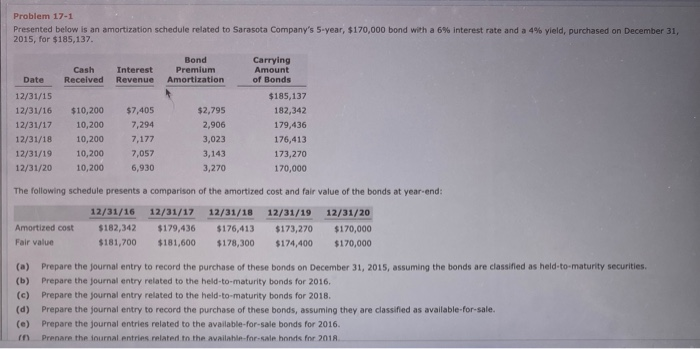

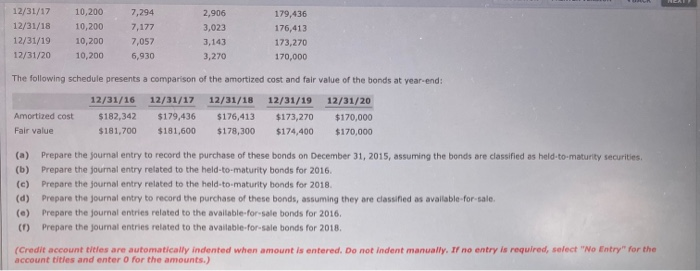

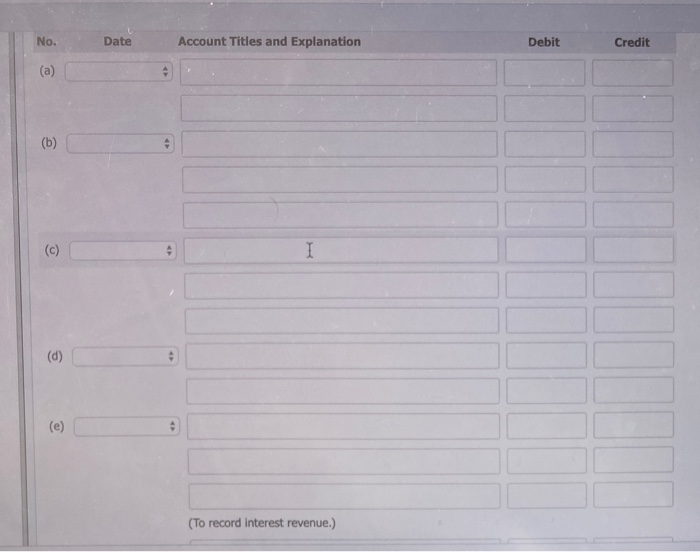

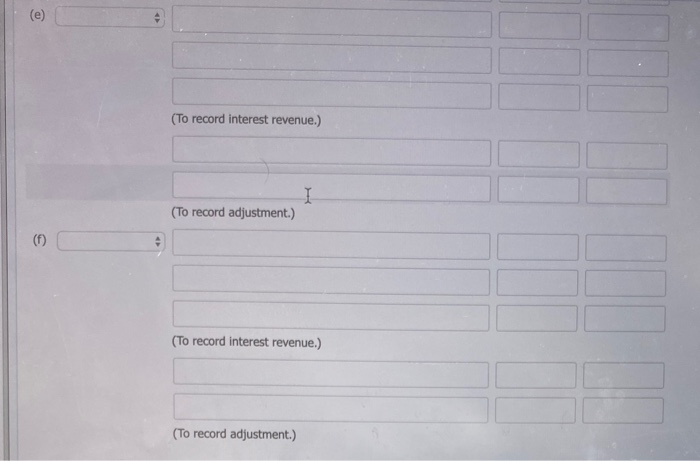

Problem 17-1 Presented below is an amortization schedule related to Sarasota Company's 5-year, $170,000 bond with a 6% interest rate and a 4% yield, purchased on December 31, 2015, for $185,137. Cash Interest Received Revenue Bond Premium Amortization Date 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 $10,200 10,200 10,200 10,200 10,200 $7,405 7,294 7,177 7,057 6,930 $2,795 2,906 3,023 3,143 3,270 Carrying Amount of Bonds $185,137 182,342 179,436 176,413 173,270 170,000 The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end: Amortized cost Fair value 12/31/16 $182,342 $181,700 12/31/17 $179,436 $181,600 12/31/18 $176,413 $178,300 12/31/19 $173,270 $174,400 12/31/20 $170,000 $170,000 (a) (b) (c) (d) (0) Prepare the journal entry to record the purchase of these bonds on December 31, 2015, assuming the bonds are classified as held-to-maturity securities Prepare the journal entry related to the held-to-maturity bonds for 2016. Prepare the journal entry related to the held-to-maturity bonds for 2018. Prepare the journal entry to record the purchase of these bonds, assuming they are classified as available for sale Prepare the journal entries related to the available for sale bonds for 2016. Prenare the tournal entries related to the available for sale hands for 2018 12/31/17 12/31/18 12/31/19 12/31/20 10,200 10,200 10,200 10,200 7,294 7,177 7,057 6,930 2,906 3,023 3,143 3,270 179,436 176,413 173,270 170,000 The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end: Amortized cost Fair value 12/31/16 $182,342 $181,700 12/31/17 $179,436 $181,600 12/31/18 $176,413 $178,300 12/31/19 $173,270 $174,400 12/31/20 $170,000 $170,000 (a) (b) (c) (d) (a) (1) Prepare the journal entry to record the purchase of these bonds on December 31, 2015, assuming the bonds are classified as held-to-maturity securities Prepare the journal entry related to the held-to-maturity bonds for 2016. Prepare the journal entry related to the held-to-maturity bonds for 2018 Prepare the journal entry to record the purchase of these bonds, assuming they are classified as available for sale Prepare the journal entries related to the available for sale bonds for 2016, Prepare the journal entries related to the available for sale bonds for 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit (To record interest revenue.) (To record interest revenue.) (To record adjustment.) (To record interest revenue.) (To record adjustment.)