Answered step by step

Verified Expert Solution

Question

1 Approved Answer

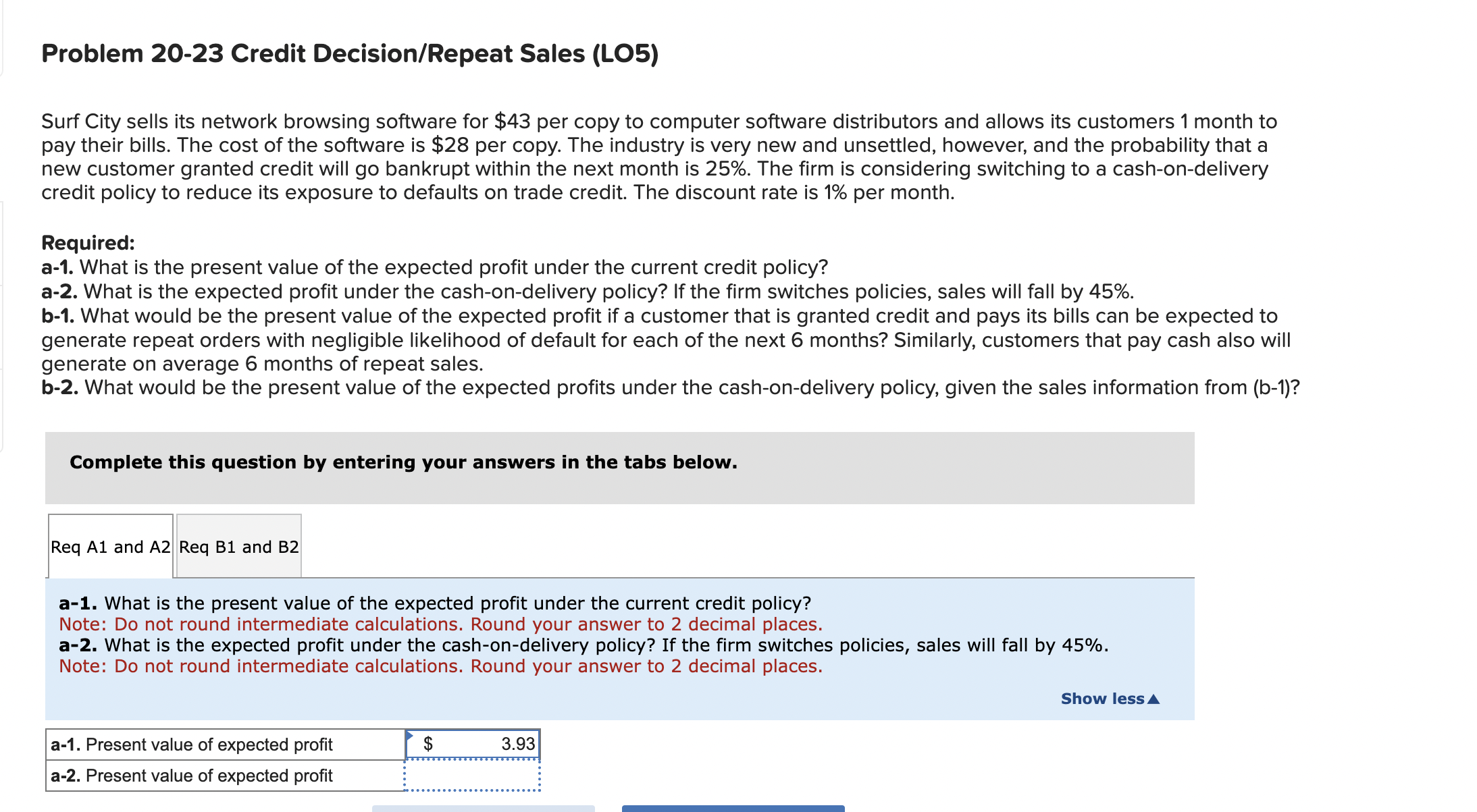

Problem 2 0 - 2 3 Credit Decision / Repeat Sales ( LO 5 ) Surf City sells its network browsing software for $ 4

Problem Credit DecisionRepeat Sales LO Surf City sells its network browsing software for $ per copy to computer software distributors and allows its customers month to

pay their bills. The cost of the software is $ per copy. The industry is very new and unsettled, however, and the probability that a

new customer granted credit will go bankrupt within the next month is The firm is considering switching to a cashondelivery

credit policy to reduce its exposure to defaults on trade credit. The discount rate is per month.

Required:

a What is the present value of the expected profit under the current credit policy?

a What is the expected profit under the cashondelivery policy? If the firm switches policies, sales will fall by

b What would be the present value of the expected profit if a customer that is granted credit and pays its bills can be expected to

generate repeat orders with negligible likelihood of default for each of the next months? Similarly, customers that pay cash also will

generate on average months of repeat sales.

b What would be the present value of the expected profits under the cashondelivery policy, given the sales information from b

Complete this question by entering your answers in the tabs below.

b What would be the present value of the expected profit if a customer that is granted credit and pays its bills can be

expected to generate repeat orders with negligible likelihood of default for each of the next months? Similarly, customers

that pay cash also will generate on average months of repeat sales.

Note: Do not round intermediate calculations. Round your answer to decimal places.

What would be the present value of the expected profits under the cashondelivery policy, given the sales information

from b

Note: Do not round intermediate calculations. Round your answer to decimal places.

b Present value of expected profit

b Present value of expected profit

Surf City sells its network browsing software for $ per copy to computer software distributors and allows its customers month to

pay their bills. The cost of the software is $ per copy. The industry is very new and unsettled, however, and the probability that a

new customer granted credit will go bankrupt within the next month is The firm is considering switching to a cashondelivery

credit policy to reduce its exposure to defaults on trade credit. The discount rate is per month.

Required:

a What is the present value of the expected profit under the current credit policy?

a What is the expected profit under the cashondelivery policy? If the firm switches policies, sales will fall by

b What would be the present value of the expected profit if a customer that is granted credit and pays its bills can be expected to

generate repeat orders with negligible likelihood of default for each of the next months? Similarly, customers that pay cash also will

generate on average months of repeat sales.

b What would be the present value of the expected profits under the cashondelivery policy, given the sales information from b

Complete this question by entering your answers in the tabs below.

Req A and A Req B and B

a What is the present value of the expected profit under the current credit policy?

Note: Do not round intermediate calculations. Round your answer to decimal places.

a What is the expected profit under the cashondelivery policy? If the firm switches policies, sales will fall by

Note: Do not round intermediate calculations. Round your answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started