Answered step by step

Verified Expert Solution

Question

1 Approved Answer

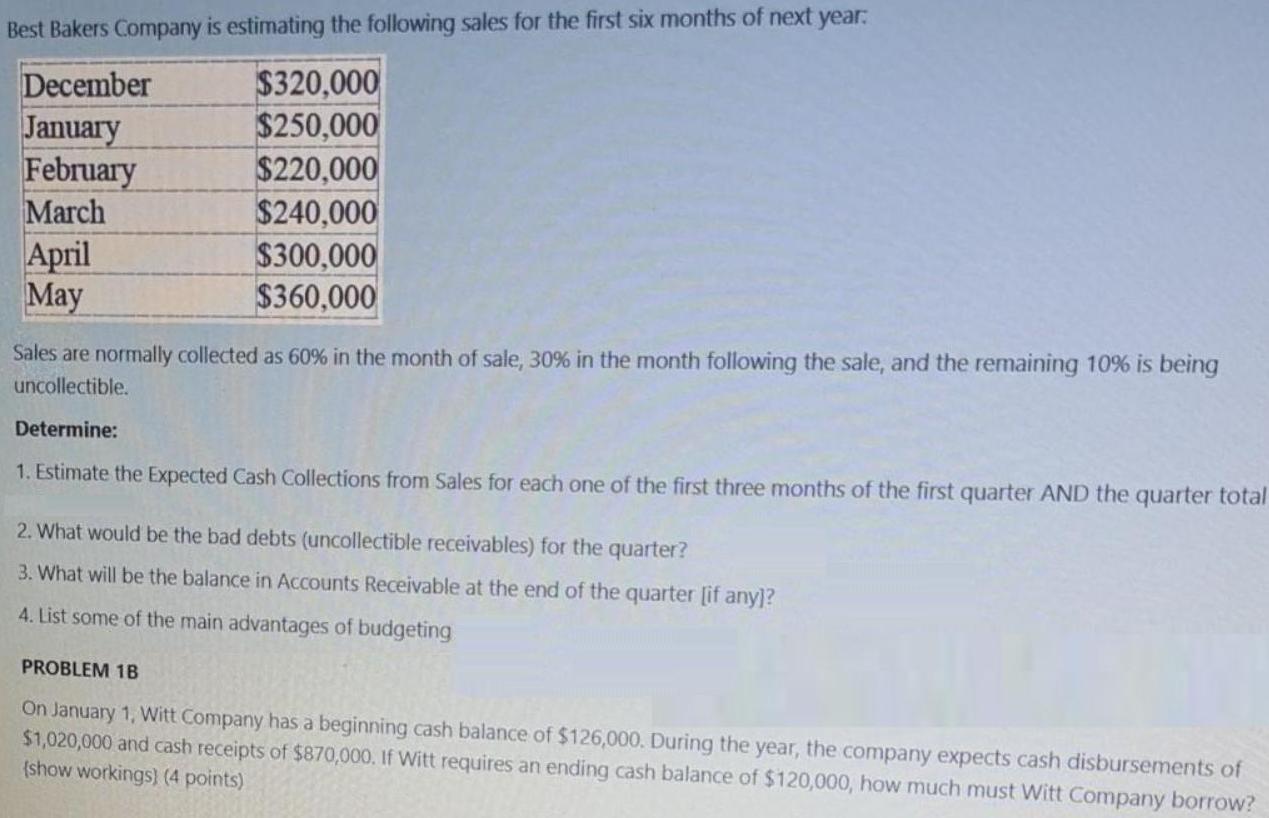

Best Bakers Company is estimating the following sales for the first six months of next year: December January February March April May $320,000 $250,000

Best Bakers Company is estimating the following sales for the first six months of next year: December January February March April May $320,000 $250,000 $220,000 $240,000 $300,000 $360,000 Sales are normally collected as 60% in the month of sale, 30% in the month following the sale, and the remaining 10% is being uncollectible. Determine: 1. Estimate the Expected Cash Collections from Sales for each one of the first three months of the first quarter AND the quarter total 2. What would be the bad debts (uncollectible receivables) for the quarter? 3. What will be the balance in Accounts Receivable at the end of the quarter [if any]? 4. List some of the main advantages of budgeting PROBLEM 1B On January 1, Witt Company has a beginning cash balance of $126,000. During the year, the company expects cash disbursements of $1,020,000 and cash receipts of $870,000. If Witt requires an ending cash balance of $120,000, how much must Witt Company borrow? (show workings) (4 points)

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

4 dvntges f budgeting Sme f the dvntges f budgeting re Mnging funds effiiently with funding lnn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started