Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 13: Equity Finance ABC plans to pay a P3 dividend per share on each of its 300,000 shares next year. ABC anticipates earnings of

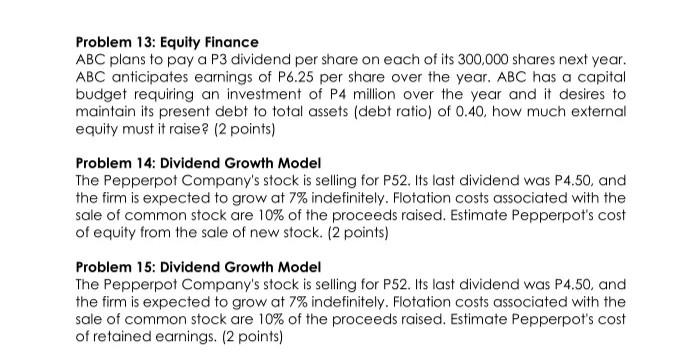

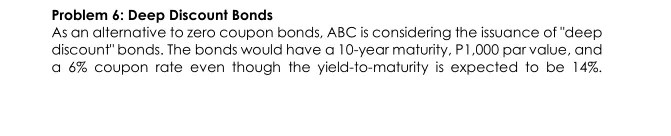

Problem 13: Equity Finance ABC plans to pay a P3 dividend per share on each of its 300,000 shares next year. ABC anticipates earnings of P6.25 per share over the year. ABC has a capital budget requiring an investment of P4 million over the year and it desires to maintain its present debt to total assets (debt ratio) of 0.40, how much external equity must it raise? (2 points) Problem 14: Dividend Growth Model The Pepperpot Company's stock is selling for P52. Its last dividend was P4.50, and the firm is expected to grow at 7% indefinitely. Flotation costs associated with the sale of common stock are 10% of the proceeds raised. Estimate Pepperpot's cost of equity from the sale of new stock. (2 points) Problem 15: Dividend Growth Model The Pepperpot Company's stock is selling for P52. Its last dividend was P4.50, and the firm is expected to grow at 7% indefinitely. Flotation costs associated with the sale of common stock are 10% of the proceeds raised. Estimate Pepperpot's cost of retained earnings. (2 points) Problem 6: Deep Discount Bonds As an alternative to zero coupon bonds, ABC is considering the issuance of "deep discount" bonds. The bonds would have a 10-year maturity. P1,000 par value, and a 6% coupon rate even though the yield-to-maturity is expected to be 14%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started