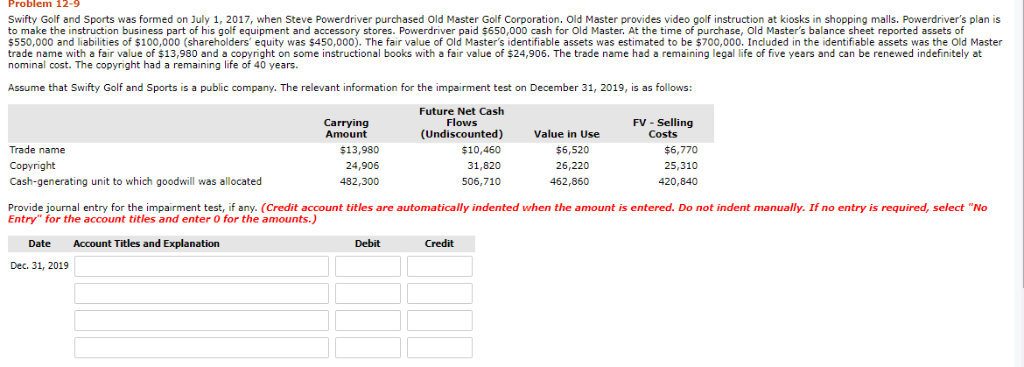

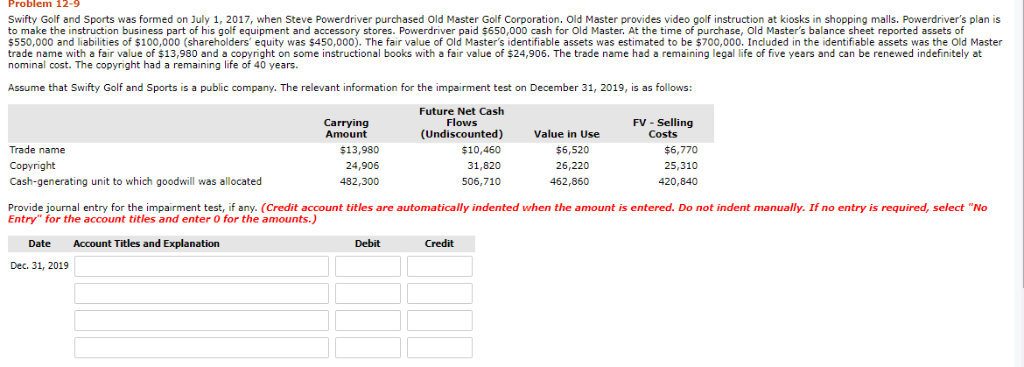

Problem 12-9 Swifty Golf and Sports was formed on July 1, 2017, when Steve Powerdriver purchased old Master Golf Corporation. Old Master provides video golf instruction at kiosks in shopping malls. Powerdriver's plan is to make the instruction business part of his golf equipment and accessory stores. Powerdriver paid $650,000 cash for Old Master. At the time of purchase, Old Master's balance sheet reported assets of $550,000 and liabilities of $100,000 (shareholders equity was $450,000). The fair value of Old Master's identifiable assets was estimated to be $700,000. Included in the identifiable assets was the Old Master trade name with a fair value of $13,980 and a copyright on some instructional books with a fair value of $24,906. The trade name had a remaining legal life of five years and can be renewed indefinitely at nominal cost. The copyright had a remaining life of 40 years. Assume that Swifty Golf and Sports is a public company. The relevant information for the impairment test on December 31, 2019, is as follows: Future Net Cash FV - Selling Carrying Amount (Undiscounted Value in Use Trade name Copyright Cash-generating unit to which goodwill was allocated $13,980 24,906 482,300 $10,460 31,820 506,710 $6,520 26,220 462,860 $6,770 25,310 420,840 Provide journal entry for the impairment test, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2019 Problem 12-9 Swifty Golf and Sports was formed on July 1, 2017, when Steve Powerdriver purchased old Master Golf Corporation. Old Master provides video golf instruction at kiosks in shopping malls. Powerdriver's plan is to make the instruction business part of his golf equipment and accessory stores. Powerdriver paid $650,000 cash for Old Master. At the time of purchase, Old Master's balance sheet reported assets of $550,000 and liabilities of $100,000 (shareholders equity was $450,000). The fair value of Old Master's identifiable assets was estimated to be $700,000. Included in the identifiable assets was the Old Master trade name with a fair value of $13,980 and a copyright on some instructional books with a fair value of $24,906. The trade name had a remaining legal life of five years and can be renewed indefinitely at nominal cost. The copyright had a remaining life of 40 years. Assume that Swifty Golf and Sports is a public company. The relevant information for the impairment test on December 31, 2019, is as follows: Future Net Cash FV - Selling Carrying Amount (Undiscounted Value in Use Trade name Copyright Cash-generating unit to which goodwill was allocated $13,980 24,906 482,300 $10,460 31,820 506,710 $6,520 26,220 462,860 $6,770 25,310 420,840 Provide journal entry for the impairment test, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2019