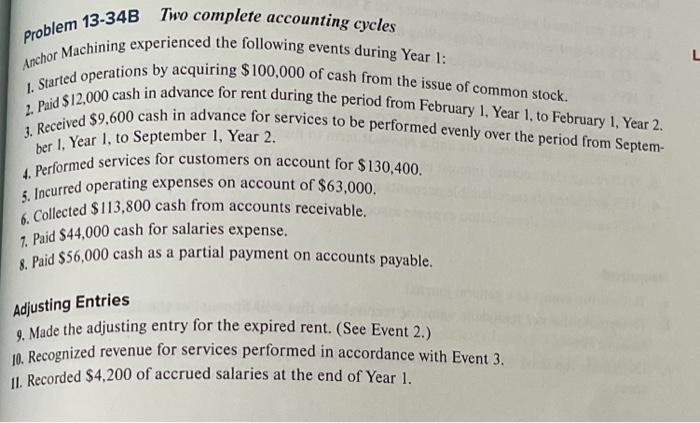

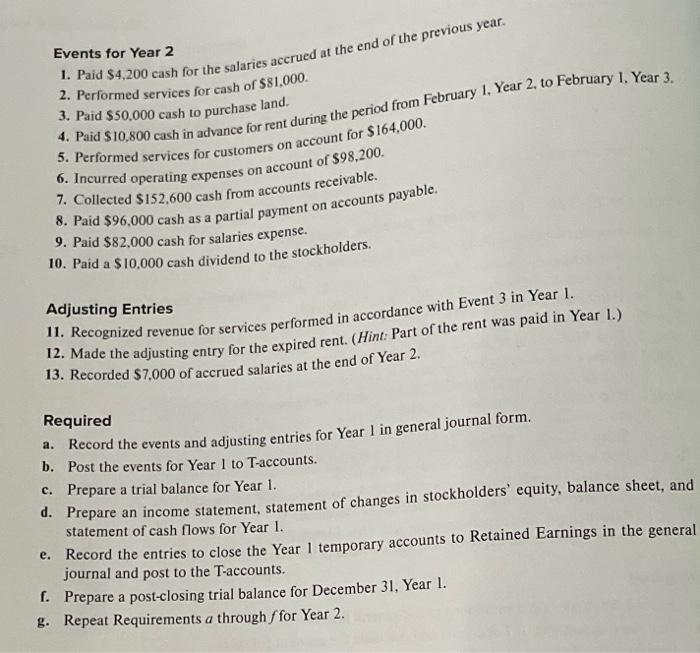

Problem 13-34B Two complete accounting cycles Anchor Machining experienced the following events during Year 1: 1. Started operations by acquiring $100,000 of cash from the issue of common stock. 2. Paid $12,000 cash in advance for rent during the period from February 1, Year 1. to February 1, Year 2. 3. Received $9,600 cash in advance for services to be performed evenly over the period from Septem- ber I. Year I, to September 1, Year 2. 4. Performed services for customers on account for $130,400. 5. Incurred operating expenses on account of $63,000. 6. Collected $113,800 cash from accounts receivable. 7. Paid $44,000 cash for salaries expense. 8. Paid $56,000 cash as a partial payment on accounts payable. Adjusting Entries 9. Made the adjusting entry for the expired rent. (See Event 2.) 10. Recognized revenue for services performed in accordance with Event 3. 11. Recorded $4,200 of accrued salaries at the end of Year 1. Events for Year 2 1. Paid $4,200 cash for the salaries accrued at the end of the previous year. 2. Performed services for cash of $81.000. 3. Paid $50,000 cash to purchase land. 4. Paid $10,800 cash in advance for rent during the period from February 1. Year 2. to February 1. Year 3. 5. Performed services for customers on account for $164.000. 6. Incurred operating expenses on account of $98,200. 7. Collected $152,600 cash from accounts receivable. 8. Paid $96,000 cash as a partial payment on accounts payable. 9. Paid $82,000 cash for salaries expense. 10. Paid a $10.000 cash dividend to the stockholders. Adjusting Entries 11. Recognized revenue for services performed in accordance with Event 3 in Year 1. 12. Made the adjusting entry for the expired rent. (Hint: Part of the rent was paid in Year 1.) 13. Recorded $7.000 of accrued salaries at the end of Year 2. Required a. Record the events and adjusting entries for Year 1 in general journal form. b. Post the events for Year 1 to T-accounts. c. Prepare a trial balance for Year 1. d. Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1. e. Record the entries to close the Year I temporary accounts to Retained Earnings in the general journal and post to the T-accounts. . Prepare a post-closing trial balance for December 31, Year 1. g. Repeat Requirements a through ffor Year 2