Answered step by step

Verified Expert Solution

Question

1 Approved Answer

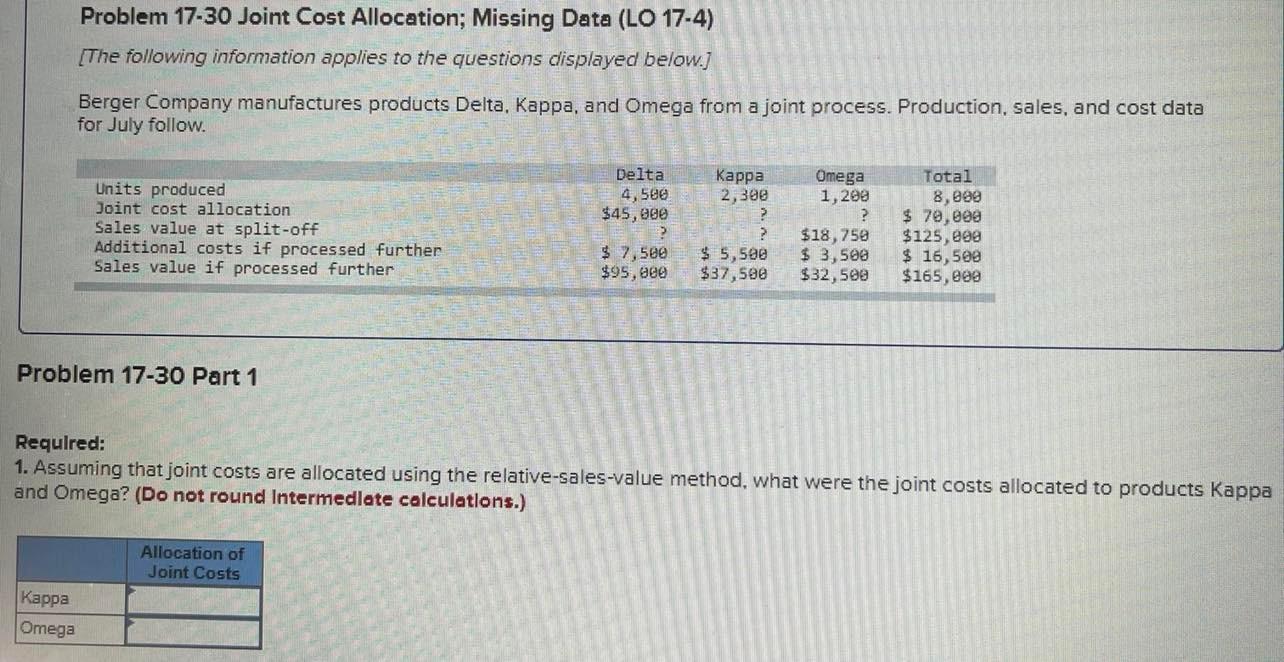

Problem 17-30 Joint Cost Allocation; Missing Data (LO 17-4) [The following information applies to the questions displayed below] Berger Company manufactures products Delta, Kappa,

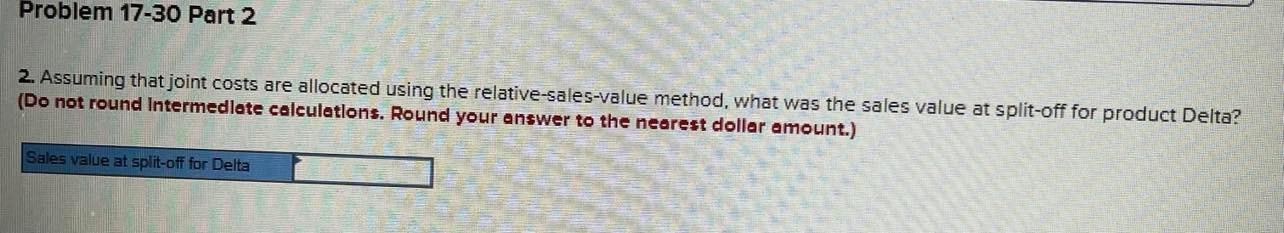

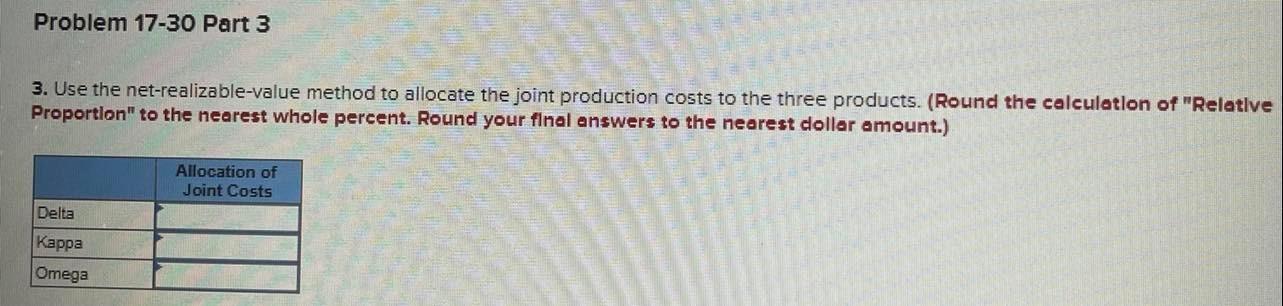

Problem 17-30 Joint Cost Allocation; Missing Data (LO 17-4) [The following information applies to the questions displayed below] Berger Company manufactures products Delta, Kappa, and Omega from a joint process. Production, sales, and cost data for July follow. Delta Units produced Joint cost allocation 4,500 $45,000 Kappa 2,300 ? Omega 1,200 ? Sales value at split-off ? $18,750 Total 8,000 $ 70,000 $125,000 Additional costs if processed further Sales value if processed further $ 7,500 $95,000 $ 5,500 $37,500 $ 3,500 $32,500 $ 16,500 $165,000 Problem 17-30 Part 1 Required: 1. Assuming that joint costs are allocated using the relative-sales-value method, what were the joint costs allocated to products Kappa and Omega? (Do not round Intermediate calculations.) Kappa Omega Allocation of Joint Costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started