Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 16-53 Profitability Analysis for an Investment Decision Suppose that you are considering investing in one of two companies, each in the same industry. The

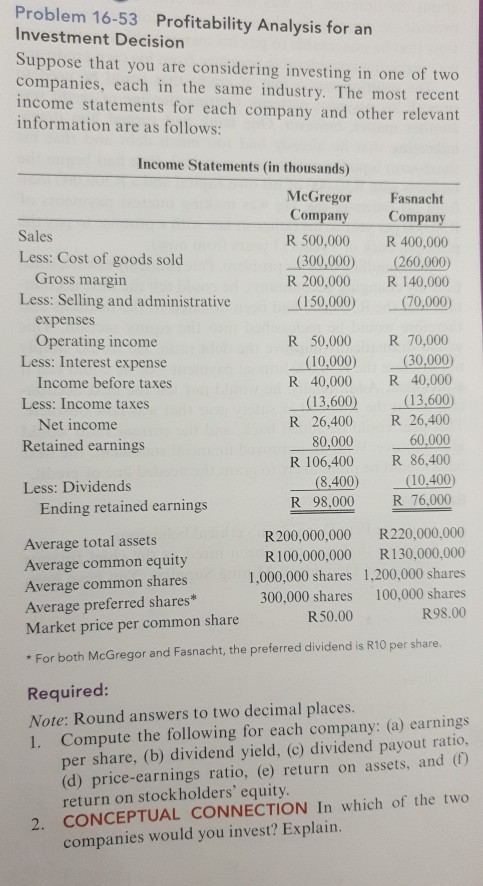

Problem 16-53 Profitability Analysis for an Investment Decision Suppose that you are considering investing in one of two companies, each in the same industry. The most recent income statements for each company and other relevant information are as follows: Income Statements (in thousands) McGregor Company Fasnacht Company Sales R 500,000 R 400,000 Less: Cost of goods sold Gross margin (300,000) R 200,000 (260,000) R 140,000 Less: Selling and administrative (150,000) (70,000) expenses Operating income Less: Interest expense R 50,000 R 70,000 (30,000) R 40,000 (10.000) Income before taxes R 40,000 (13,600) R 26,400 (13,600) R 26,400 Less: Income taxes Net income 60,000 R 86,400 80,000 Retained earnings R 106,400 (10.400) (8,400) Less: Dividends R 76,000 R 98,000 Ending retained earnings R220,000,000 R130,000,000 R200,000,000 Average total assets Average common equity Average common shares Average preferred shares* Market price per common share R100,000,000 1,000,000 shares 1,200,000 shares 100,000 shares 300,000 shares R98.00 R50.00 For both McGregor and Fasnacht, the preferred dividend is R10 per share. Required: Note: Round answers to two decimal places. 1. Compute the following for each company: (a) earnings per share, (b) dividend yield, (c) dividend payout ratio, (d) price-earnings ratio, (e) return on assets, and (f) return on stockholders' equity. 2. CONCEPTUAL CONNECTION In which of the two companies would you invest? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started