all variable expenses, including cost of merehandise sold, from sales revenue to obtain the contribution margin. 2. How would the segmented income statement help the president of Buckeje Department Stores manage the company? = Problem 12-45 Prepare Segmented Income Statement; Contribution-Margin Format; Retail ( (2) 12-5) = Buckeje Department Stores, Inc, operates a chain of departmeat stores in Ohio. The company's orpanitation chart appears below. Operating data for 20x1 follow. The foliowing ftred expenses are controliatet at the divisional Jerel depreciatios-furnithinge conryuting and batine: The following fixed expenses are controllable at the divisional level: depreciation-furnishings, computing and billing. warehouse, insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs. which are not allocated to individual stores. The following fixed expenses are controllable only at the company level: depreciation-building. property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $100,000, which are not allocated to individual stores. Buckeje Department Stores incurs common fixed expenses of $120.000, which are not allocated to the two divisions. Income-tax expense for 20xl is $1,950,000. Required: 1. Prepare a segmented income statement similar to (4 Exhibit 12-7 for Buckeye Department Stores, Ine. The statement should have the following columns: Prepare the statement in the contribution format, and indicate the controllability of expenses. Subtract all variable expenses, including cost of merehandise sold, from sales revenue to obtain the contribution margin. 2. How would the segmented income statement help the president of Buckeje Department Stores manage the company