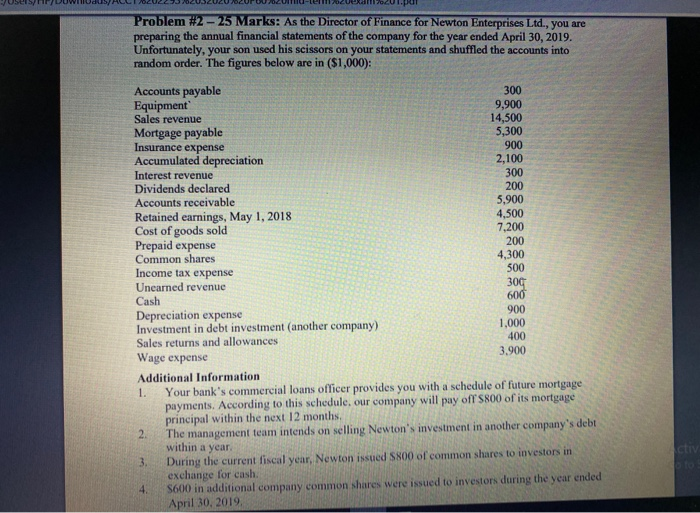

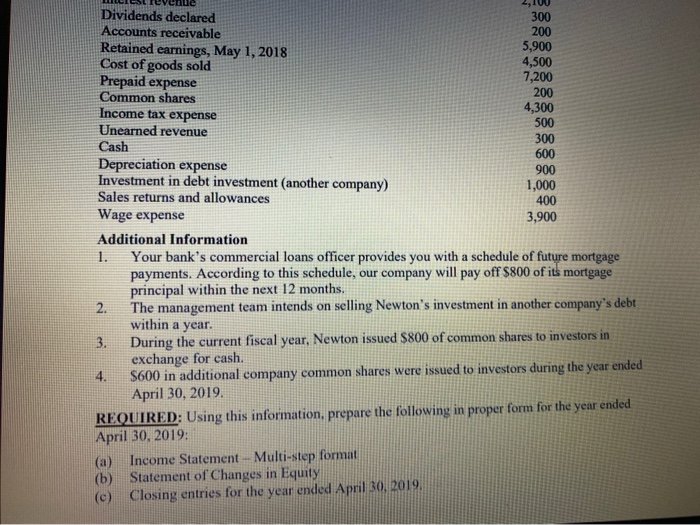

Problem #2 - 25 Marks: As the Director of Finance for Newton Enterprises Ltd., you are preparing the annual financial statements of the company for the year ended April 30, 2019. Unfortunately, your son used his scissors on your statements and shuffled the accounts into random order. The figures below are in ($1,000): Accounts payable 300 Equipment 9,900 Sales revenue 14,500 Mortgage payable 5,300 Insurance expense 900 Accumulated depreciation 2,100 Interest revenue 300 Dividends declared 200 Accounts receivable 5,900 Retained earnings, May 1, 2018 4,500 Cost of goods sold 7,200 Prepaid expense 200 Common shares 4,300 Income tax expense 500 Unearned revenue 300 Cash 600 Depreciation expense 900 Investment in debt investment another company) 1,000 400 Sales returns and allowances Wage expense 3.900 Additional Information 1. Your bank's commercial loans officer provides you with a schedule of future mortgage payments. According to this schedule, our company will pay off 800 of its mortgage principal within the next 12 months. 2 The management team intends on selling Newton's investment in another company's debt within a year 3 During the current fiscal year, Newton issued S800 of common shares to investors in exchange for cash. 4 S600 in additional company common shares were issued to investors during the year ended April 30, 2019, Activ Dividends declared 300 Accounts receivable 200 Retained earnings, May 1, 2018 5,900 Cost of goods sold 4,500 Prepaid expense 7,200 Common shares 200 Income tax expense 4,300 500 Unearned revenue 300 Cash 600 Depreciation expense 900 Investment in debt investment another company) 1,000 Sales returns and allowances 400 Wage expense 3,900 Additional Information 1. Your bank's commercial loans officer provides you with a schedule of future mortgage payments. According to this schedule, our company will pay off $800 of its mortgage principal within the next 12 months. 2. The management team intends on selling Newton's investment in another company's debt within a year. 3. During the current fiscal year, Newton issued $800 of common shares to investors in exchange for cash. 4. $600 in additional company common shares were issued to investors during the year ended April 30, 2019. REQUIRED: Using this information, prepare the following in proper form for the year ended April 30, 2019: (a) Income Statement - Multi-step format (b) Statement of Changes in Equity (e) Closing entries for the year ended April 30,2019