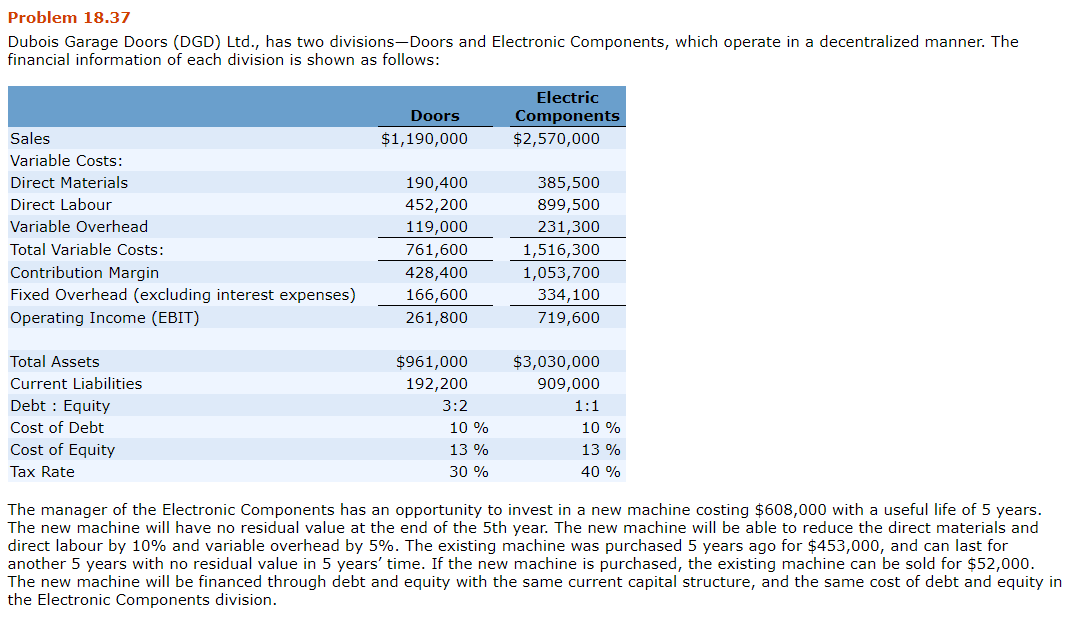

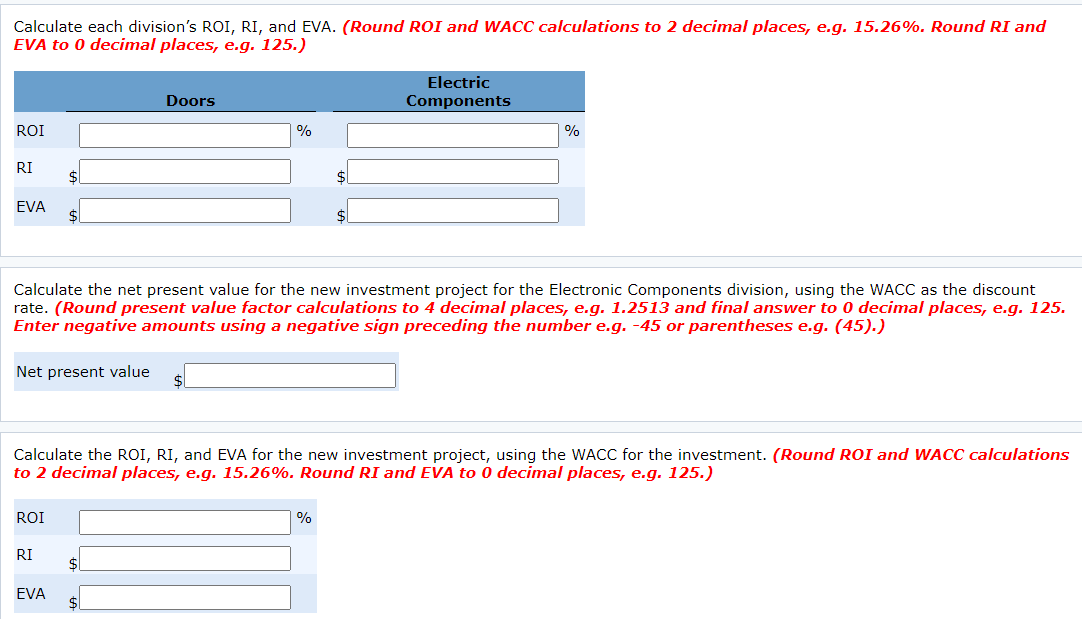

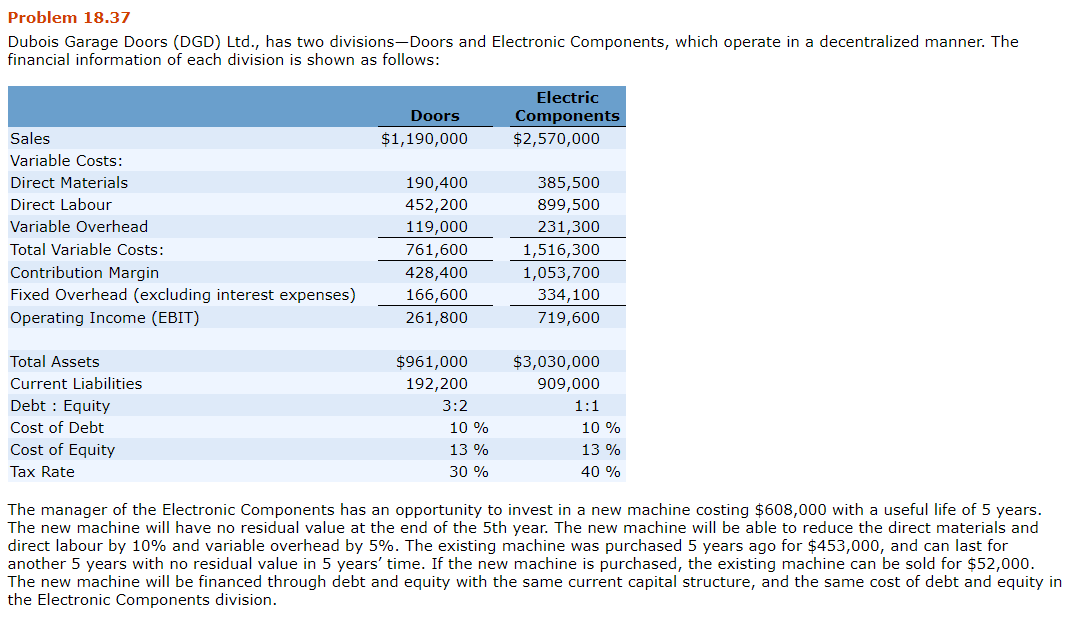

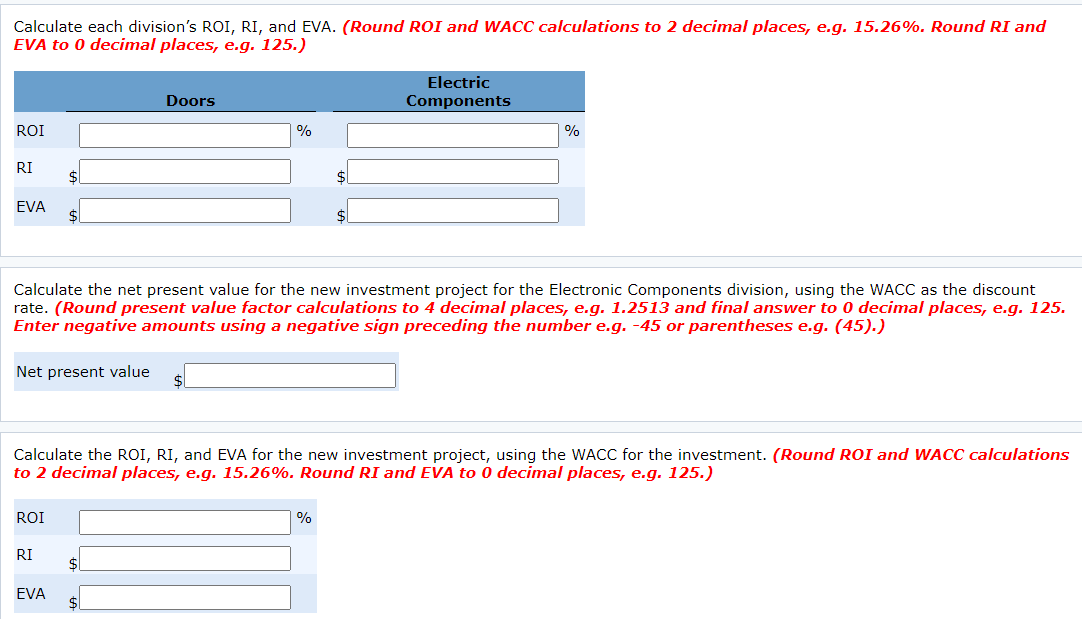

Problem 18.37 Dubois Garage Doors (DGD) Ltd., has two divisions-Doors and Electronic Components, which operate in a decentralized manner. The financial information of each division is shown as follows: Doors Electric Components $2,570,000 Sales $1,190,000 Variable Costs: Direct Materials Direct Labour Variable Overhead 190,400 452,200 119,000 761,600 428,400 166,600 261,800 385,500 899,500 231,300 1,516,300 Total Variable Costs: Contribution Margin Fixed Overhead (excluding interest expenses) Operating Income (EBIT) 1,053,700 334,100 719,600 Total Assets Current Liabilities Debt : Equity Cost of Debt Cost of Equity $961,000 192,200 3:2 $3,030,000 909,000 1:1 10 % 10 % 13 % 13 % Tax Rate 30 % 40 % The manager of the Electronic Components has an opportunity to invest in a new machine costing $608,000 with a useful life of 5 years. The new machine will have no residual value at the end of the 5th year. The new machine will be able to reduce the direct materials and direct labour by 10% and variable overhead by 5%. The existing machine was purchased 5 years ago for $453,000, and can last for another 5 years with no residual value in 5 years' time. If the new machine is purchased, the existing machine can be sold for $52,000. The new machine will be financed through debt and equity with the same current capital structure, and the same cost of debt and equity in the Electronic Components division. Calculate each division's ROI, RI, and EVA. (Round ROI and WACC calculations to 2 decimal places, e.g. 15.26%. Round RI and EVA to 0 decimal places, e.g. 125.) Electric Components Doors ROI % % RI $ EVA $ Calculate the net present value for the new investment project for the Electronic Components division, using the WACC as the discount rate. (Round present value factor calculations to 4 decimal places, e.g. 1.2513 and final answer to 0 decimal places, e.g. 125. Enter negative amounts using a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net present value $ Calculate the ROI, RI, and EVA for the new investment project, using the WACC for the investment. (Round ROI and WACC calculations to 2 decimal places, e.g. 15.26%. Round RI and EVA to 0 decimal places, e.g. 125.) ROI % RI $ EVA $ Problem 18.37 Dubois Garage Doors (DGD) Ltd., has two divisions-Doors and Electronic Components, which operate in a decentralized manner. The financial information of each division is shown as follows: Doors Electric Components $2,570,000 Sales $1,190,000 Variable Costs: Direct Materials Direct Labour Variable Overhead 190,400 452,200 119,000 761,600 428,400 166,600 261,800 385,500 899,500 231,300 1,516,300 Total Variable Costs: Contribution Margin Fixed Overhead (excluding interest expenses) Operating Income (EBIT) 1,053,700 334,100 719,600 Total Assets Current Liabilities Debt : Equity Cost of Debt Cost of Equity $961,000 192,200 3:2 $3,030,000 909,000 1:1 10 % 10 % 13 % 13 % Tax Rate 30 % 40 % The manager of the Electronic Components has an opportunity to invest in a new machine costing $608,000 with a useful life of 5 years. The new machine will have no residual value at the end of the 5th year. The new machine will be able to reduce the direct materials and direct labour by 10% and variable overhead by 5%. The existing machine was purchased 5 years ago for $453,000, and can last for another 5 years with no residual value in 5 years' time. If the new machine is purchased, the existing machine can be sold for $52,000. The new machine will be financed through debt and equity with the same current capital structure, and the same cost of debt and equity in the Electronic Components division. Calculate each division's ROI, RI, and EVA. (Round ROI and WACC calculations to 2 decimal places, e.g. 15.26%. Round RI and EVA to 0 decimal places, e.g. 125.) Electric Components Doors ROI % % RI $ EVA $ Calculate the net present value for the new investment project for the Electronic Components division, using the WACC as the discount rate. (Round present value factor calculations to 4 decimal places, e.g. 1.2513 and final answer to 0 decimal places, e.g. 125. Enter negative amounts using a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net present value $ Calculate the ROI, RI, and EVA for the new investment project, using the WACC for the investment. (Round ROI and WACC calculations to 2 decimal places, e.g. 15.26%. Round RI and EVA to 0 decimal places, e.g. 125.) ROI % RI $ EVA $