Answered step by step

Verified Expert Solution

Question

1 Approved Answer

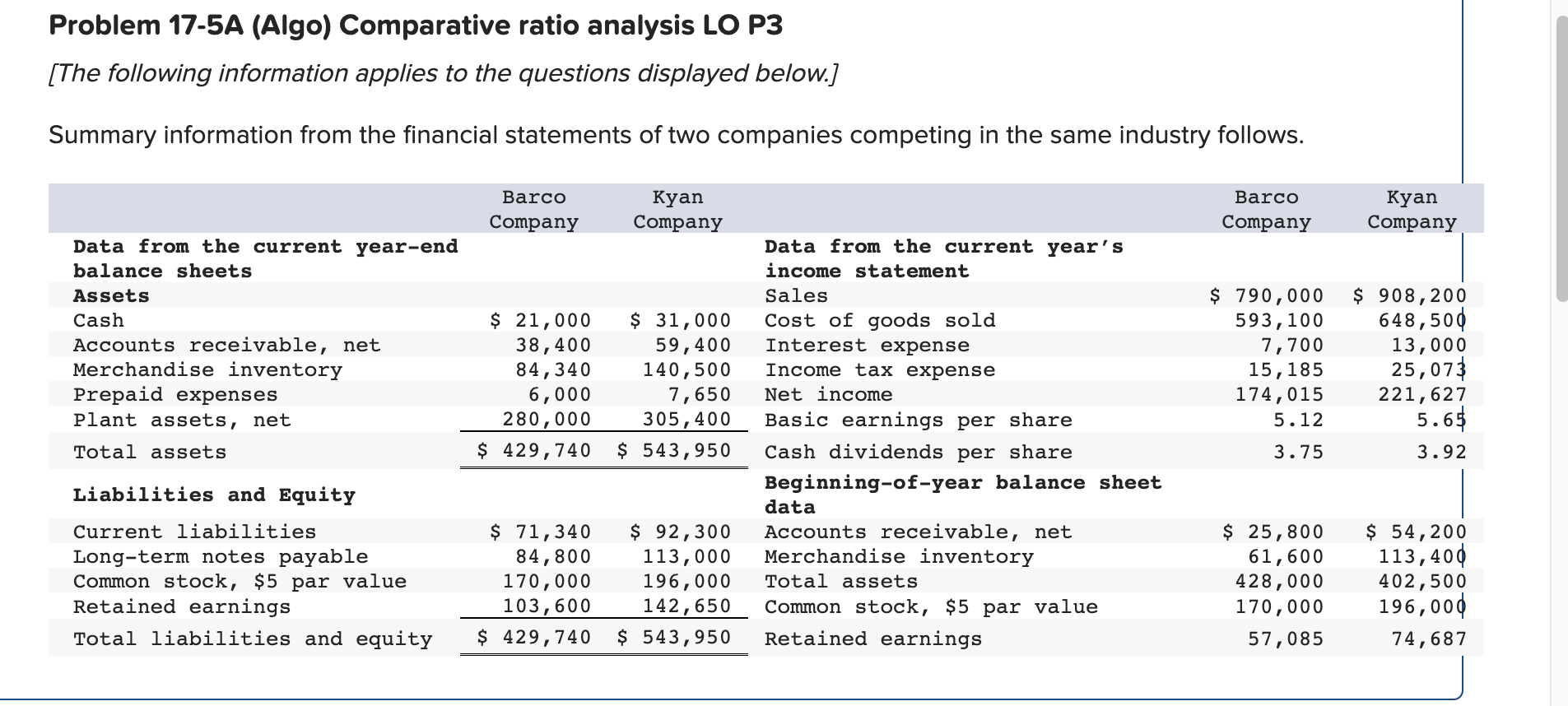

Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two

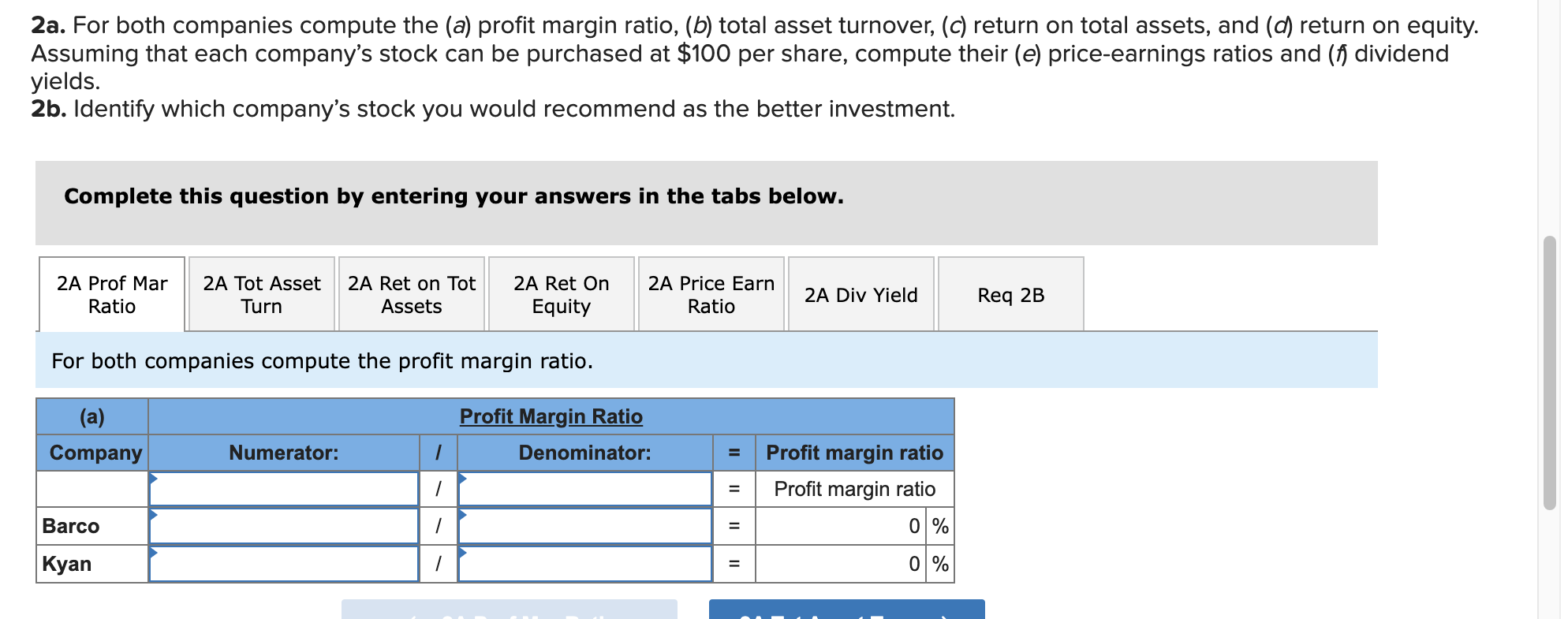

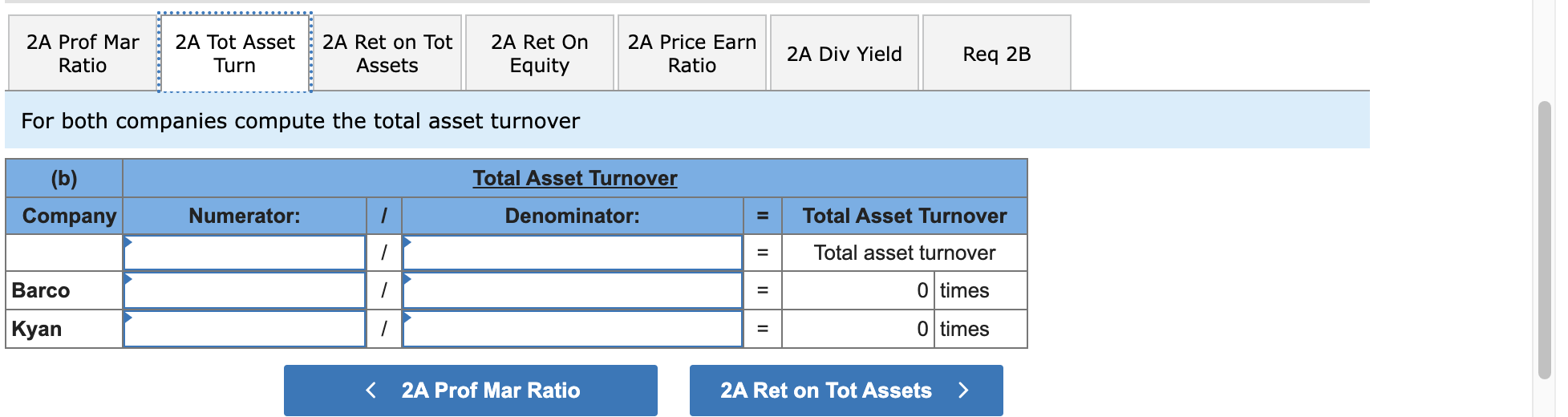

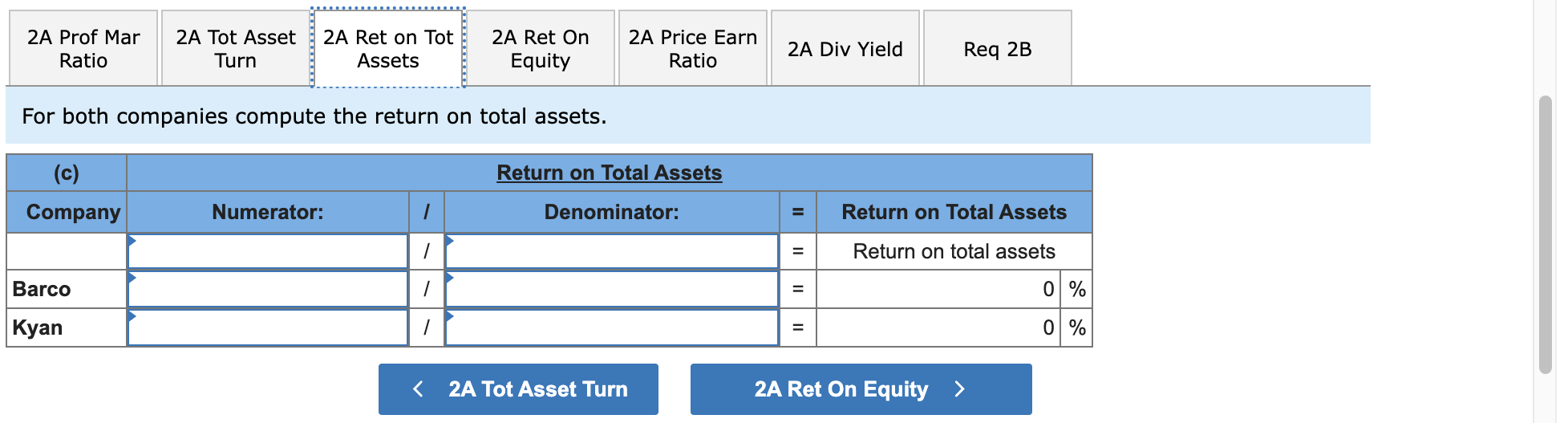

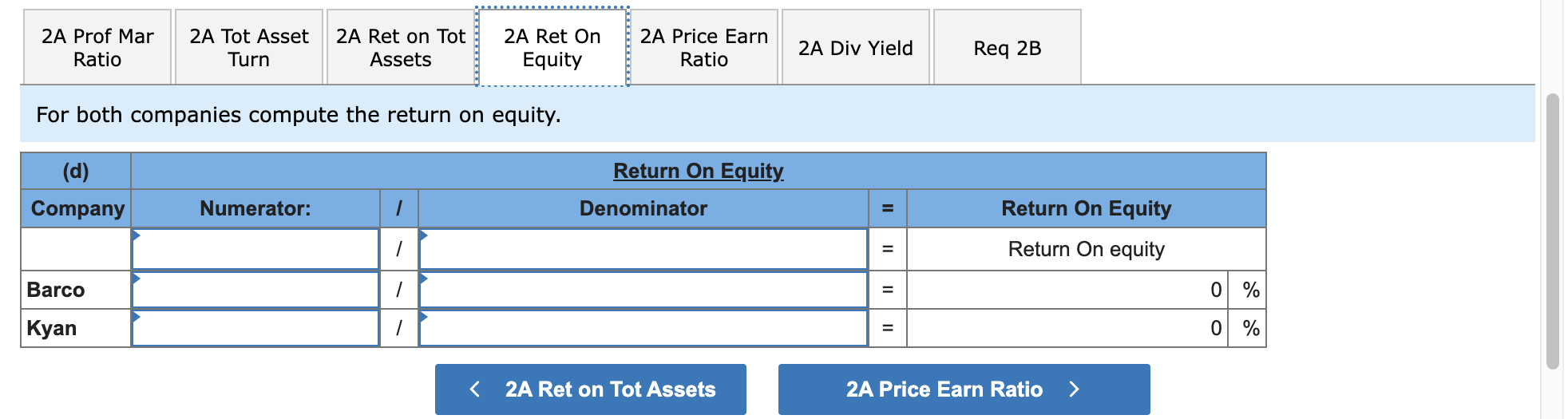

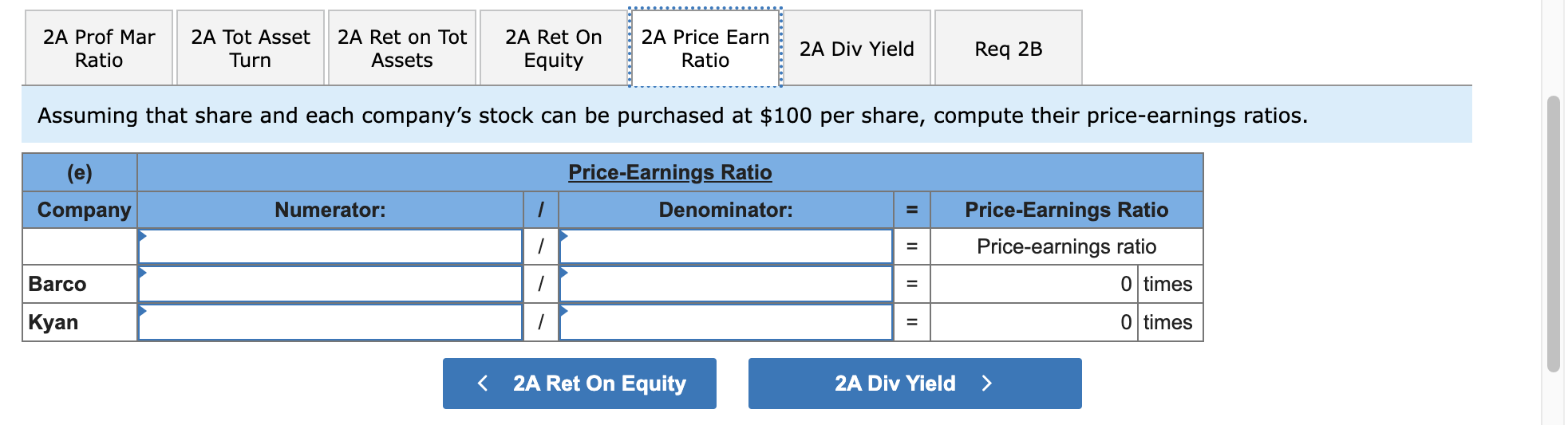

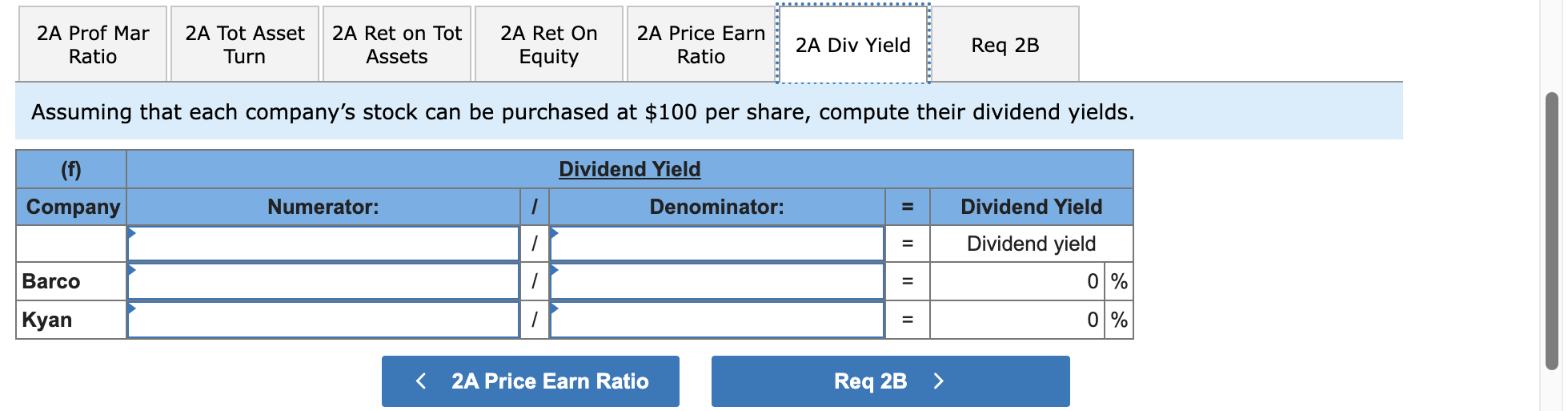

Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $100 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the profit margin ratio. For both companies compute the total asset turnover For both companies compute the return on total assets. For both companies compute the return on equity. \begin{tabular}{|c|c|c|c|c|c|} \hline 2AProfMarRatio & 2ATotAssetTurn & 2ARetonTotAssets & 2ARetOnEquity & 2APriceEarnRatio & 2A Div Yield \\ \hline \end{tabular} Assuming that share and each company's stock can be purchased at $100 per share, compute their price-earnings ratios. Assuming that each company's stock can be purchased at $100 per share, compute their dividend yield Identify which company's stock you would recommend as the better investment

Problem 17-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $100 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the profit margin ratio. For both companies compute the total asset turnover For both companies compute the return on total assets. For both companies compute the return on equity. \begin{tabular}{|c|c|c|c|c|c|} \hline 2AProfMarRatio & 2ATotAssetTurn & 2ARetonTotAssets & 2ARetOnEquity & 2APriceEarnRatio & 2A Div Yield \\ \hline \end{tabular} Assuming that share and each company's stock can be purchased at $100 per share, compute their price-earnings ratios. Assuming that each company's stock can be purchased at $100 per share, compute their dividend yield Identify which company's stock you would recommend as the better investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started