Question

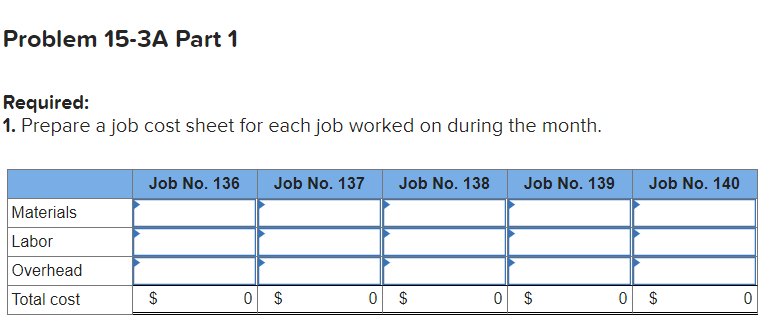

Problem 15-3A Source documents, journal entries, and accounts in job order costing LO P1, P2, P3 [The following information applies to the questions displayed below.]

Problem 15-3A Source documents, journal entries, and accounts in job order costing LO P1, P2, P3

[The following information applies to the questions displayed below.] Widmer Watercrafts predetermined overhead rate is 200% of direct labor. Information on the companys production activities during May follows.

- Purchased raw materials on credit, $220,000.

- Materials requisitions record use of the following materials for the month.

| Job 136 | $ | 49,500 | |

| Job 137 | 33,000 | ||

| Job 138 | 19,800 | ||

| Job 139 | 22,600 | ||

| Job 140 | 6,600 | ||

| Total direct materials | 131,500 | ||

| Indirect materials | 20,000 | ||

| Total materials used | $ | 151,500 | |

- Paid $15,250 cash to a computer consultant to reprogram factory equipment.

- Time tickets record use of the following labor for the month. These wages were paid in cash.

| Job 136 | $ | 12,100 | |

| Job 137 | 10,600 | ||

| Job 138 | 37,900 | ||

| Job 139 | 39,000 | ||

| Job 140 | 4,000 | ||

| Total direct labor | 103,600 | ||

| Indirect labor | 24,000 | ||

| Total | $ | 127,600 | |

- Applied overhead to Jobs 136, 138, and 139.

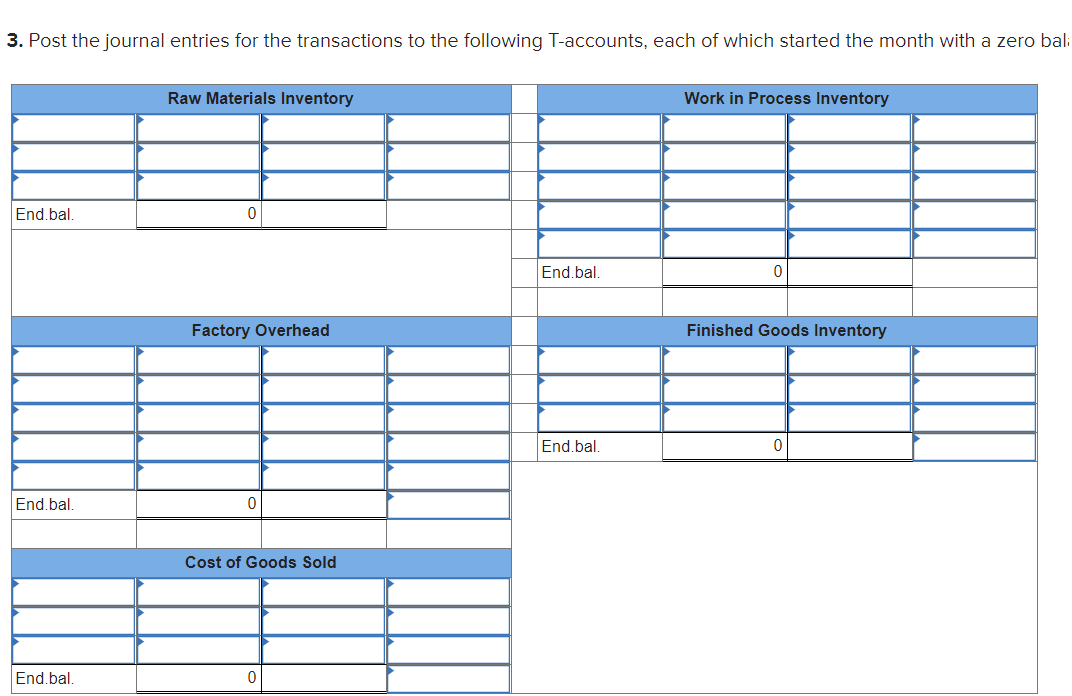

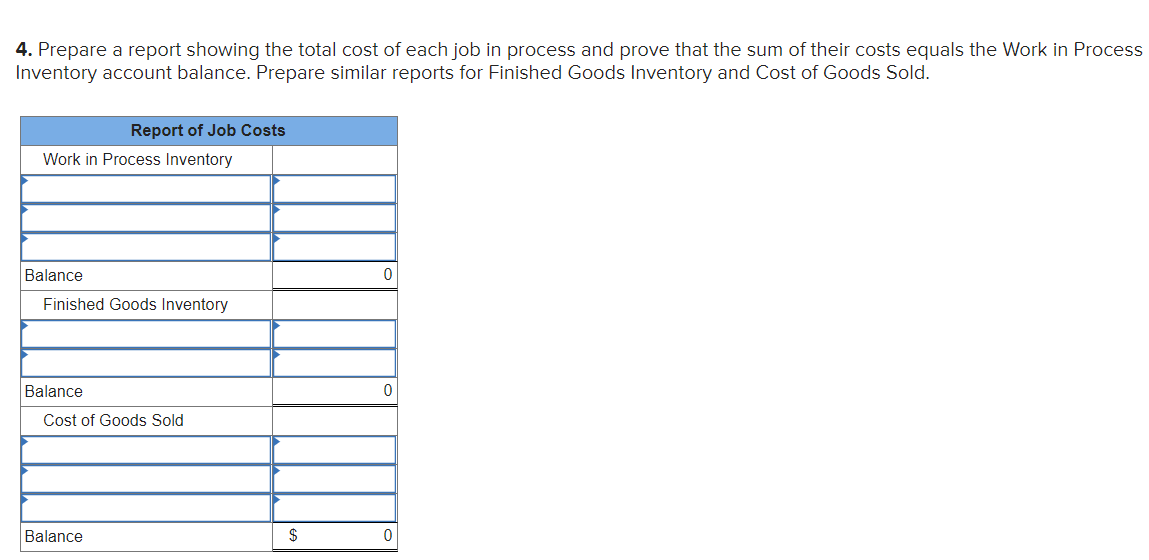

- Transferred Jobs 136, 138, and 139 to Finished Goods.

- Sold Jobs 136 and 138 on credit at a total price of $530,000.

- The company incurred the following overhead costs during the month (credit Prepaid Insurance for expired factory insurance).

| Depreciation of factory building | $ | 69,000 | |

| Depreciation of factory equipment | 37,500 | ||

| Expired factory insurance | 11,000 | ||

| Accrued property taxes payable | 36,500 | ||

- Applied overhead at month-end to the Work in Process Inventory account (Jobs 137 and 140) using the predetermined overhead rate of 200% of direct labor cost

- Prepare journal entries to record the events and transactions a through i

-

1

Record raw material purchases on credit.

-

2

Record the requisition of direct and indirect materials.

-

3

Record payment to computer consultant to reprogram factory equipment.

-

4

Record the entry for direct and indirect labor, paid in cash.

-

5

Record the entry to apply overhead to jobs 136, 138 and 139.

-

6

Record the transfer of completed jobs 136,138 and 139 to finished goods.

-

7

Record the entry for sales on account for Jobs 136 and 138.

-

8

Record the entry for the cost of sales of Jobs 136 and 138.

-

9

Record other factory overhead (depreciation, insurance and property taxes).

-

10

Record the entry to apply overhead to Jobs 137 and 140 (Work in Process).

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started