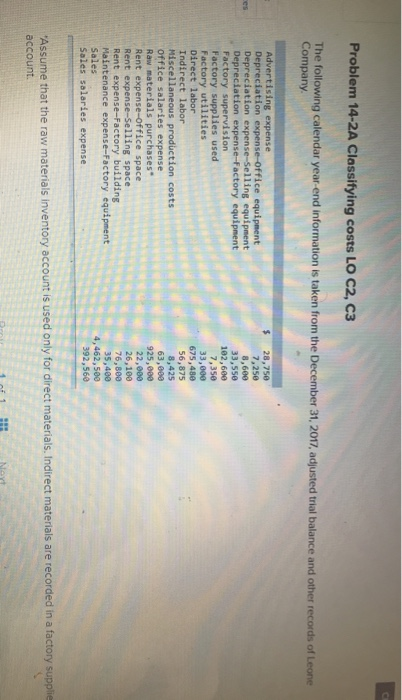

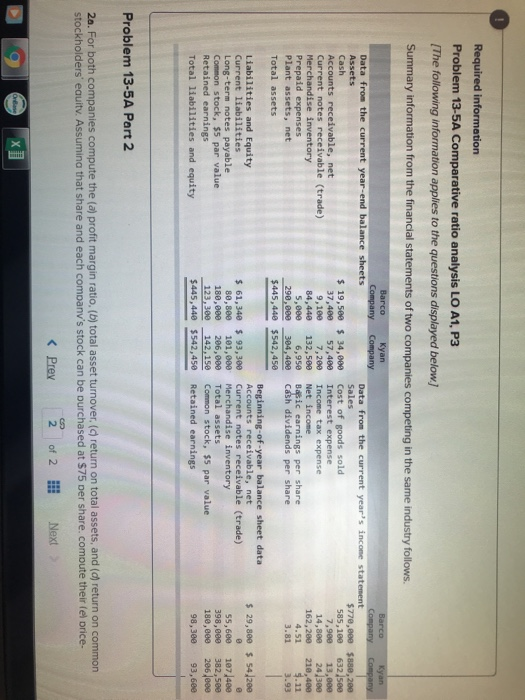

Problem 14-2A Classifying costs LO C2, C3 The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Direct labore Indirect labor Miscellaneous production costs office salaries expense Raw materials purchases" Rent expense-office space Rent expense-selling space Rent expense-Factory building Maintenance expense-Factory equipmer Sales Sales salaries expense 28,750 7,250 8,600 33,550 102,600 7,35e 33,000 675,480 56,875 8,425 63,000 925,000 22,000 26,100 76,800 35,400 4,462,500 392,560 "Assume that the raw materials inventory account is used only for direct materials. Indirect materials are recorded in a factory supplie account. 11 Nyt Required information Problem 13-5A Comparative ratio analysis LO A1, P3 (The following information applies to the questions displayed below.) Summary information from the financial statements of two companies competing in the same industry follows. Barco Kyan Barco Ryan Company Company Company Company Data from the current year-end balance sheets Data from the current year's income statement Assets Sales $770,000 $880, 280 Cash $ 19,500 $ 34,000 cost of goods sold 585,189 632 500 Accounts receivable, net 37,400 57,400 Interest expense 7,98 13,000 Current notes receivable (trade) 9,1 7,200 Income tax expense 14,860 24,300 Merchandise inventory 84,440 132,580 Net income 162,289 210,480 Prepaid expenses 5,eee 6,950 Bopic earnings per share 4.51 5.11 Plant assets, net 290.000 384,400 cash dividends per share 3.81 3.93 Total assets $445,440 $542,450 Beginning-of-year balance sheet data Liabilities and Equity Accounts receivable, net $ 29,800 $ 54,200 Current liabilities $ 61,340 $ 93,300 Current notes receivable (trade) Long-term notes payable 80,8ee 101,600 Merchandise inventory 55,600 107.480 Common stock, $5 par value 180,000 206,000 Total assets 398,eee 382,500 Retained earnings 123,300 142,150 Common stock, $5 par value 180, eee 206.000 Total liabilities and equity $445,440 $542,450 Retained earnings 98,300 93,600 Problem 13-5A Part 2 2a. For both companies compute the (a) profit margin ratio. (b) total asset turnover (return on total assets, and (c) return on common stockholders' equity. Assumina that share and each company's stock can be purchased at $75 per share, compute their le price- Problem 14-2A Classifying costs LO C2, C3 The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-Factory equipment Factory supervision Factory supplies used Factory utilities Direct labore Indirect labor Miscellaneous production costs office salaries expense Raw materials purchases" Rent expense-office space Rent expense-selling space Rent expense-Factory building Maintenance expense-Factory equipmer Sales Sales salaries expense 28,750 7,250 8,600 33,550 102,600 7,35e 33,000 675,480 56,875 8,425 63,000 925,000 22,000 26,100 76,800 35,400 4,462,500 392,560 "Assume that the raw materials inventory account is used only for direct materials. Indirect materials are recorded in a factory supplie account. 11 Nyt Required information Problem 13-5A Comparative ratio analysis LO A1, P3 (The following information applies to the questions displayed below.) Summary information from the financial statements of two companies competing in the same industry follows. Barco Kyan Barco Ryan Company Company Company Company Data from the current year-end balance sheets Data from the current year's income statement Assets Sales $770,000 $880, 280 Cash $ 19,500 $ 34,000 cost of goods sold 585,189 632 500 Accounts receivable, net 37,400 57,400 Interest expense 7,98 13,000 Current notes receivable (trade) 9,1 7,200 Income tax expense 14,860 24,300 Merchandise inventory 84,440 132,580 Net income 162,289 210,480 Prepaid expenses 5,eee 6,950 Bopic earnings per share 4.51 5.11 Plant assets, net 290.000 384,400 cash dividends per share 3.81 3.93 Total assets $445,440 $542,450 Beginning-of-year balance sheet data Liabilities and Equity Accounts receivable, net $ 29,800 $ 54,200 Current liabilities $ 61,340 $ 93,300 Current notes receivable (trade) Long-term notes payable 80,8ee 101,600 Merchandise inventory 55,600 107.480 Common stock, $5 par value 180,000 206,000 Total assets 398,eee 382,500 Retained earnings 123,300 142,150 Common stock, $5 par value 180, eee 206.000 Total liabilities and equity $445,440 $542,450 Retained earnings 98,300 93,600 Problem 13-5A Part 2 2a. For both companies compute the (a) profit margin ratio. (b) total asset turnover (return on total assets, and (c) return on common stockholders' equity. Assumina that share and each company's stock can be purchased at $75 per share, compute their le price-