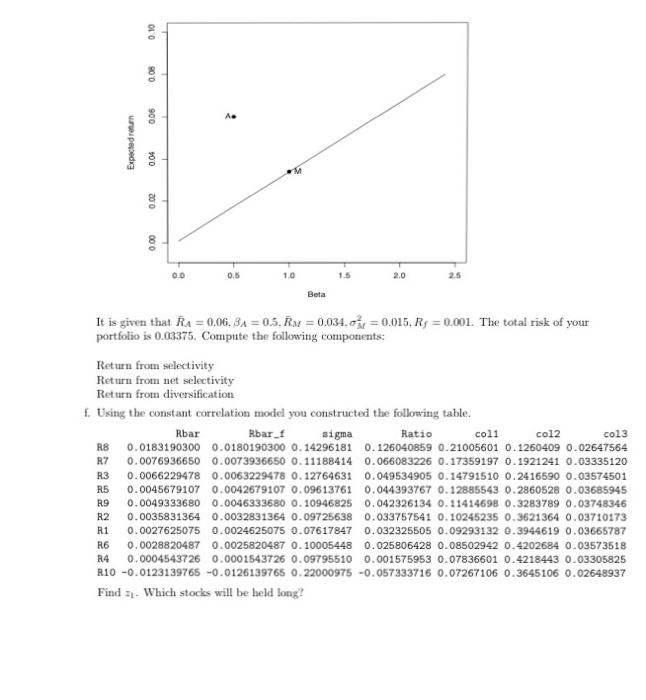

Problem 17 Answer the following questions: a. Consider the single index model with n stocks. You are given all the inputs you need to find the composition of the point of tangency using the ranking of stocks based on the excess return to beta ratio. Show the entire derivation for find the cut-off point C when short sales are allowed b. Consid he multi-ndex model as discussed in class with the assumptions given in the handout Multi-index model. Suppose we construct a portfolio using five industries with five stocks in each industry. The composition of the point of tangency is based on solving ?-M 1 R Write the element M5.3 c. You decided to use the multigroup model for your portfolio analysis. These are your stocks and Ticker Industry C Money Center Banks 2 KEY oney Center Banks KFC Money Center Banka SD Electrical Utilities DUK Electrical Utilitiea D Electrical Utilities HE Electrical Utilities EIX Electrical Utilities Biotechnology Biotechnology Biotechnology Biotechnology Fuel Refining Fuel Refining Fuel Refining Autonobile 5 6 7 AMGN 0 GILD 11 CELG 12 BIIB 13 IMO 14 MRO 15 YPF 16 Is there any problem here? d. A large pension fund wants to evaluate the performance of four portfolio managers for the last 5 years. During this time period the average annual return of the S&P500 was 14% with standard deviation 12%. The average annual risk free interest rate was 8%. The four portfolios gave the following data: Portfolio Average annual return ( Standard deviation Beta 10 15 16 10 13 1.9 0.8 1.3 For funds A and B, how much the retuon B has to change to reverse the ranking using the Sharpe measure? e. The following plot shows the expected return against beta of the market portfolio and your portfolio A based on some model you chose. Problem 17 Answer the following questions: a. Consider the single index model with n stocks. You are given all the inputs you need to find the composition of the point of tangency using the ranking of stocks based on the excess return to beta ratio. Show the entire derivation for find the cut-off point C when short sales are allowed b. Consid he multi-ndex model as discussed in class with the assumptions given in the handout Multi-index model. Suppose we construct a portfolio using five industries with five stocks in each industry. The composition of the point of tangency is based on solving ?-M 1 R Write the element M5.3 c. You decided to use the multigroup model for your portfolio analysis. These are your stocks and Ticker Industry C Money Center Banks 2 KEY oney Center Banks KFC Money Center Banka SD Electrical Utilities DUK Electrical Utilitiea D Electrical Utilities HE Electrical Utilities EIX Electrical Utilities Biotechnology Biotechnology Biotechnology Biotechnology Fuel Refining Fuel Refining Fuel Refining Autonobile 5 6 7 AMGN 0 GILD 11 CELG 12 BIIB 13 IMO 14 MRO 15 YPF 16 Is there any problem here? d. A large pension fund wants to evaluate the performance of four portfolio managers for the last 5 years. During this time period the average annual return of the S&P500 was 14% with standard deviation 12%. The average annual risk free interest rate was 8%. The four portfolios gave the following data: Portfolio Average annual return ( Standard deviation Beta 10 15 16 10 13 1.9 0.8 1.3 For funds A and B, how much the retuon B has to change to reverse the ranking using the Sharpe measure? e. The following plot shows the expected return against beta of the market portfolio and your portfolio A based on some model you chose