Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1-8A Analyzing effects of Transactions LO, C4, P1, P2, A1 Question 1 (of 1) Use the following information for exercise 15 to 18 LO

Problem 1-8A Analyzing effects of Transactions LO, C4, P1, P2, A1

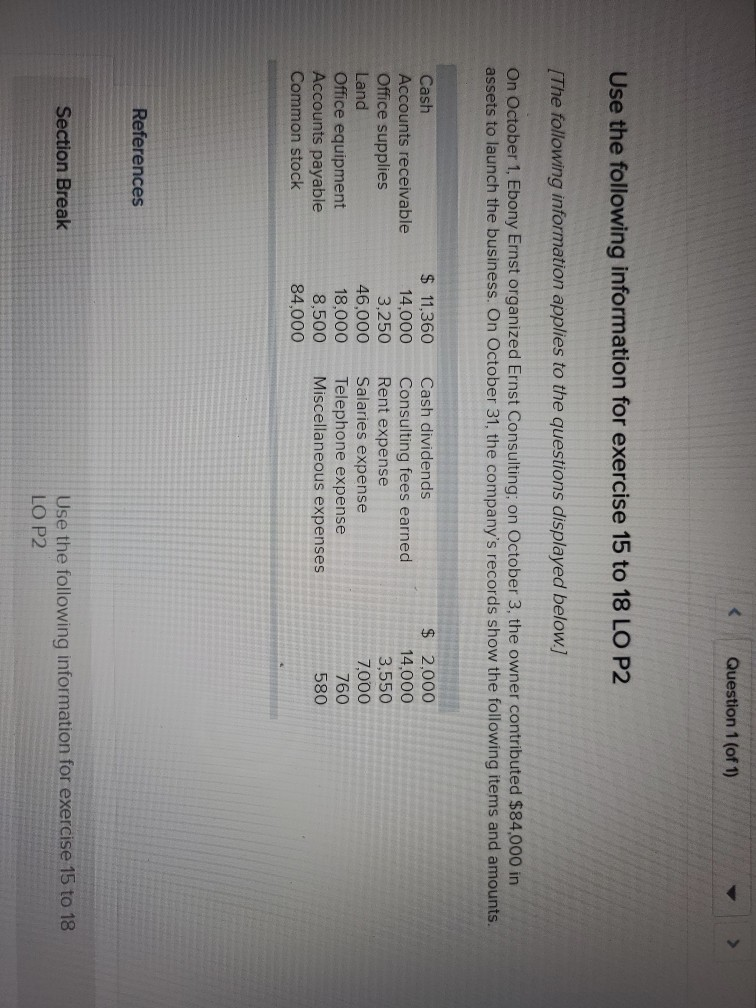

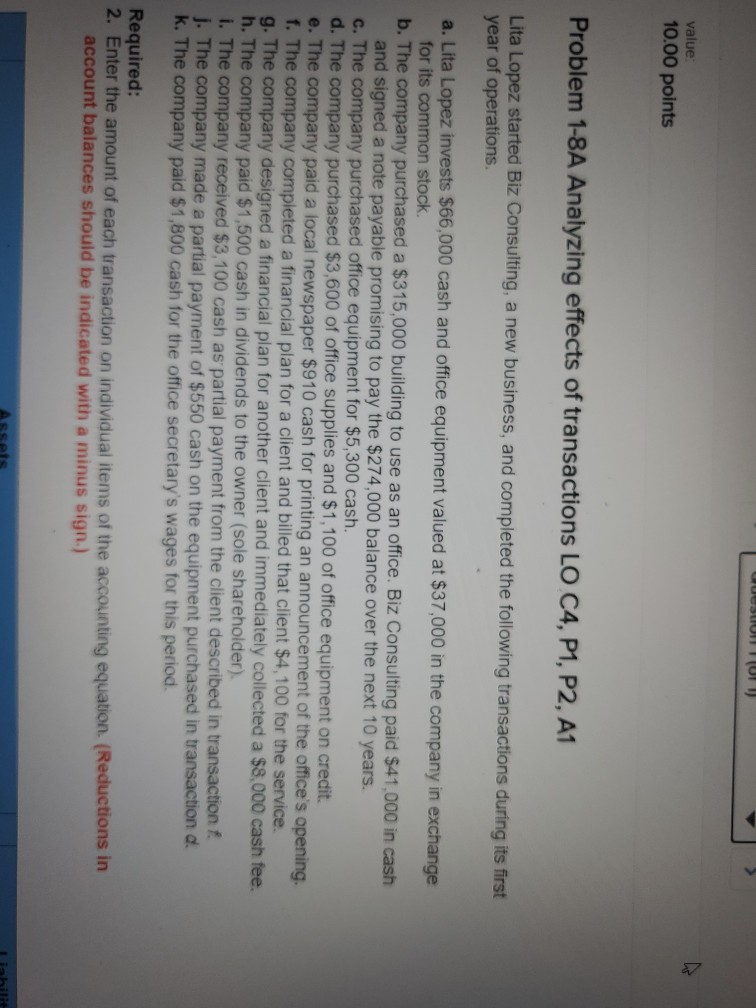

Question 1 (of 1) Use the following information for exercise 15 to 18 LO P2 [The following information applies to the questions displayed below.) On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $84,000 in assets to launch the business. On October 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Land Office equipment Accounts payable Common stock $ 11,360 14.000 3,250 46,000 18,000 8,500 84,000 Cash dividends Consulting fees earned Rent expense Salaries expense Telephone expense Miscellaneous expenses $ 2,000 14.000 3.550 7,000 760 580 References Section Break Use the following information for exercise 15 to 18 LO P2 UUSUI (UF1) value 10.00 points Problem 1-8A Analyzing effects of transactions LO C4, P1, P2, A1 Lita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of operations. a. Lita Lopez invests $66,000 cash and office equipment valued at $37,000 in the company in exchange for its common stock b. The company purchased a $315,000 building to use as an office. Biz Consulting paid $41,000 in cash and signed a note payable promising to pay the $274,000 balance over the next 10 years. c. The company purchased office equipment for $5,300 cash. d. The company purchased $3,600 of office supplies and $1,100 of office equipment on credit. e. The company paid a local newspaper $910 cash for printing an announcement of the office's opening. f. The company completed a financial plan for a client and billed that client $4,100 for the service. g. The company designed a financial plan for another client and immediately collected a $8,000 cash fee. h. The company paid $1,500 cash in dividends to the owner (sole shareholder) 1. The company received $3,100 cash as partial payment from the client described in transaction f. J. The company made a partial payment of $550 cash on the equipment purchased in transaction d. k. The company paid $1,800 cash for the office secretary's wages for this period. Required: 2. Enter the amount of each transaction on individual items of the accounting equation. (Reductions in account balances should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started