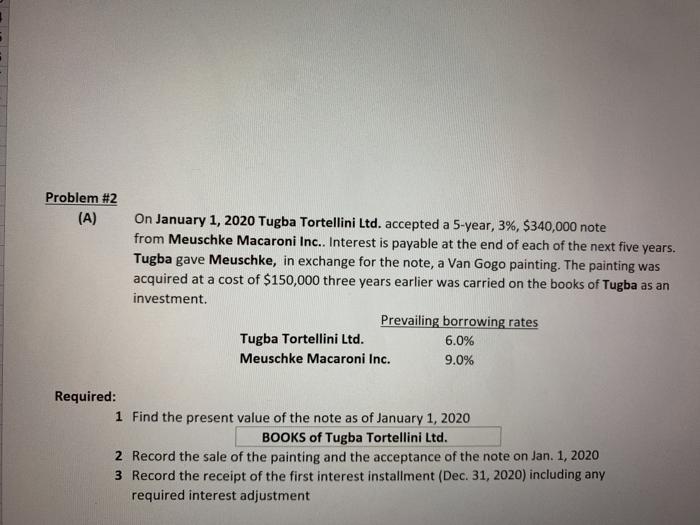

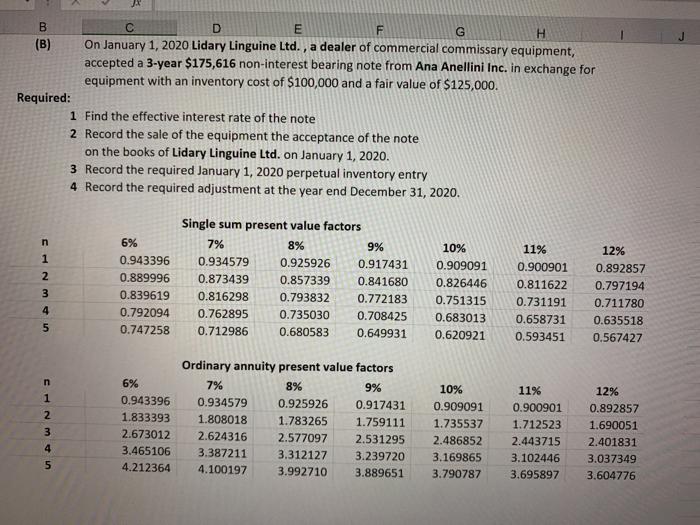

Problem #2 (A) On January 1, 2020 Tugba Tortellini Ltd. accepted a 5-year, 3%, $340,000 note from Meuschke Macaroni Inc.. Interest is payable at the end of each of the next five years. Tugba gave Meuschke, in exchange for the note, a Van Gogo painting. The painting was acquired at a cost of $150,000 three years earlier was carried on the books of Tugba as an investment Prevailing borrowing rates Tugba Tortellini Ltd. 6.0% Meuschke Macaroni Inc. 9.0% Required: 1 Find the present value of the note as of January 1, 2020 BOOKS of Tugba Tortellini Ltd. 2 Record the sale of the painting and the acceptance of the note on Jan. 1, 2020 3 Record the receipt of the first interest installment (Dec 31, 2020) including any required interest adjustment B C D E F G H (B) On January 1, 2020 Lidary Linguine Ltd., a dealer of commercial commissary equipment, accepted a 3-year $175,616 non-interest bearing note from Ana Anellini Inc. in exchange for equipment with an inventory cost of $100,000 and a fair value of $125,000. Required: 1 Find the effective interest rate of the note 2 Record the sale of the equipment the acceptance of the note on the books of Lidary Linguine Ltd. on January 1, 2020. 3 Record the required January 1, 2020 perpetual inventory entry 4 Record the required adjustment at the year end December 31, 2020. n 1 2 6% 0.943396 0.889996 0.839619 0.792094 0.747258 Single sum present value factors 7% 8% 9% 0.934579 0.925926 0.917431 0.873439 0.857339 0.841680 0.816298 0.793832 0.772183 0.762895 0.735030 0.708425 0.712986 0.680583 0.649931 10% 0.909091 0.826446 0.751315 0.683013 0.620921 11% 0.900901 0.811622 0.731191 0.658731 0.593451 12% 0.892857 0.797194 0.711780 0.635518 0.567427 CNM in 6% 0.943396 1.833393 2.673012 3.465106 4.212364 Ordinary annuity present value factors 7% 8% 9% 0.934579 0.925926 0.917431 1.808018 1.783265 1.759111 2.624316 2.577097 2.531295 3.387211 3.312127 3.239720 4.100197 3.992710 3.889651 10% 0.909091 1.735537 2.486852 3.169865 3.790787 11% 0.900901 1.712523 2.443715 3.102446 3.695897 12% 0.892857 1.690051 2.401831 3.037349 3.604776 Problem #2 (A) On January 1, 2020 Tugba Tortellini Ltd. accepted a 5-year, 3%, $340,000 note from Meuschke Macaroni Inc.. Interest is payable at the end of each of the next five years. Tugba gave Meuschke, in exchange for the note, a Van Gogo painting. The painting was acquired at a cost of $150,000 three years earlier was carried on the books of Tugba as an investment Prevailing borrowing rates Tugba Tortellini Ltd. 6.0% Meuschke Macaroni Inc. 9.0% Required: 1 Find the present value of the note as of January 1, 2020 BOOKS of Tugba Tortellini Ltd. 2 Record the sale of the painting and the acceptance of the note on Jan. 1, 2020 3 Record the receipt of the first interest installment (Dec 31, 2020) including any required interest adjustment B C D E F G H (B) On January 1, 2020 Lidary Linguine Ltd., a dealer of commercial commissary equipment, accepted a 3-year $175,616 non-interest bearing note from Ana Anellini Inc. in exchange for equipment with an inventory cost of $100,000 and a fair value of $125,000. Required: 1 Find the effective interest rate of the note 2 Record the sale of the equipment the acceptance of the note on the books of Lidary Linguine Ltd. on January 1, 2020. 3 Record the required January 1, 2020 perpetual inventory entry 4 Record the required adjustment at the year end December 31, 2020. n 1 2 6% 0.943396 0.889996 0.839619 0.792094 0.747258 Single sum present value factors 7% 8% 9% 0.934579 0.925926 0.917431 0.873439 0.857339 0.841680 0.816298 0.793832 0.772183 0.762895 0.735030 0.708425 0.712986 0.680583 0.649931 10% 0.909091 0.826446 0.751315 0.683013 0.620921 11% 0.900901 0.811622 0.731191 0.658731 0.593451 12% 0.892857 0.797194 0.711780 0.635518 0.567427 CNM in 6% 0.943396 1.833393 2.673012 3.465106 4.212364 Ordinary annuity present value factors 7% 8% 9% 0.934579 0.925926 0.917431 1.808018 1.783265 1.759111 2.624316 2.577097 2.531295 3.387211 3.312127 3.239720 4.100197 3.992710 3.889651 10% 0.909091 1.735537 2.486852 3.169865 3.790787 11% 0.900901 1.712523 2.443715 3.102446 3.695897 12% 0.892857 1.690051 2.401831 3.037349 3.604776