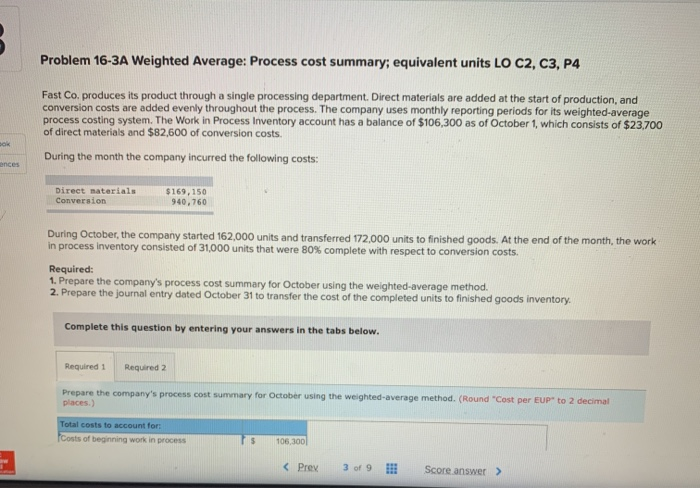

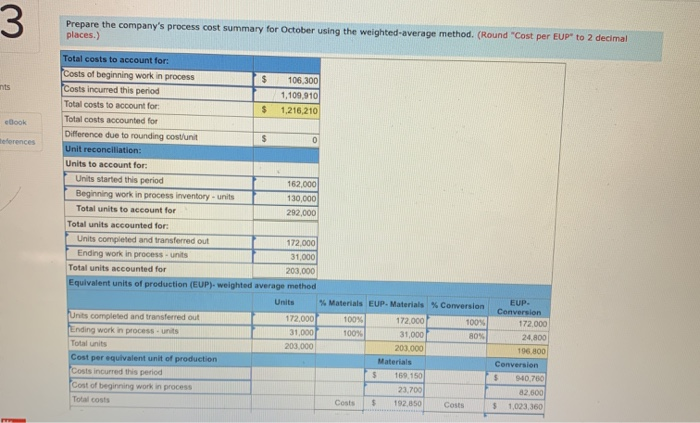

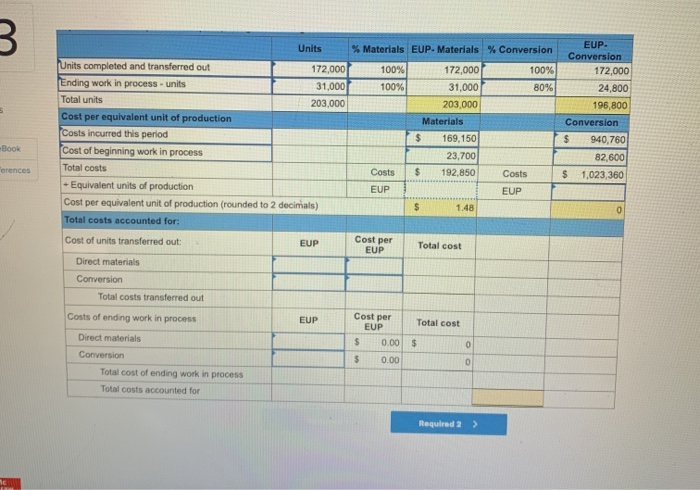

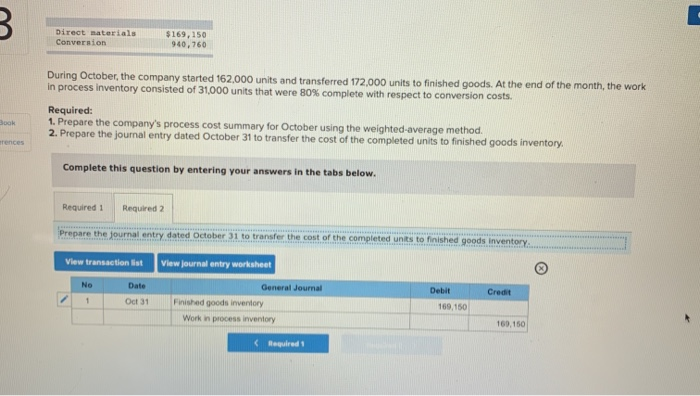

Problem 16-3A Weighted Average: Process cost summary; equivalent units LO C2, C3, P4 Fast Co, produces its product through a single processing department. Direct materials are added at the start of production, and conversion costs are added evenly throughout the process. The company uses monthly reporting periods for its weighted average process costing system. The Work in Process Inventory account has a balance of $106,300 as of October 1, which consists of $23.700 of direct materials and $82,600 of conversion costs During the month the company incurred the following costs: Direct materials Conversion $169,150 940,760 During October, the company started 162,000 units and transferred 172,000 units to finished goods. At the end of the month, the work in process inventory consisted of 31,000 units that were 80% complete with respect to conversion costs. Required: 1. Prepare the company's process cost summary for October using the weighted average method. 2. Prepare the journal entry dated October 31 to transfer the cost of the completed units to finished goods inventory. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's process cost summary for October using the weighted average method. (Round "Cost per EUP" to 2 decimal places) Total costs to account for: Costs of beginning work in process 105.300 3 Prepare the company's process cost summary for October using the weighted average method. (Round "Cost per EUP" to 2 decimal places.) Is 106.300 1,109,910 1,216.210 $ ebook Total costs to account for: Costs of beginning work in process Costs incurred this period Total costs to account for Total costs accounted for Difference due to rounding costunit Unit reconciliation: Units to account for: Units started this period Beginning work in process inventory- units Total units to account for rences 12 000 Total units accounted for Units completed and transferred out 172.000 Ending work in process units 31.000 Total units accounted for 201000 Equivalent units of production (EUP) weighted average method Units EUP Conversion Units completed and transferred out Ending work in process uns 172.0001 31000 000 203.000 Materials EUP. Materials 100% 172.000 1 00 31000 100% 30% 172.000 24.800 201000 Materials $ 159 150 Conversion 9400 780 Cost per equivalent unit of production Costs incurred this period Cost of beginning work in process 23.700 192 850 Toots Costs B EUP: Units Units completed and transferred out 172,000 Ending work in process units 31,000 Total units 203.000 Cost per equivalent unit of production Costs incurred this period Cost of beginning work in process Total costs - Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Cost of units transferred out: EUP % Materials EUP-Materials % Conversion 100% 172,000 100% 100% 31,000 80% 203.000 Materials $ 169,150 23,700 Costs $ 192,850 Costs EUP 172,000 24,800 196,800 Conversion $ 940,760 82,600 $ 1,023,360 Book verences Cost per EUP Total cost Direct materials Conversion Total costs transferred out Costs of ending work in process EUP Cost per Total cost Direct materials 0.00 Conversion Total cost of ending work in process Total costs accounted for Required 2 > 3 Direct materials Conversion $169, 150 During October, the company started 162.000 units and transferred 172,000 units to finished goods. At the end of the month, the work in process inventory consisted of 31,000 units that were 80% complete with respect to conversion costs. Required: 1. Prepare the company's process cost summary for October using the weighted average method. 2. Prepare the journal entry dated October 31 to transfer the cost of the completed units to finished goods inventory. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry dated October 31 to transfer the cost of the completed units to finished goods inventory View transaction ist View journal entry worksheet NO Date Debit Credit Oct 31 General Journal Finished goods inventory Work in process inventory 169.150