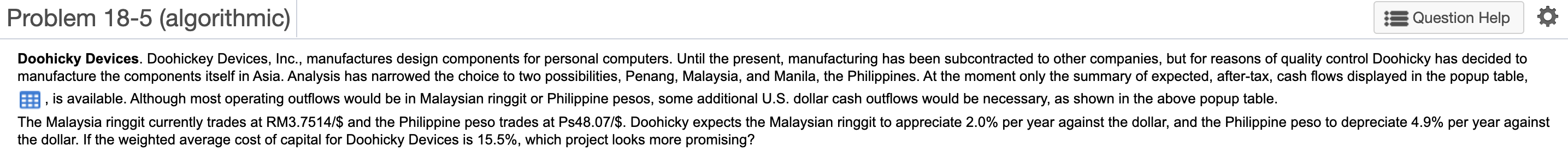

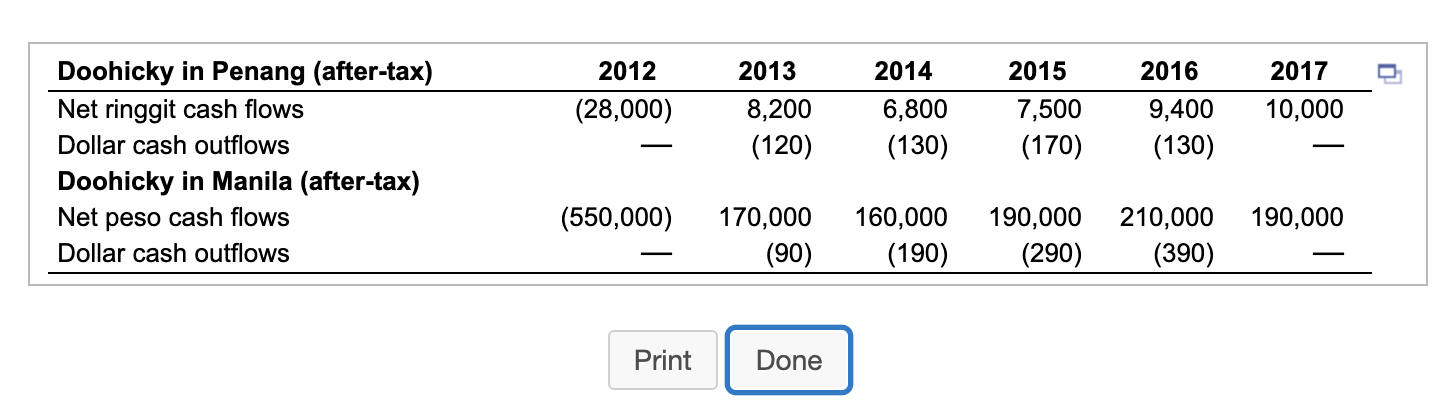

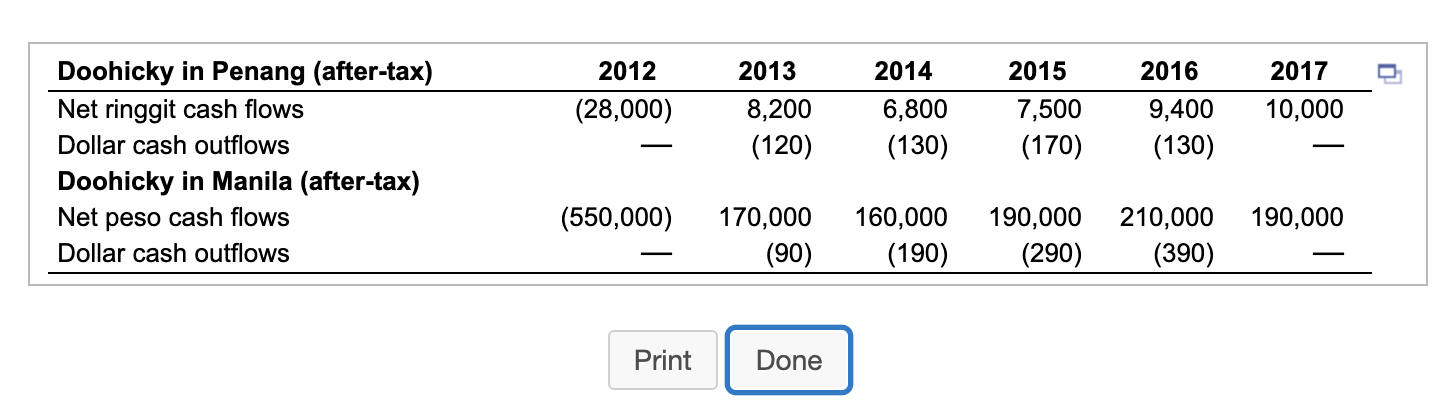

Problem 18-5 (algorithmic) Question Help 0 Doohicky Devices. Doohickey Devices, Inc., manufactures design components for personal computers. Until the present, manufacturing has been subcontracted to other companies, but for reasons of quality control Doohicky has decided to manufacture the components itself in Asia. Analysis has narrowed the choice to two possibilities, Penang, Malaysia, and Manila, the Philippines. At the moment only the summary of expected, after-tax, cash flows displayed in the popup table, B, is available. Although most operating outflows would be in Malaysian ringgit or Philippine pesos, some additional U.S. dollar cash outflows would be necessary, as shown in the above popup table. The Malaysia ringgit currently trades at RM3.7514/$ and the Philippine peso trades at Ps48.07/$. Doohicky expects the Malaysian ringgit to appreciate 2.0% per year against the dollar, and the Philippine peso to depreciate 4.9% per year against the dollar. If the weighted average cost of capital for Doohicky Devices is 15.5%, which project looks more promising? 2015 2012 (28,000) 2013 8,200 (120) 2014 6,800 (130) Doohicky in Penang (after-tax) Net ringgit cash flows Dollar cash outflows Doohicky in Manila (after-tax) Net peso cash flows Dollar cash outflows 2016 9,400 (130) 2017 10,000 7,500 (170) (550,000) 190,000 170,000 (90) 160,000 (190) 190,000 (290) 210,000 (390) Print Done Problem 18-5 (algorithmic) Question Help 0 Doohicky Devices. Doohickey Devices, Inc., manufactures design components for personal computers. Until the present, manufacturing has been subcontracted to other companies, but for reasons of quality control Doohicky has decided to manufacture the components itself in Asia. Analysis has narrowed the choice to two possibilities, Penang, Malaysia, and Manila, the Philippines. At the moment only the summary of expected, after-tax, cash flows displayed in the popup table, B, is available. Although most operating outflows would be in Malaysian ringgit or Philippine pesos, some additional U.S. dollar cash outflows would be necessary, as shown in the above popup table. The Malaysia ringgit currently trades at RM3.7514/$ and the Philippine peso trades at Ps48.07/$. Doohicky expects the Malaysian ringgit to appreciate 2.0% per year against the dollar, and the Philippine peso to depreciate 4.9% per year against the dollar. If the weighted average cost of capital for Doohicky Devices is 15.5%, which project looks more promising? 2015 2012 (28,000) 2013 8,200 (120) 2014 6,800 (130) Doohicky in Penang (after-tax) Net ringgit cash flows Dollar cash outflows Doohicky in Manila (after-tax) Net peso cash flows Dollar cash outflows 2016 9,400 (130) 2017 10,000 7,500 (170) (550,000) 190,000 170,000 (90) 160,000 (190) 190,000 (290) 210,000 (390) Print Done