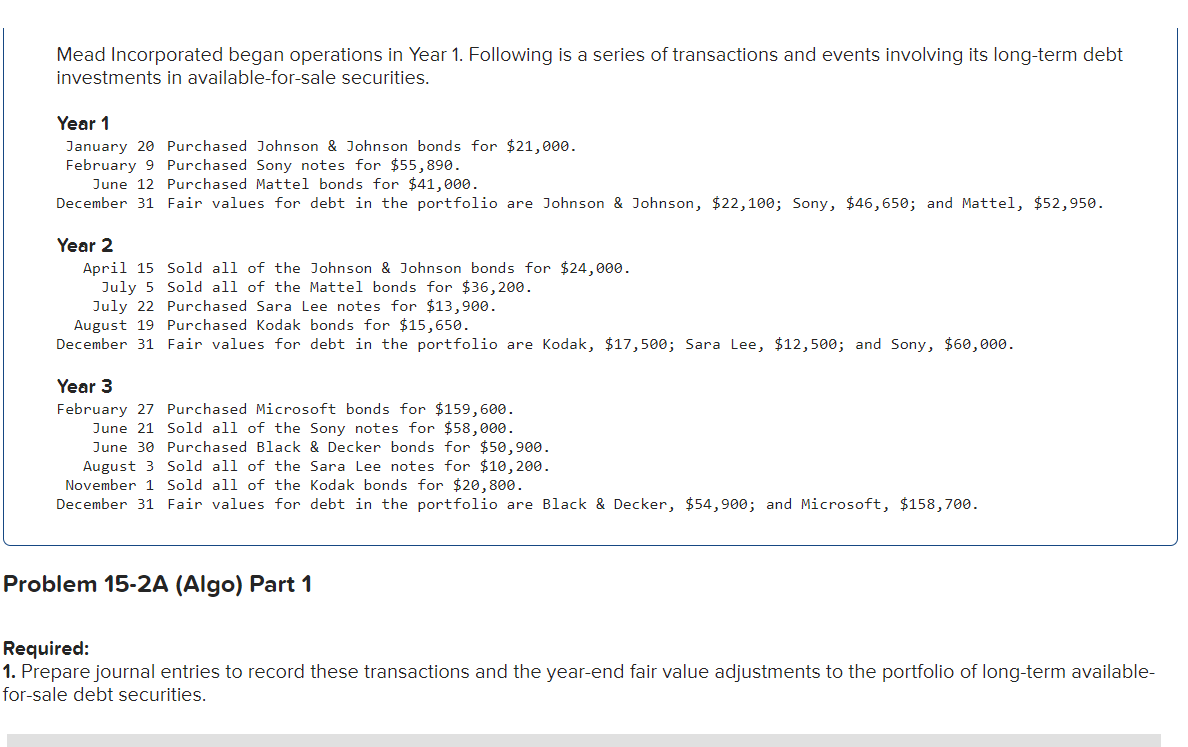

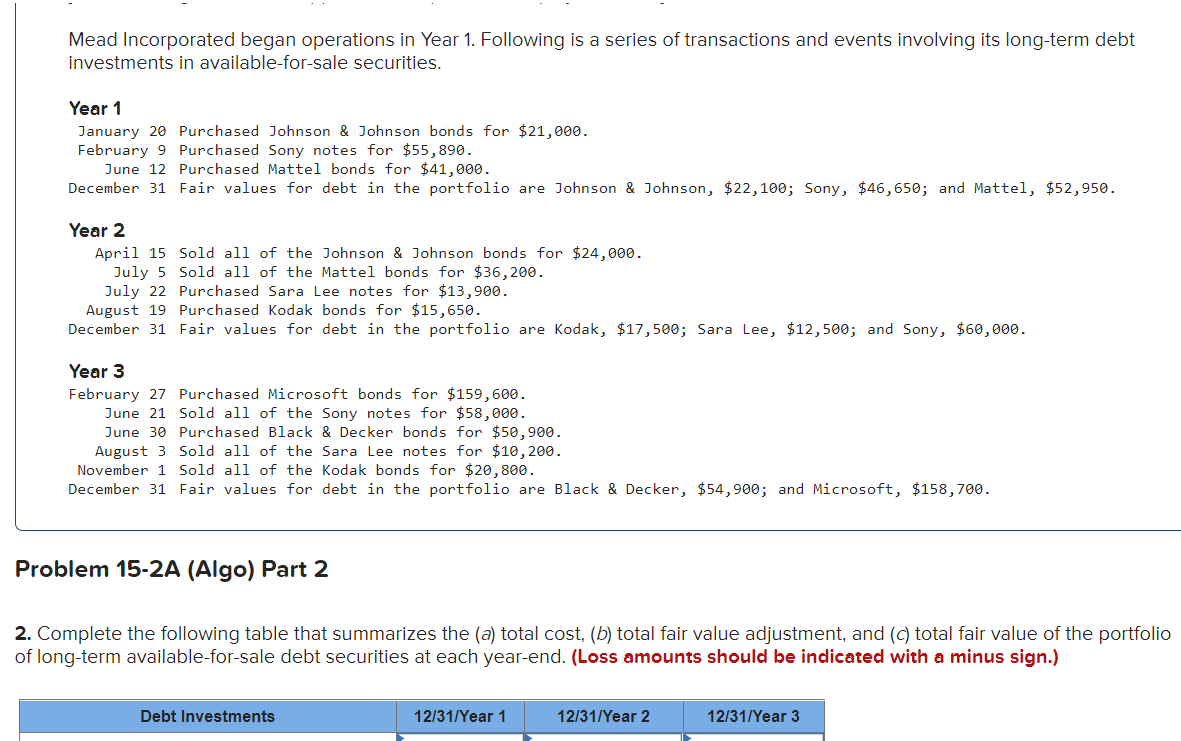

Problem 15-1A (Algo) Recording and adjusting trading debt securities LO P1 Kirkland Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt securities. August 2 Purchased Verizon bonds for $12,000. September 7 Purchased Apple bonds for $37,000. September 12 Purchased Mastercard bonds for $22,000. October 21 Sold some of its Verizon bonds that had cost $2,100 for $2,200 cash. October 23 Sold some of its Apple bonds that had cost $17,000 for $17,400 cash. November 1 Purchased Walmart bonds for $42,000. December 10 Sold all of its Mastercard bonds for $20,000 cash. Required 1. Prepare journal entries to record these transactions. 2. Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values: Verizon, $10,500; Apple, $23,000; and Walmart, $40,000. 3. Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $21,000. February 9 Purchased Sony notes for $55,890. June 12 Purchased Mattel bonds for $41,000. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $22,100; Sony, $46,650; and Mattel, $52,950. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $24,000. July 5 Sold all of the Mattel bonds for $36,200. July 22 Purchased Sara Lee notes for $13,900. August 19 Purchased Kodak bonds for $15,650. December 31 Fair values for debt in the portfolio are Kodak, $17,500; Sara Lee, $12,500; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $159,600. June 21 sold all of the Sony notes for $58,000. June 30 Purchased Black & Decker bonds for $50,900. August 3 Sold all of the Sara Lee notes for $10,200. November 1 sold all of the Kodak bonds for $20,800. December 31 Fair values for debt in the portfolio are Black & Decker, $54,900; and Microsoft, $158,700. Problem 15-2A (Algo) Part 1 Required: 1. Prepare journal entries to record these transactions and the year-end fair value adjustments to the portfolio of long-term available- for-sale debt securities. Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $21,000. February 9 Purchased Sony notes for $55,890. June 12 Purchased Mattel bonds for $41,000. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $22,100; Sony, $46,650; and Mattel, $52,950. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $24,000. July 5 Sold all of the Mattel bonds for $36,200. July 22 Purchased Sara Lee notes for $13,900. August 19 Purchased kodak bonds for $15,650. December 31 Fair values for debt in the portfolio are Kodak, $17,500; Sara Lee, $12,500; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $159,600. June 21 Sold all of the Sony notes for $58,000. June 30 Purchased Black & Decker bonds for $50,900. August 3 Sold all of the Sara Lee notes for $10,200. November 1 Sold all of the Kodak bonds for $20,800. December 31 Fair values for debt in the portfolio are Black & Decker, $54,900; and Microsoft, $158,700. Problem 15-2A (Algo) Part 2 2. Complete the following table that summarizes the (a) total cost, (b) total fair value adjustment, and (c) total fair value of the portfolio of long-term available-for-sale debt securities at each year-end. (Loss amounts should be indicated with a minus sign.) Debt Investments 12/31/Year 1 12/31/Year 2 12/31/Year 3