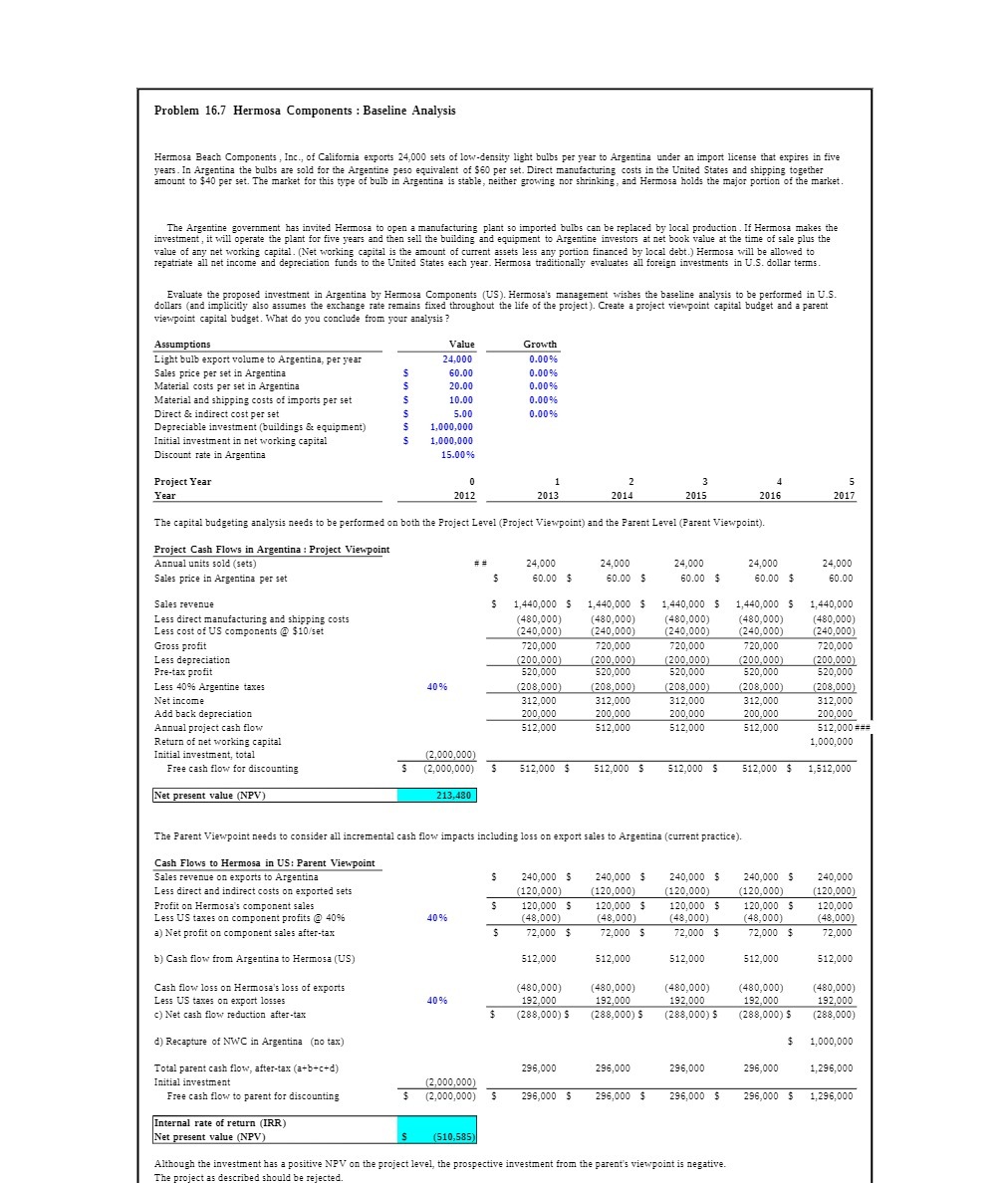

Problem 16.7 Hermosa Components : Baseline Analysis Hermosa Beach Components, Inc., of California exports 24,000 sets of low-density light bulbs per year to Argentina under an import license that expires in five years. In Argentina the bulbs are sold for the Argentine peso equivalent of $60 per set. Direct manufacturing costs in the United States and shipping together amount to $40 per set. The market for this type of bulb in Argentina is stable, neither growing nor shrinking, and Hermosa holds the major portion of the market. The Argentine government has invited Hermosa to open a manufacturing plant so imported bulbs can be replaced by local production . If Hermosa makes the investment, it will operate the plant for five years and then sell the building and equipment to Argentine investors at net book value at the time of s value of any net working capital. (Net working capital is the amount of current assets less any portion financed by local debt.) Hermosa will be allowed to repatriate all net income and depreciation funds to the United States each year. Hermosa traditionally evaluates all foreign investments in U.S. dollar terms Evaluate the proposed investment in Argentina by Hermosa Components (US ). Hermosa's management wishes the baseline analysis to be performed in U.S dollars (and implicitly also assumes the exchange rate remains fixed throughout the life of the project ). Create a project viewpoint capital budget and a parent viewpoint capital budget. What do you conclude from your analysis ? Assumptions Value Growth Light bulb export volume to Argentina, per year 0.00% Sales price per set in Argentina 60.0 0.00% Material costs per set in Argentina 20.00 0.00% Material and shipping costs of imports per set 10.0 0.00% Direct & indirect cost per set 5.00 0.00% Depreciable investment (buildings & equipment) 1,000,000 Initial investment in net working capital 1,000,000 Discount rate in Argentina 15.00% Project Year 3 S Year 2012 2013 2014 2015 2016 2017 The capital budgeting analysis needs to be performed on both the Project Level (Project Viewpoint) and the Parent Level (Parent Viewpoint) Project Cash Flows in Argentina : Project Viewpoint Annual units sold (sets) 24,000 24,000 24,000 24,000 24,00 Sales price in Argentina per set 60.00 $ 60.00 $ 60.00 $ 60.00 $ 60.0 Sales revenue 1,440,000 5 1,440,000 $ 1,440,000 $ 1,440,000 5 1,440,000 Less direct manufacturing and shipping costs (480,000 480,000) (480,000 480,000) (480,000) Less cost of US components @ $10/set 240,000) 240,000) 240,000) 240,000) (240,000) Gross profit 720,000 20,000 20,000 20,000 20,000 Less depreciation 200,000 200,000 100,000 200,000 00,000) Pre-tax profit 520,00 20,000 20,000 20,000 520,000 Less 409% Argentine taxes 40 % 208,000) 208,000) 208,000) 208,000 208,000) Net income 312,000 12,000 $12,00 (12,000 312,000 Add back depreciation 200,000 200,000 200,000 200,000 200,000 Annual project cash flow 512,000 512,000 512,000 512,000 $12,000## Return of net working capital 1,000,000 Initial investment, total (2,000,000) Free cash flow for discounting $ (2,000,000) 512,000 $ 512,000 $ 512,000 $ 512,000 $ 1,512,000 Net present value (NPV) 213,480 The Parent Viewpoint needs to consider all incremental cash flow impacts including loss on export sales to Argentina (current practice). Cash Flows to Hermosa in US: Parent Viewpoint Sales revenue on exports to Argentina 240,000 $ 240,000 $ 240,000 $ 240,000 $ 240,000 Less direct and indirect costs on exported sets 120,000) (120,000) 120,000) (120,000) (120,000) Profit on Hermosa's component sales 120,000 S 120,000 $ 20,000 $ 120,000 $ 120,000 Less US taxes on component profits @ 40% 40 9% 48,000) 48,000) 48,000) 48,000) (48,000) a) Net profit on component sales after-tax 2,000 $ 72,000 72,000 72,000 72,000 b) Cash flow from Argentina to Hermosa (US) 512,000 512,000 512,000 512,000 $12,000 Cash flow loss on Hermosa's loss of exports 480,000 480,000) 180,000) (480,000) (480,000 Less US taxes on export losses 40% 192,000 192,000 192,000 192,000 192,000 c) Net cash flow reduction after-tax (288,000) $ (288,000) (288,000) $ (288,000) $ (288,000) d) Recapture of NWC in Argentina (no tax) 1,000,000 Total parent cash flow, after-tax (a+b+c+d) 296,000 296,000 296,000 296,000 1,296,000 Initial investment (2,000,000 Free cash flow to parent for discounting $ (2,000,000) 296,000 5 296,000 $ 296,000 $ 296,000 $ 1,296,000 Internal rate of return (IRR) Net present value (NPV) (510,585) Although the investment has a positive NPV on the project level, the prospective investment from the parent's viewpoint is negative