Answered step by step

Verified Expert Solution

Question

1 Approved Answer

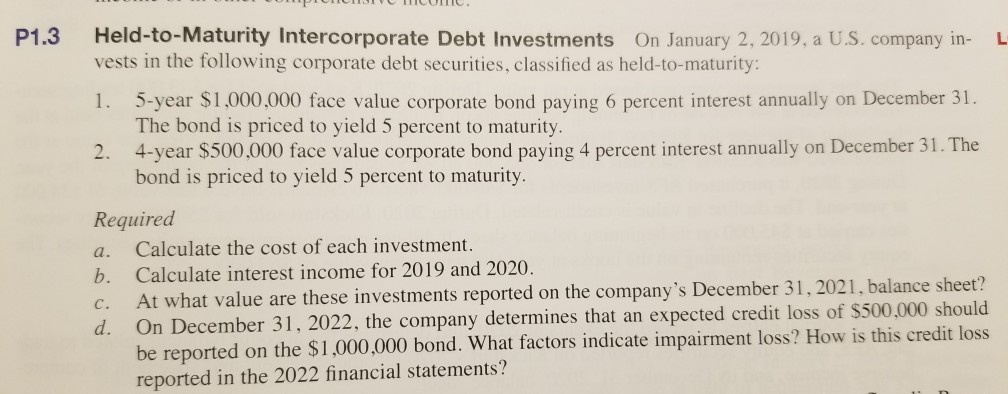

Problem 1.3 P1.3 Held-to-Maturity Intercorporate Debt Investments On January 2, 2019, a U.S. company in- L vests in the following corporate debt securities, classified as

Problem 1.3

P1.3 Held-to-Maturity Intercorporate Debt Investments On January 2, 2019, a U.S. company in- L vests in the following corporate debt securities, classified as held-to-maturity: 1. 2. 5-year $1.000.000 face value corporate bond paying 6 percent interest annually on December 31. The bond is priced to yield 5 percent to maturity. 4-year $500,000 face value corporate bond paying 4 percent interest annually on December 31. The bond is priced to yield 5 percent to maturity. Required a. Calculate the cost of each investment. b. Calculate interest income for 2019 and 2020. c. At what value are these invest ments reported on the company's December 31, 2021, balance sheet? 1, 2022, the company determines that an expected credit loss of $500.000 shoulod credit loss be reported on the $1,000,000 bond. What factors indicate impairment loss? How is this reported in the 2022 financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started