Answered step by step

Verified Expert Solution

Question

1 Approved Answer

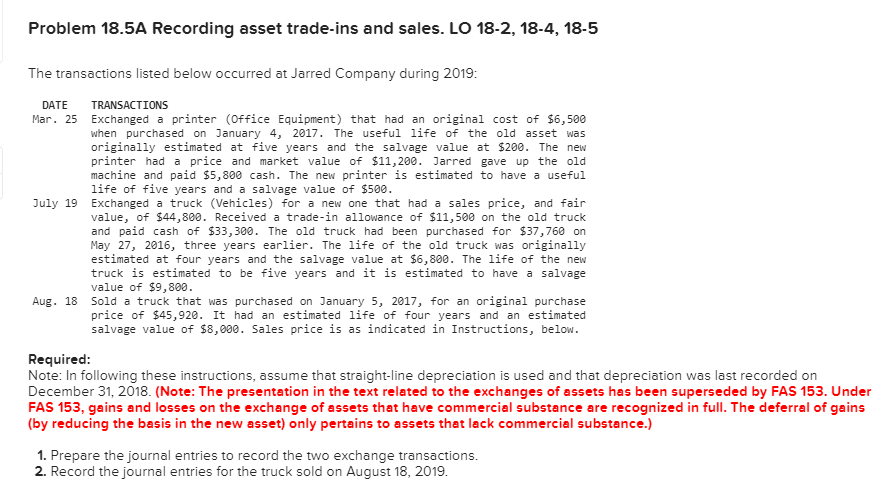

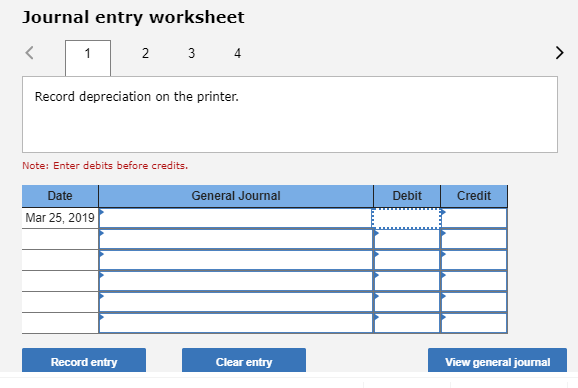

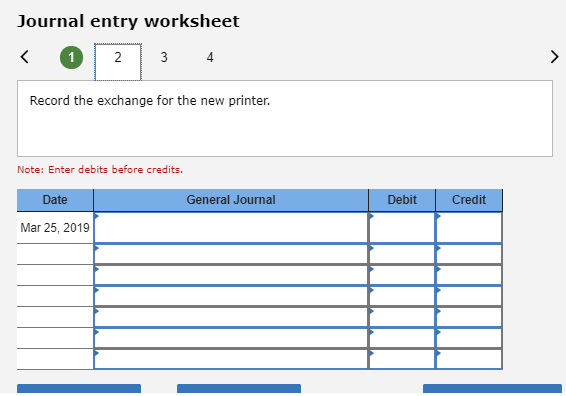

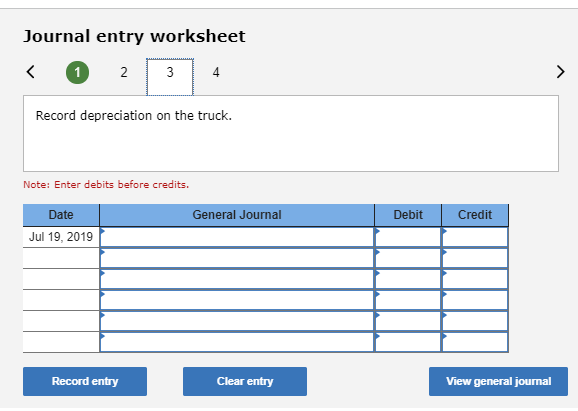

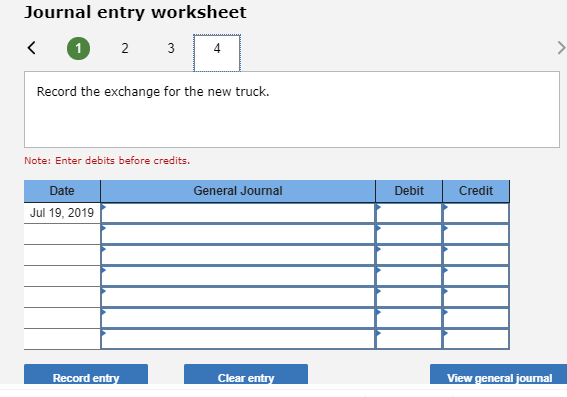

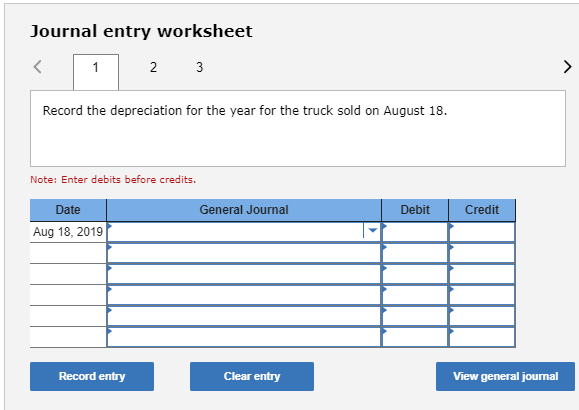

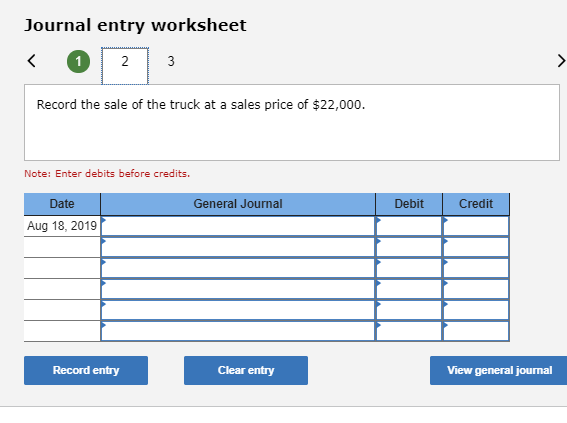

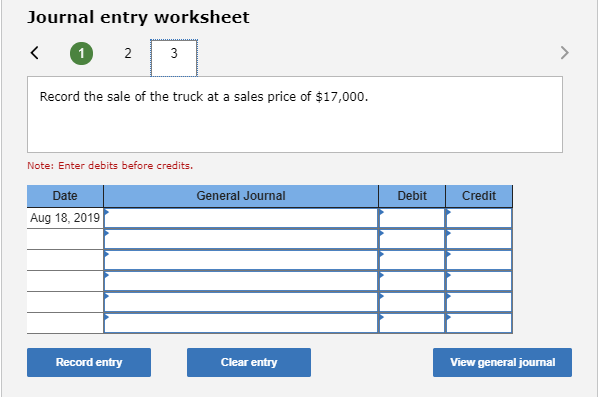

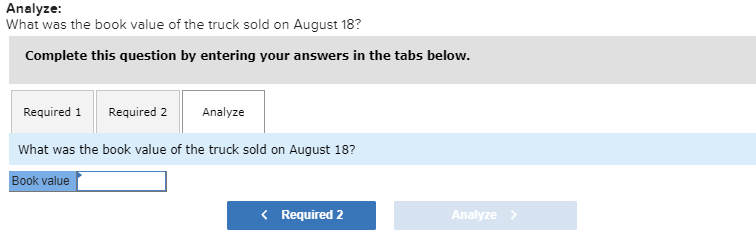

Problem 18.5A Recording asset trade-ins and sales. LO 18-2, 18-4, 18-5 The transactions listed below occurred at Jarred Company during 2019: DATE TRANSACTIONS Mar. 25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started