Answered step by step

Verified Expert Solution

Question

1 Approved Answer

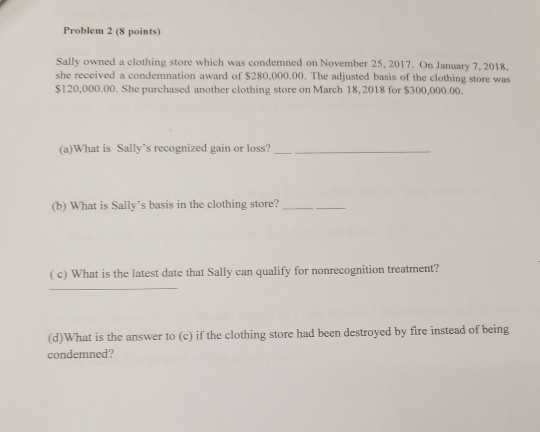

Problem 2 (8 points) Sally owned a clothing store which was condemned on November 25, 2017. On January 7, 2018, she received a condemnation award

Problem 2 (8 points) Sally owned a clothing store which was condemned on November 25, 2017. On January 7, 2018, she received a condemnation award of $280,000.00. The adjusted basis of the clothing store was S120,000.00. She purchased another clothing store on March 18,2018 for $300,000.00. (a)What is Sally's recognized gain or loss? (b) What is Sally's basis in the clothing store? (c) What is the latest date that Sally can qualify for nonrecognition treatment? (d)What condemned? is the answer to (c) if the clothing store had been destroyed by fire instead of being

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started